Weekly Market Roundup

_20251220104632666_6788c3.jpeg?width=950&height=450&format=Webp)

MG News | December 21, 2025 at 04:44 PM GMT+05:00

December 21, 2025 (MLN): The Pakistan Stock Exchange ended the week on a positive note as the benchmark KSE-100 Index advanced by 1,540 points, or 0.91% week-on-week, closing at 171,405 compared to 169,865 last week.

Investor sentiment improved notably after the State Bank of Pakistan announced a 50bps policy rate cut on Monday, which encouraged fresh buying interest, particularly in rate-sensitive sectors.

The momentum, however, remained selective, with banks leading the rally while energy and fertilizer stocks faced pressure.

_20251220103807908_155b5f.jpeg)

Market Capitalization:

In terms of market capitalization, the total market cap in rupee terms rose to Rs5.03 trillion this week from Rs4.99 trillion in the previous week, reflecting an increase of approximately Rs45.2 billion or 0.91% WoW, in line with the index gain.

In dollar terms, market capitalization increased to $17.96 billion from $17.79 billion last week, showing a rise of around $166 million or 0.93% WoW.

_20251220103842338_9cb708.jpeg)

Consequently, USD returns for the week stood at 0.93%, lower than last week’s stronger return of 1.70%, indicating relatively moderate foreign-adjusted gains.

_20251220103747041_11d24f.jpeg)

On the macroeconomic front, Pakistan recorded a current account surplus of $100 million in November 2025, significantly lower than the $709 million surplus posted in November 2024 but an improvement from the $291 million deficit recorded in October 2025.

Foreign direct investment remained steady, with net FDI inflows amounting to $180 million in November 2025, broadly in line with the $179 million inflow recorded in the preceding month.

In the money market, the government raised Rs445 billion in the latest through its latest Pakistan Investment Bonds (PIBs) auction.

Auto financing showed a strong recovery, rising by 35.5% YoY to Rs318 billion in November 2025 compared to Rs235 billion in the same month last year.

Fertilizer consumption in Pakistan during November 2025 witnessed a 13.9% increase YoY in overall nutrient offtake to stand at 616,000 tonnes.

On the external liquidity front, SBP-held foreign exchange reserves increased by $1.3 billion during the week to $15.9 billion, while commercial bank reserves rose by $0.2 billion to $5.2 billion.

The Pakistani rupee appreciated slightly against the US dollar, strengthening by 0.023% WoW to close at PKR 280.25 per dollar, offering marginal support to foreign investor returns.

Index Movers:

In terms of index contributions, Commercial Banks dominated market performance during the week, adding a substantial 1,818 points to the KSE-100 Index, making them the single largest driver of the weekly gain.

Investment Banks, Investment Companies and Securities Companies also provided meaningful support, contributing 190 points, while Technology and Communication stocks added 72 points on the back of selective buying in major names.

Pharmaceuticals contributed 44 points, supported by defensive interest, while Food and Personal Care Products added 43 points amid stability in large-cap names.

Transport stocks contributed 41 points, whereas Real Estate Investment Trusts added 26 points, reflecting improving sentiment toward yield-sensitive assets in a falling interest rate environment.

Additional positive contributions came from Property (+20 points), Tobacco (+19 points), Insurance (+12 points), Paper and Board (+6 points), Close-End Mutual Funds (+7 points) and Sugar (+4 points), providing incremental support to the benchmark.

On the downside, Oil and Gas Exploration Companies emerged as the largest drag on the index, subtracting 220 points, as heavyweight stocks faced selling pressure.

This was followed by Oil and Gas Marketing Companies, which shaved off 157 points, reflecting profit-taking amid margin and inventory concerns.

Fertilizer stocks weighed on the index by 81 points, while Miscellaneous and Power Generation and Distribution sectors reduced the index by 68 points and 62 points, respectively.

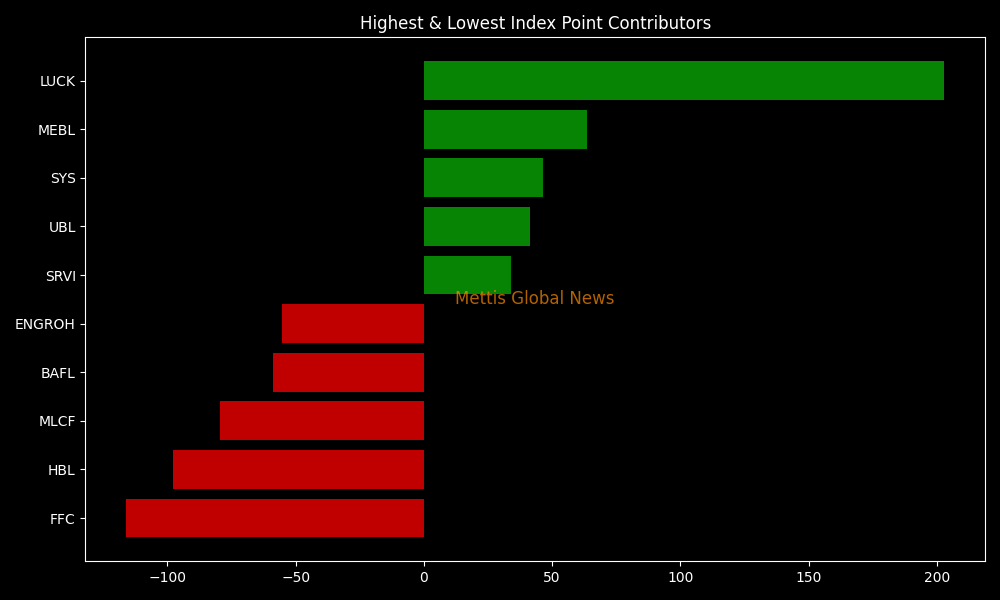

Scripwise, United Bank Limited (UBL) emerged as the single largest contributor, adding a hefty 968 points to the KSE-100 Index, as investor interest intensified following the policy rate cut.

This was followed by Engro Holdings (ENGROH), which contributed 421 points, while National Bank of Pakistan (NBP) added 349 points.

Other notable positive contributors included Habib Bank Limited (HBL) with 183 points, Lucky Cement (LUCK) with 153 points, Meezan Bank (MEBL) adding 107 points, and Bank of Punjab (BOP) contributing 82 points.

On the downside, selling pressure was most pronounced in heavyweight energy and fertilizer names. DHPL emerged as the largest drag on the index, shaving off 241 points, followed by Oil & Gas Development Company (OGDC), which reduced the index by 156 points.

Hub Power Company (HUBC) exerted significant pressure as well, subtracting 124 points, while Pakistan State Oil (PSO) dragged the index down by 80 points.

Other notable laggards included POL, PPL, and SSGC, which collectively weighed heavily on index performance amid weakness in the oil and gas space.

FIPI/LIPI:

From an investor flow perspective, foreign investors remained net sellers during the week, with total Foreign Institutional Portfolio Investor (FIPI) outflows amounting to $12.66 million.

The selling was primarily driven by foreign corporates, which recorded net selling of $14.60 million, while foreign individuals also remained marginal net sellers.

This was partially offset by overseas Pakistanis, who provided support to the market with net buying of $1.96 million, though not enough to reverse the overall foreign outflow trend.

In contrast, local investors absorbed the foreign selling almost entirely, as Local Institutional Portfolio Investors (LIPI) posted net buying of $12.66 million. Buying interest was led by individual investors, who emerged as the largest net buyers with inflows of $16.68 million, reflecting improved retail sentiment following the policy rate cut.

Mutual funds also supported the market with net purchases of $2.38 million, alongside modest buying from other organizations and NBFCs.

On the other hand, insurance companies booked profits worth $8.15 million, while banks/DFIs and companies also remained net sellers during the week.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,202.86 341.59M | -0.20% -384.80 |

| ALLSHR | 112,423.22 745.46M | -0.07% -79.96 |

| KSE30 | 57,956.48 141.89M | -0.12% -70.41 |

| KMI30 | 267,375.33 135.18M | -0.39% -1043.48 |

| KMIALLSHR | 72,363.20 391.84M | -0.20% -146.78 |

| BKTi | 53,485.97 53.11M | 0.26% 139.85 |

| OGTi | 38,916.61 17.01M | 0.72% 278.13 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,690.00 | 88,985.00 87,550.00 | 105.00 0.12% |

| BRENT CRUDE | 66.17 | 66.78 65.00 | 0.58 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.22 | 61.86 60.14 | 0.59 0.97% |

| SUGAR #11 WORLD | 14.93 | 14.98 14.74 | 0.14 0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market