UBL goes extra mile, hitting 50% ADR target

.jpg?width=950&height=450&format=Webp)

Nilam Bano | October 31, 2024 at 04:48 PM GMT+05:00

October 31, 2024 (MLN): United Bank Limited (PSX: UBL) has successfully met the Advances to Deposits Ratio (ADR) requirement of 50% by lending over Rs200 billion to the Pakistan Agricultural Storage and Services Corporation (PASSCO), trimming high-cost deposits, and increasing private sector lending.

This achievement was confirmed by the bank’s President, Muhammad Jawaid Iqbal during the Corporate Briefing Session held yesterday.

He also informed that the bank has incurred no additional tax expense related to the ADR for the first nine months of 2024.

In a proactive strategic move, UBL is planning to focus on reducing costly corporate savings deposits which are not mandatory for banks to accept to achieve next year’s ADR target.

Additionaly, the bank will expand its lending portfolio to meet regulatory requirements, he stated.

Banks across the sector are likely to contest the ADR tax as it is seen as unfair by the industry which would result in a joint legal challenge against the policy, according to Mr Jawaid Iqbal.

Over the last 1.5 years, UBL's current accounts have grown by 58%, from Rs876bn in Dec-2022 to Rs1,387bn in Jun-2024, compared to the industry growth of 38%, from Rs8,739bn to Rs12,080bn in the same period.

In response to a query, the President also informed that GCC current accounts has achieved growth of 95% to $1.18bn in September 2024

President credited this success to UBL’s fair, market-based HR policies, which have fostered low employee turnover and strong international account performance. He said this remarkable achievement was not possible in the absence of dedicated efforts of UBL’s employees.

With regard to the future outlook, the bank aims to increase current account segment by 15–16%.

The house was also informed that the Central Bank granted concession on leverage ratio is currently below the required threshold and set to expire in January 2025.

UBL management anticipates that the bank's leverage ratio will meet regulatory requirements by the end of this year on the back of high equity reserves and investment maturities.

Particularly on participation in OMO’s, the President apprised the house that UBL's OMO borrowing stands at Rs4.160trn as of September 2024, while its T-Bills portfolio, valued at Rs3.268trn with a yield of 20.51%, has Rs2.628trn maturing by December 31, 2024, and Rs525bn by April 30, 2025.

These maturities worth Rs3.153trn are expected to reduce OMO borrowing unless reinvested.

It is important to note that the bank has already reduced OMO borrowing by nearly Rs1trn this month.

Going forward, UBL’s Profitability is expected to remain strong in 2025 and 2026, as the bank has strategically positioned its investment portfolio in anticipation of further declining interest income.

President UBL foresees the policy rate dropping to 12%, with a significantly wider spread between inflation and the policy rate.

To note, UBL is one of the largest networks, with 1,407 branches, including 241 Islamic branches and over 500 Islamic banking windows. Its digital banking proposition is also robust, serving over 4m customers through a state-of-the-art mobile application

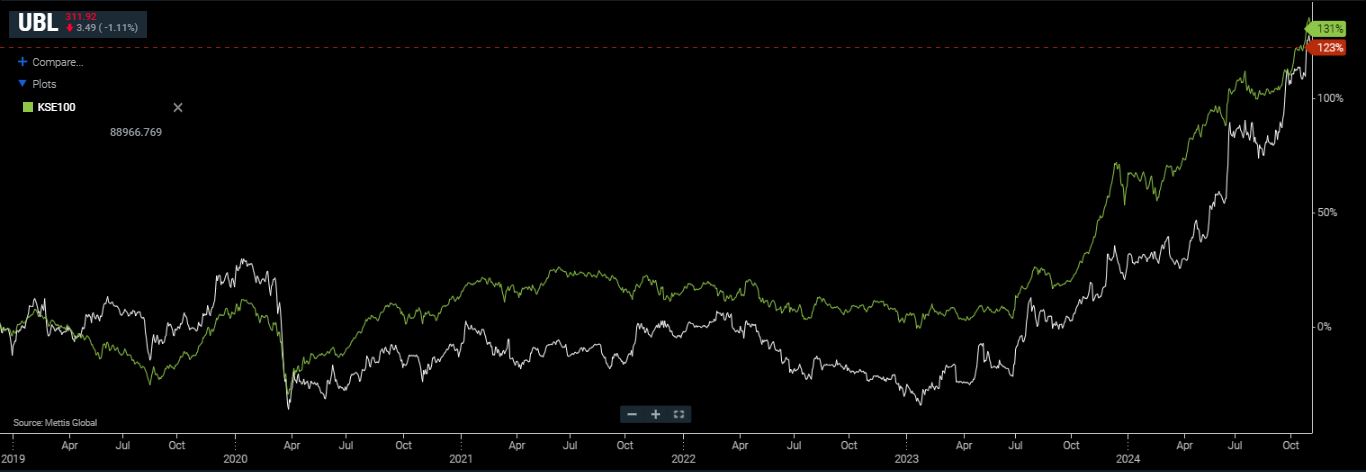

Regarding the scrip performance, the bank's share price has increased by approximately 238.6%, reaching 311.92 to date compared to its price on January 23, 2023.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,325.00 | 68,625.00 65,685.00 | 30.00 0.04% |

| BRENT CRUDE | 103.17 | 119.50 99.00 | 10.48 11.31% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 99.66 | 119.48 96.25 | 8.76 9.64% |

| SUGAR #11 WORLD | 14.33 | 14.48 14.25 | 0.23 1.63% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)