Tech Beat: Gold sets eyes on $2,300

.png)

By Abdur Rahman | October 22, 2023 at 02:32 PM GMT+05:00

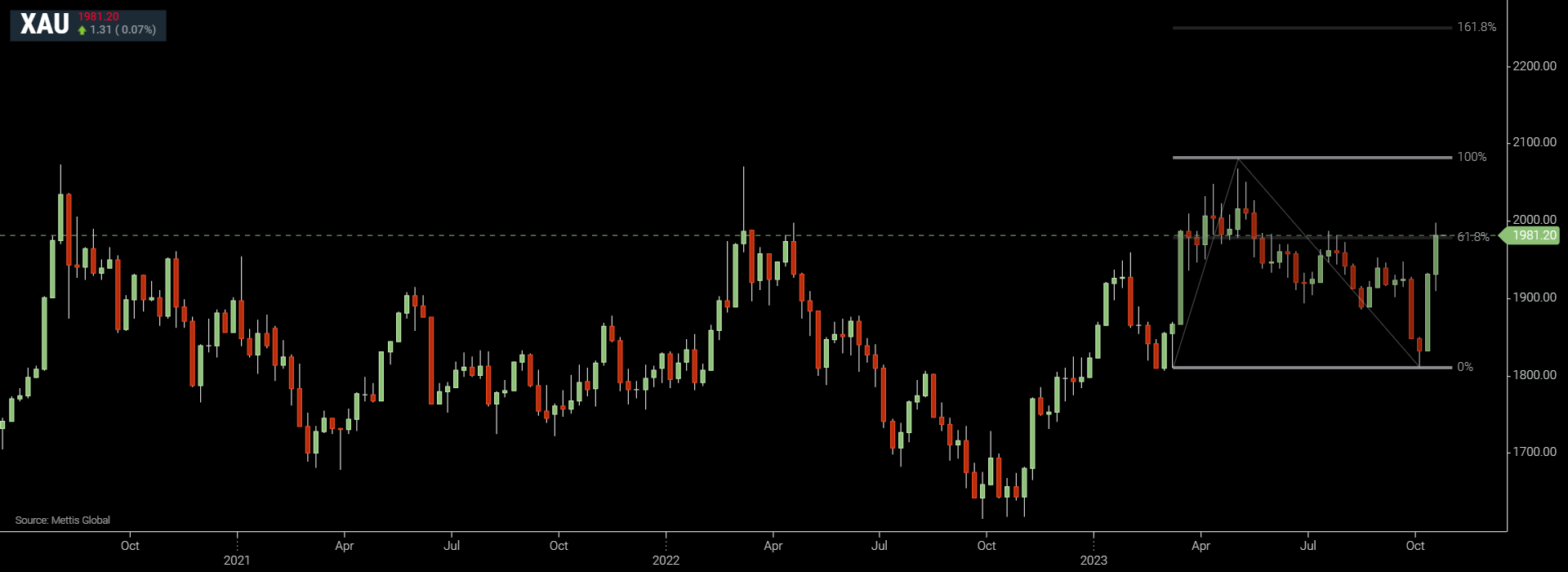

October 22, 2023 (MLN): The international spot gold experienced a strong rally, with prices surging by 9.4% or $170 over a mere 10 trading sessions, ultimately closing the week at $1980, which is above the key resistance level of $1974.

The prevailing sentiment among market participants is that gold is likely to undergo a correction, as historical trends suggest that such rapid rallies triggered by geopolitical concerns often tend to fade. A prime example of this pattern can be observed in February 2022.

However, it is important to acknowledge that gold has concluded the week above the pivotal resistance level. From a technical standpoint, this signals an exceptionally bullish trend.

Technicals support further room for expansion, targeting new all-time highs, with a clear stop level at break and acceptance back below the $1974 level.

XAU/USD Daily time-frame chart:

| Support Levels | ||

|---|---|---|

| $1,974 | $1938 | $1,898 |

| S1 | S2 | S3 |

| Resistance Levels | ||

|---|---|---|

| $2,003 | $2,025 | $2,060 |

| R1 | R2 | R3 |

The ideal bullish scenario would be to see more buying pressure next week on open, followed by some correction leading to the formation of a higher low above this key $1974 level.

This would form the classic resistance-turned-support pattern and a potential demand zone, where the sellers who exited the market at these levels or lower would likely seek to re-enter.

This would create a bullish retest pattern before the market continues its uptrend.

Anticipating the next market movements, it is reasonable to project a target of around $2,300, which is based on Fibonacci extensions drawn from the recent highs and lows.

The weekly chart also shows a clear and consistent uptrend, which supports the bullish outlook. There is no sign of reversal or weakness in the market. The market is still in a strong bullish phase.

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,866.56 148.00M |

1.30% 1667.13 |

| ALLSHR | 80,791.33 406.65M |

1.26% 1003.71 |

| KSE30 | 39,736.61 60.05M |

1.62% 631.61 |

| KMI30 | 188,984.71 51.03M |

1.11% 2069.10 |

| KMIALLSHR | 54,651.68 184.13M |

0.83% 449.80 |

| BKTi | 34,699.54 29.60M |

3.65% 1222.86 |

| OGTi | 28,160.13 3.52M |

0.71% 197.55 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,985.00 | 107,055.00 105,440.00 |

1235.00 1.17% |

| BRENT CRUDE | 67.27 | 67.29 67.05 |

0.16 0.24% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.57 | 65.65 65.34 |

0.12 0.18% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI