Weekly Market Roundup

MG News | March 27, 2022 at 04:11 PM GMT+05:00

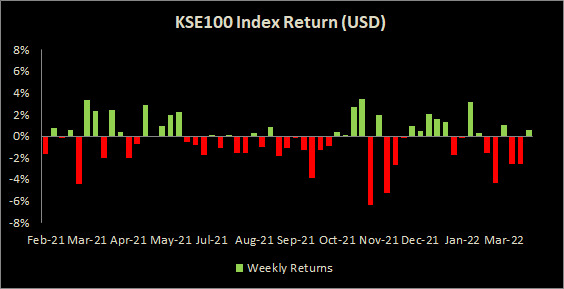

March 27, 2022 (MLN): The Pakistan Stock Exchange (PSX) endured a lacklustre trading week as local political uncertainty and global geopolitics kept investors on the back foot, subsequently, the benchmark KSE-100 index closed the week with a gain of 521 points or 0.54% at the 43,551-point level.

Although the market gained some momentum amid 78% MoM contraction in the current account during Feb’22 coupled with a landmark agreement on the Reko Dig between the Federal government, Government of Baluchistan and Barrick Gold Corporation, this remained short-lived. Rising cut off rates in the T-bill auction, signalling monetary tightening, as well as the rupee weakening to its historic low, crossing the 181/USD mark, kept the index range bound, a note by Arif Habib Securities said.

Overall, the market witnessed two bearish sessions and three bullish sessions throughout the week. The average daily traded value in the benchmark remained at Rs3.91bn with an average daily volume of 65.46mn shares.

From the sector-specific lens, Fertilizers, Cement, Power Generation & Distribution, Commercial Banks, and Chemical kept the index in green territory as they added 146, 97, 57, 56, and 47 points to the index respectively.

Contrary to that, Automobile, Paper & Board, Oil & Gas Exploration Companies, and Insurance during the week collectively took away 35 points from the bourse.

Scrip-wise, HBL, LUCK, FFC, TRG, and HUBC were the best-performing stocks during the week as they added 365 points to the index, whereas SYS, UBL, BAHL, THALL, and HMB eroded 133 points from the index.

Meanwhile, the KSE All Share market cap increased by Rs83.8 billion or 1.15% over the week, being recorded at Rs7.35 trillion as compared to a market cap of Rs7.27tr recorded last week.

Flow-wise, foreigners were the net sellers during the week, offloading stocks worth $4.1mn compared to a net sale of $4.9mn last week, largely backed by foreign corporations amounting to $5.16mn. Sector-wise, major selling was witnessed in Banks ($5.9mn) and E&Ps ($0.8mn).

On the local side, the majority of the buying was reported by Mutual Funds, Individuals and Insurance companies amounting to $5.3mn, $2.6mn, and $1.8mn, respectively. However, Banks and Companies stood on the other side with net selling of $4.6mn and $1.9mn respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction