US FDI dominance fades as China gains ground in global greenfield investments

MG News | November 25, 2024 at 11:37 AM GMT+05:00

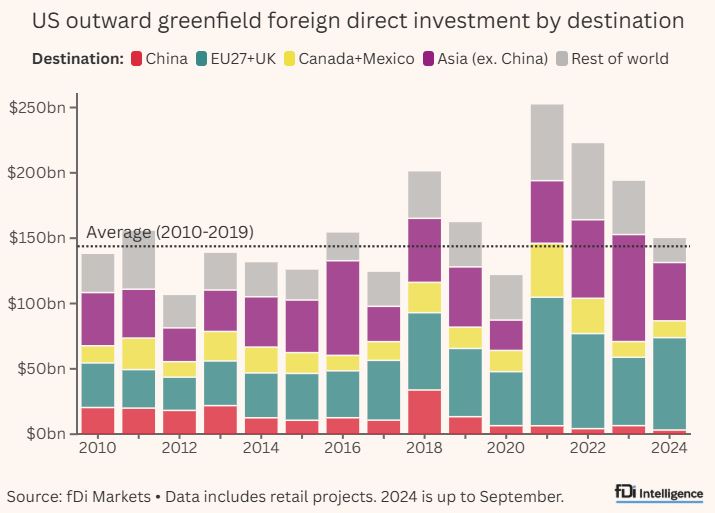

November 25, 2024 (MLN): The US has become a less dominant source of greenfield foreign direct investment (FDI), with the share of global capital pledges and projects originating from the world’s largest economies falling to their lowest levels on record last year, according to the report by FDI Intelligence.

Around 14% of the $1.38tn worth of global greenfield FDI capital expenditure (capex) in 2023 was announced by US-headquartered companies, down from a peak of almost 30% in 2021 and the lowest proportion since records began, according to fDi Markets data.

Meanwhile, China’s share as a source of global FDI capex jumped to almost 12% in 2023, just short of the 13% record in 2016, it added.

The US was also the source of a record low 17% for the roughly 18,700 global FDI projects tracked in 2023.

This was still way ahead of the 9% of FDI projects from the UK, the second-placed source country, and more than three times the share held by China.

Preliminary data for the first three quarters of 2024 shows a slight increase, but the US share as a source market of global FDI projects and capex remained at their second-lowest level after the all-time lows recorded in 2023, it further noted.

The US remains the world’s largest source of FDI, both in terms of project numbers and capex, as confirmed by fDi Markets data on greenfield investment, as well as other sources like Unctad’s data on outflows and outbound stock of headline FDI — which includes greenfield investment and cross-border mergers and acquisitions.

But more recent data on greenfield FDI announcements show signs of American multinationals’ dominance in global capital flows beginning to fray, and a shift to invest more in the US, which was the fastest-growing major advanced economy in 2023.

Economists polled by Consensus Economics last week expect the US to have real gross domestic product growth of 2.7% this year — three times the 0.8% expected growth rate in the Eurozone.

So far in 2024, US companies pledged 63% of their total capex to domestic interstate projects, while the remaining 37% went to FDI projects abroad, according to preliminary fDi Markets data up to September.

The trend is less clear cut with the number of investments, but US-based companies have still announced more projects at home (54.7%) than abroad so far this year.

This domestic inclination has coincided with greater restrictions on US outbound investment and policies to encourage investment at home. While this started in Republican president-elect Donald Trump’s first term, it has continued under Joe Biden and the Democrats with federal policies like the Inflation Reduction Act and Chips Act, which offer huge subsidies for US investment.

Richard Bolwijn, Unctad’s director of investment research, says that these policies — and a strong US economy with rising asset prices and expectations of future lower costs of doing business — have incentivised stronger domestic investment.

“The drive for [American] firms to go and invest abroad is much lower,” he argues.

These investment trends are also a reflection of recent experience. “US companies are investing at home because they want their supplies handy” and to avoid the supply chain disruption caused by relying on sourcing components from abroad, says Paige Webster, an Arizona-based site selector with his practice, Webster Global Site Selectors.

“Timing is everything in building products,” he adds.

But experts caution that despite an improving US economic outlook, the incentive for US companies to invest at home may change. “Inflationary pressures caused by excessive spending or trade barriers could set off another inflationary cycle, which could jeopardise continued real growth in the US,” says Maggie Switek, senior director of research at the Milken Institute, a think tank.

While full of nuances, the US’s stance has shifted from one that encourages outward FDI to a more inward-looking protectionist streak.

As Trump is set to take office on January 20 next year, with business tax cuts coupled with protectionist trade policy proposals, US investment at home and abroad is once again likely to shift.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves