Weekly Market Roundup

MG News | July 03, 2022 at 04:31 PM GMT+05:00

July 3, 2022 (MLN): This week, the local bourse gained 579 points or up by 1.4% WoW and closed at 41,630 index levels.

The market posed a significant recovery during the outgoing week, as the credited of $2bn Chinese SAFE loans took the SBP reserves to $10bn.

Besides, $3.8bn debt relief by G-20 countries to Pakistan and hope of resuming the IMF financing program as Pakistan received a Memorandum of Economic and Financial Policies (MEFP) for the combined 7th and 8th tranche from IMF that could result in inflows of $2.bn to the national reserves also supported the recovery in the stock market.

However, the market sentiment was adversely affected by another hike in fuel prices by the government to fulfil IMFs demand. Following this, the market was unable to continue its momentum and followed a topsy-turvy ride over the rest of the week.

Moreover, despite the highest ever tax collection of Rs6.1 trillion, up by 29% YoY in FY22, investors’ sentiments did not improve primarily due to 13-year high inflation in the month of June’22 and widening current account deficit which was reported at $15.2bn for 11MFY22. In addition, fear of a 100-150bps rise in policy rate in next MPS further dampened market sentiments.

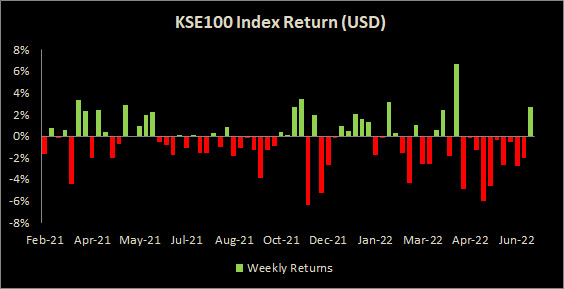

In USD terms, the index recovered by 2.7% as PKR strengthened by 2.4 rupees against the greenback settling at Rs204.85 on 30th Jun’22.

Overall, the bourse witnessed 3 sessions in favour of bull while 2 sessions were in favour of bear. The KSE-100 index oscillated between high and low of 2,149 and 41,052 levels, respectively, before settling the week at 41,630 levels.

.jpeg)

From the sector-specific lens, Cement, Fertilizer, Power Generation & Distribution, Oil & Gas Exploration companies, Banks kept the index in green territory as they added 97, 79, 74, 69, and 55 points to the index respectively.

Contrary to that, Investment Banks, Refinery, Cable & Electric Goods, Sugar & Allied Industries, and Modarabas during the week collectively took away 22 points from the bourse.

Scrip-wise, HUBC, POL, LUCK, EFERT, and MARI were the best-performing stocks during the week as they added 83, 64, 47,39, and 36 points to the index respectively. Whereas HBL, EPCL, OGDC, KAPCO, and DAWH collectively snatched 100 points from the index.

.jpeg)

Meanwhile, the KSE All Share market cap increased by Rs100.2 billion or 1.46% over the week, being recorded at Rs6.9trillion as compared to a market cap of Rs6.8tr recorded last week.

Flow-wise, foreigners turned net buyers during the week, purchasing stocks worth $1.52mn compared to a net sell of $2.3mn last week. Sector-wise, the major selling was observed in Fertilizer ($0.3mn) and all other sectors ($0.2mn).

On the local side, the majority of the selling was reported by Insurance companies and Mutual Funds amounting to $12.2mn and $2.6mn, respectively. However, Banks and Individuals stood on the other side with net buying of $6.8mn and $4mn respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction