Weekly Market Roundup

Abdur Rahman | February 03, 2024 at 04:04 PM GMT+05:00

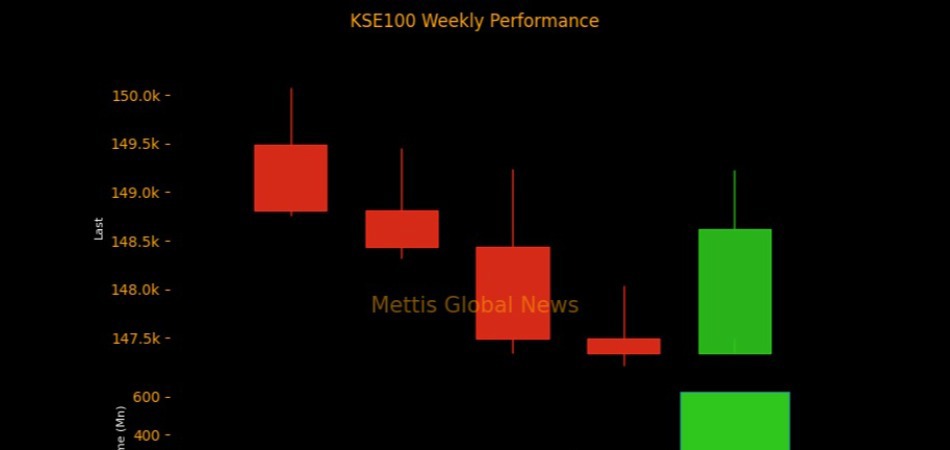

February 03, 2024 (MLN): The benchmark KSE-100 index closed this week at 63,003 showing a decrease of 810 points or 1.27%.

The market was partly weighed down by the central bank's decision to keep the policy rate unchanged at a record high of 22% for a fifth consecutive meeting to curb inflation, disappointing investors who were hoping for an early rate cut.

The consumer price index (CPI) for January 2024 remained sticky at 28.34% YoY, with a significant jump of 1.83% MoM.

Moreover, the government raised petrol prices by Rs13.55 or 5.2% to Rs272.89 per litre until February 15, which will add more pressure to the inflation next month.

Meanwhile, the Pakistani Rupee recorded a marginal gain of 0.07% WoW.

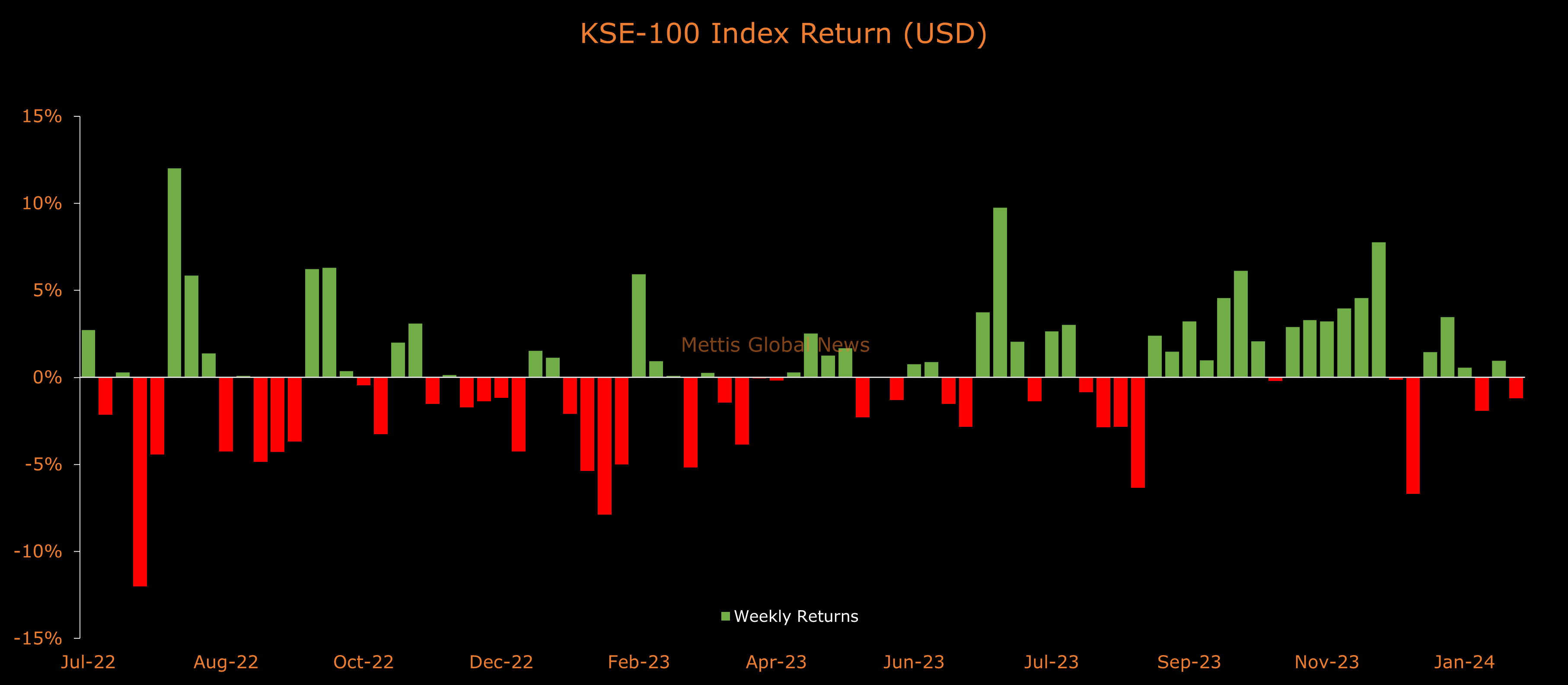

In USD terms, the KSE-100 index lost 1.20% this week.

Throughout the week, KSE-100 oscillated in a range of 2,155 points, between high and low of 63,793 and 61,638 levels, respectively, before settling the week at 63,003.

The market turnover saw a fall during the week, with an average traded volume of 164 million shares worth Rs8.70 billion, marking a decrease of 33.73% MoM in the number of shares and 48.75% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 313m shares worth Rs11.51bn, marking a decrease of 24.69% MoM in the number of shares while a decrease of 43.23% MoM in traded value.

Top Index Movers

From the sector-specific lens, Fertilizer was the worst performing sector, as it took away 177 points from the index.

This was followed by Oil & Gas Marketing Companies, Chemical, Technology & Communication, and Power Generation & Distribution as they kept the index in negative territory by taking away 130, 121, 86, and 66 point, respectively.

Contrary to that, Automobile Assembler, Cable & Electrical Goods, Insurance, and Pharmaceuticals were the only sectors that landed in the green zone, as they added 88, 7, 7, and 3 points to the index.

Scrip-wise, COLG, MARI, PPL, EFERT, and PSO were the worst-performing stocks during the week as they stripped off 105, 94, 80, 77, and 64 points from the index respectively.

Whereas, OGDC, MTL, MCB, BAFL, and AKBL added 122, 80, 78, 22, and 8 points to the index respectively.

FIPI/LIPI

Foreign investors were net sellers during the week, offloading $9.71m worth of equities.

Flow-wise, Insurance Companies were the dominant buyers, with a net investment of $6.98m.

They allocated the majority of their capital, $2.01m, to Cement.

On the other hand, the leading sellers were Foreign Corporates, with a net sale of $11.21m.

Their most substantial sales activity was in Commercial Banks, amounting to $2.79m, while they acquired $0.67m of equities in the Fertilizer.

For the upcoming week, attention will be directed towards the February 08 elections. Historical data suggests that the runup to the elections may be a good time to bet on a continued move higher in the country’s stocks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI