The last status quo?

Muhammad Ghazanfar Sakrani | December 14, 2023 at 10:01 AM GMT+05:00

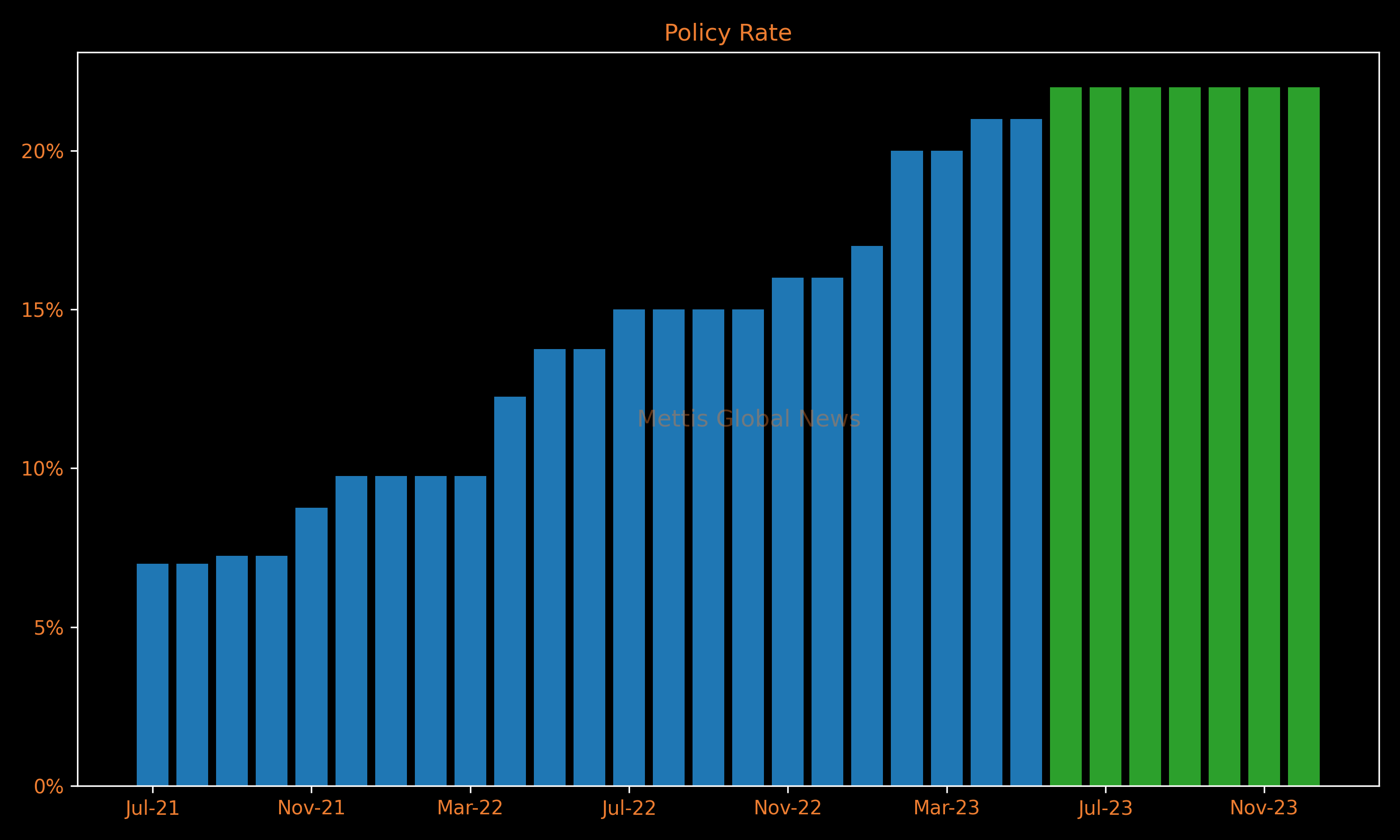

December 14, 2023 (MLN): The calendar year which started with a policy rate of 16% skyrocketed to 22% in just 6 months before stabilizing at that level. The much-awaited and last monetary policy decision of a year full of thick and thin for the country’s economy did not deviate from the analyst’s expectations.

Would this last policy decision of the current calendar year turn out to be the last status quo and thus the pivot is on the cards?

The prominent factor behind the maintenance of the status quo was the hike in inflation which resulted in weekly SPI-based inflation surging by 1.6%.

The predominant factor behind this uptick was the hike in gas prices which surged by a whopping 1,108.59% in quarter 1, resulting in a 43% YoY rise in SPI. Amid this development, the central bank maintained the policy rate to ensure it caters to the implications of the inflation outlook.

On the contrary, the decline in oil prices internationally below $70 despite production cuts by OPEC+ has raised hopes of declining inflation. Last year’s catastrophic floods also adversely affected the agricultural produce which started to gain momentum in the current fiscal year.

Cotton production gained 83% and reached 6.79 million bales. A bumper crop is also expected for rice production which will help in exerting downward pressure on food items compared to the same period last year.

Since the last MPC meeting, various improvements were also observed in the country’s economy. The smooth first review of IMF is set to unlock $700 million in January 2024. Complying with the IMF demands, the PBS for the first time published quarterly economic performance which depicts economic recovery as evidenced by a growth of 2.17% in the quarterly GDP figures. The LSM also expanded by 0.68% after a long wait as it declined by almost 10% which painted a grim picture of the industrial sector.

However, the services sector which makes the lion’s share of GDP recorded a meagre growth of 0.82%. The country’s external account also improved with the current account deficit declining by almost two-thirds to $1.059 billion during July-October.

The administrative actions in the exchange market also put brakes on the volatility in exchange rates hovering around Rs285/$.

The country’s FX reserves position also remains steady at $7 billion with the expected unlocking of funds from IMF and other multilateral lenders. Unluckily, the fact that the country received only $550 million in the first five months against an anticipated $6.5 to $7 billion for the current fiscal year may again lead to the precarious position of our forex reserves.

The materialization of $25 billion on account of investment attracted via the Special Investment Facilitation Council (SIFC) is still awaited, which if not materialized may jeopardize the country’s forex position. Remittance performance is also worrisome as it dropped by 10% to $11 billion during the first five months of FY24.

This may also dent the so-far so-good performance of the country’s current account.

The fiscal position of the country remains intact as evidenced by 29.6% rise in FBR tax revenues during the first five months of FY24. Non-tax revenues including petroleum development levy also witnessed favourable growth. The transfer of SBP profits which is expected to touch Rs1 trillion also enhanced the government revenues.

However, the target of Rs940 billion for December 2023 seems unattainable which may hamper the overall tax collection.

The money supply also started to shrink on account of M2 (broad money) which declined by 13.7% YoY as of November 24, 2023. The foreign inflows accelerated which improved the Net Foreign Assets of the banking system including SBP while Net Domestic Assets declined. This has improved the composition of broad and reserve money.

Though inflation may have plateaued, it remains at elevated levels as endorsed by the 29.2% CPI of November 2023. The core inflation of 21.5% is sticky. It is expected that a decline in global commodity prices and food prices would pull inflation figures on the lower side in the second half of FY24.

Consequently, the stage may be set for SBP to reverse its course and shift to a dovish policy stance.

It is safe to conclude that the discount rate and inflation have peaked and a reversal in policy rate is now just a matter of WHEN and not IF!

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction