Trump’s win pressures gold prices in Pakistan

By Rafay Malik | November 11, 2024 at 07:44 AM GMT+05:00

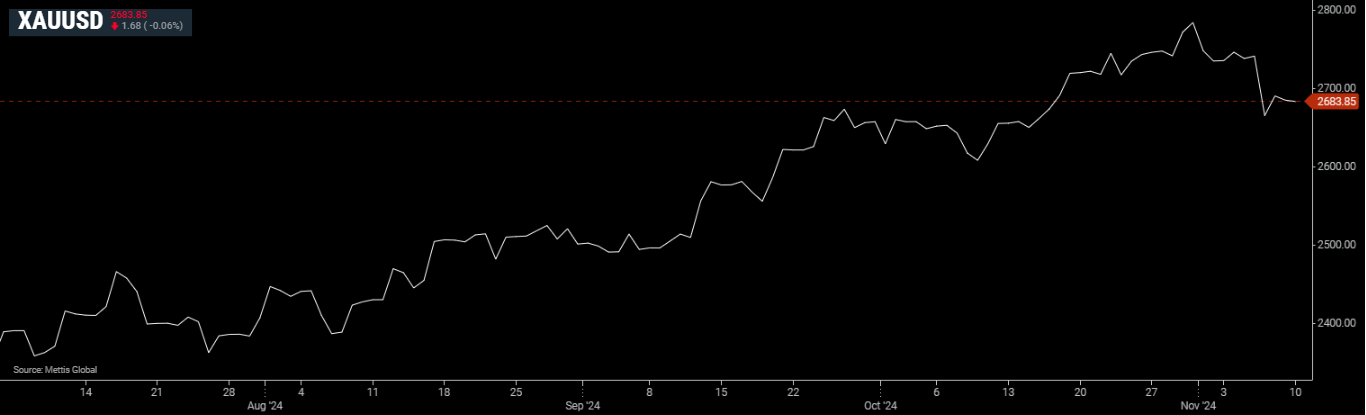

November 11, 2024 (MLN): Investors in Pakistan’s bullion market suffered severe losses last week as international gold recorded its biggest weekly drop in nearly 5 months.

Donald Trump's win in the US presidential election prompted this drop, which resulted in both local and international rates falling for the second consecutive week —a rare trend, as gains have echoed across gold for quite some time.

Initially, bullion was widely expected to rally after a Trump victory, but improved sentiments strengthened the US dollar, making the yellow metal relatively expensive for holders of other currencies.

The U.S. Dollar index (DXY), which tracks the value of the greenback against six other top currencies surged 0.61% over the week.

Additionally, the risk-on assets garnered significant attention and rallied on hopes of future policy, which caused money to flow out of safe and secure gold.

24-karat gold, the key benchmark in the domestic market settled the week at Rs278,800 per tola, down by 1.48% compared to last week’s closing.

Meanwhile, international spot gold dropped 1.9% or nearly $50 to settle at $2,683.95 per ounce.

Another key event during the week was the FOMC meeting, where the US Fed delivered a 25bps cut, in line with the market expectations and marking the second consecutive cut.

This placed pressure on the yields, with the 10-year U.S. government bond yield falling to 4.308% in contrast to the rate of 4.386% at the close of the preceding week.

Likewise, the DXY faced headwinds, dropping as much as 0.72% on the day the rate cut was announced.

Nonetheless, the Trump effect played off, allowing the DXY to settle for a favorable close —for the sixth consecutive week, to be precise.

As for yields, they had already been rising by a significant margin before this weekly drop, reducing the appeal of gold as a safe-haven asset.

In Pakistan, gold rates are determined by international spot rates, converted to the local currency using interbank exchange rates with an additional $20 premium.

With this, the yellow metal’s gain in the ongoing calendar year stands at 26.73%, while its fiscal year gain is an impressive 15.35% for the fiscal year.

Comparative analysis shows that local equities have outpaced gold as the KSE-100 index has delivered a fiscal year return of 18.93% and a record-breaking 49.38% for the current calendar year, both now outpacing gold.

Impact of Local Currency

It is worth mentioning that Pakistan’s currency also has a major role in driving gold prices in the country.

The Pakistani rupee (PKR) has remained largely stable against the strong U.S. dollar for a prolonged period, which generally benefits local gold as it allows changes in international gold prices to have a more direct impact, as the local market remains shielded from currency fluctuations.

On a weekly basis, the home currency registered a meager loss of 4 paisa against the mighty Dollar.

Since gold is denominated in U.S. Dollar terms, when PKR falls against the greenback, the value of PKR-denominated gold rises.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,176.40 73.64M |

0.37% 489.75 |

| ALLSHR | 81,639.81 346.18M |

0.41% 334.56 |

| KSE30 | 40,111.55 31.92M |

0.42% 166.10 |

| KMI30 | 191,132.18 37.36M |

0.23% 434.13 |

| KMIALLSHR | 55,131.55 169.19M |

0.10% 57.39 |

| BKTi | 35,005.42 6.16M |

1.26% 437.02 |

| OGTi | 28,583.18 2.85M |

-0.54% -156.17 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,530.00 | 110,525.00 109,360.00 |

-885.00 -0.80% |

| BRENT CRUDE | 68.70 | 68.89 68.37 |

-0.10 -0.15% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 108.45 | 0.00 0.00 |

0.25 0.23% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 67.02 | 67.18 66.69 |

0.02 0.03% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

FX Reserves

FX Reserves

CPI

CPI