Weekly Market Roundup

By Abdur Rahman | February 17, 2024 at 08:00 AM GMT+05:00

February 17, 2024 (MLN): The Pakistan stock market faced severe pressure throughout the week amid increasing political uncertainty following the general elections.

The benchmark KSE-100 index closed this week at 59,873 plummeting 3,071 points or 4.88%.

The country needs to secure a larger and longer International Monetary Fund (IMF) loan program to meet its high debt obligations. However, continued political instability could put this in jeopardy, raising default risk.

Meanwhile, the Pakistani Rupee snapped its 13-week-long winning streak and recorded a marginal decline of 0.03% WoW.

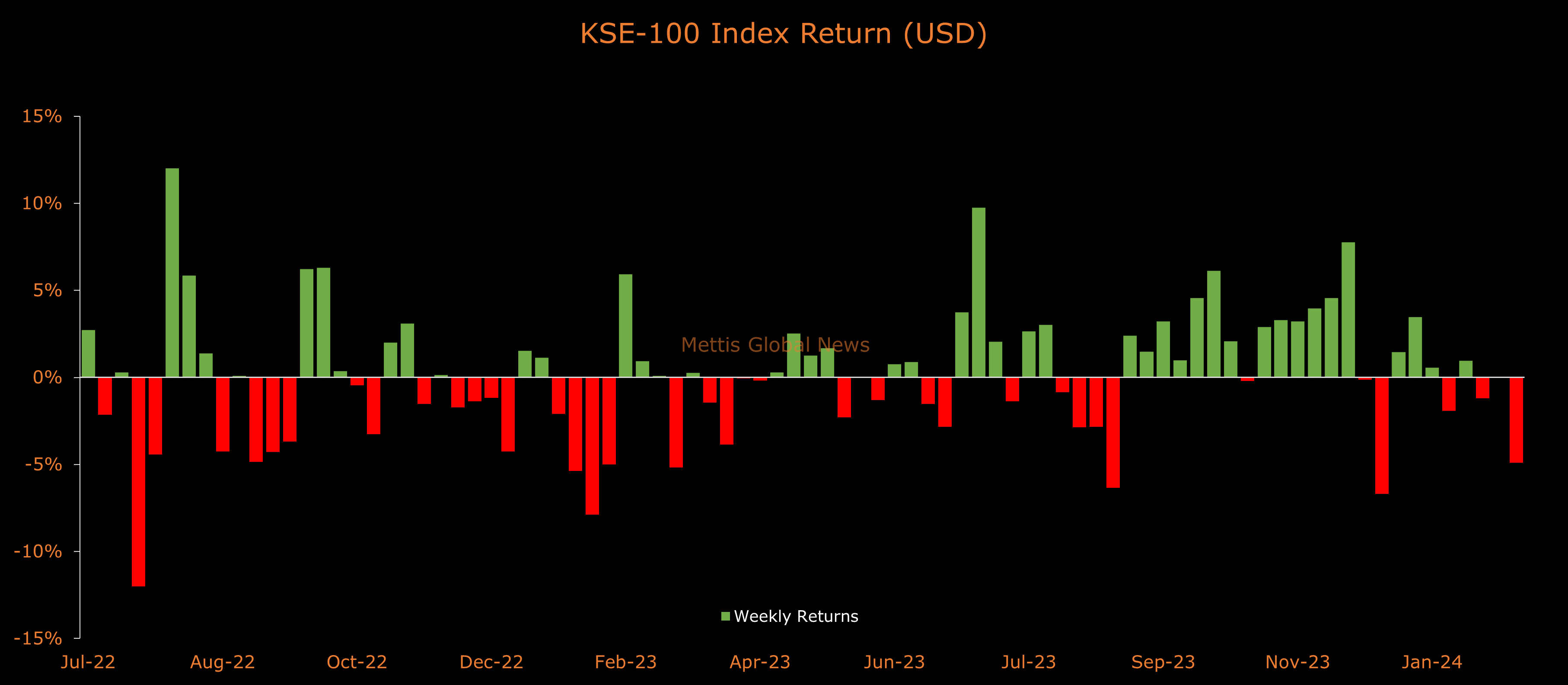

In USD terms, the KSE-100 index lost 4.91% this week.

Throughout the week, KSE-100 oscillated in a wide range of 3,021 points, between high and low of 62,634 and 59,613 levels, respectively, before settling the week near the weekly lows at 59,873.

The average traded volume arrived at 190 million shares worth Rs10.30 billion, marking an increase of 10.96% MoM in the number of shares while a fall of 7.80% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 350m shares worth Rs13.50bn, marking an increase of 14.66% MoM in the number of shares while a decrease of 3.56% MoM in traded value.

A Bloomberg Economics report said that the inconclusive February 08 election means political uncertainty is set to linger, which could hinder fresh investment.

"A weak coalition government, the most likely outcome is likely to face tougher conditions for aid under the new IMF program," it said.

A new IMF program, after the current one ends in April, is needed to avoid a default over the medium term and tougher loan conditions are likely to hit near-term growth.

During the week, the Federal Cabinet approved an increase in the weighted average gas price by around 12.3% to Rs1,533/MMBtu, in line with the IMF's conditions for the upcoming review of the loan program.

Top Index Movers

A deep market-wide sell-off was witnessed throughout the week, with most of the stocks taking a beating.

The index suffered a heavy blow from the Oil & Gas Exploration Companies sector, which dragged it down by 1,176 points.

This was due to the delays in the circular debt reduction and tariff rationalization plans.

Other sectors contributing negatively to the index were Cement with 288, Power Generation & Distribution with 287, Oil & Gas Marketing Companies with 216, and Commercial Banks with 208 points.

On the other hand, the only sectors that managed to stay in the green zone were Synthetic & Rayon and Textile Spinning, cumulatively adding a bare 5 points.

Scrip-wise, OGDC, PPL, HUBC, PSO, and LUCK were the worst-performing stocks during the week as they stripped off 730, 377, 221, 149, and 117 points from the index respectively.

Whereas, EFERT, MCB, FATIMA, NATF, and AGP added 93, 33, 19, 14, and 9 points to the index respectively.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $5.23m worth of equities.

Flow-wise, Overseas Pakistani were the dominant buyers, with a net investment of $3.88m.

They allocated the majority of their capital, $2.00m, to Oil and Gas Exploration Companies, while divesting from the Cement sector, amounting to $0.5m in sales.

On the other hand, the leading sellers were Broker Proprietary Trading, with a net sale of $5.88m.

Their most substantial sales activity was in Oil and Gas Exploration Companies, amounting to $4.45m.

To note, the KSE-100 has gained 18,420 points or 44.44% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative decrease of 2,578 points, equivalent to 4.13%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 133,274.18 132.40M |

0.53% 697.19 |

| ALLSHR | 83,395.96 447.31M |

0.50% 412.29 |

| KSE30 | 40,496.15 20.14M |

0.34% 137.35 |

| KMI30 | 191,270.46 25.35M |

0.28% 543.14 |

| KMIALLSHR | 55,918.32 224.11M |

0.39% 219.84 |

| BKTi | 36,629.99 8.02M |

1.07% 387.93 |

| OGTi | 28,202.11 2.65M |

-0.43% -121.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,705.00 | 112,170.00 111,395.00 |

-540.00 -0.48% |

| BRENT CRUDE | 70.28 | 70.42 69.91 |

0.09 0.13% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.42 | 68.57 68.04 |

0.04 0.06% |

| SUGAR #11 WORLD | 16.54 | 16.61 16.08 |

0.41 2.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances