SRB to achieve Rs120 billion revenue collection target for 2018-19: Chairman

MG News | January 23, 2019 at 05:14 PM GMT+05:00

January 23, 2019: Chairman Sindh Revenue Board (SRB) Khalid Mehmood has said that since its inception, SRB has been achieving all its revenue collection targets every year therefore the Revenue Board will also be able to achieve Rs120 billion target set for current fiscal year ending on June 30, 2019, of which around Rs44 billion have already been collected during July to December 2018.

Highlighting the overall performance of SRB during his visit to the Karachi Chamber of Commerce & Industry, Khalid Mehmood informed that SRB began its operations from just Rs16.6 billion in 2010-11, which was followed by revenue collection of Rs25 billion in 2011-12, Rs33 billion in 2012-13, Rs42 billion in 2013-14, Rs49 billion in 2014-15, Rs61 billion in 2015-16, Rs78 billion in 2016-17 and Rs100 billion achieved in 2017-18, making SRB the single largest contributor to the provincial exchequer. “During the last couple of years, SRB has witnessed a rise of 27 percent in its revenue collection because of the contribution, support and patronage of the business and industrial community of Karachi”, he added.

Chairman Businessmen Group & Former President KCCI Siraj Kassam Teli, Vice Chairman BMG Tahir Khaliq, President KCCI Junaid Esmail Makda, Senior Vice President KCCI Khurram Shahzad, Vice President KCCI Asif Sheikh Javaid, Chairman GST/ SRB Subcommittee Shakeel-ur-Rehman and Managing Committee members were also present at the meeting.

Chairman SRB said that although the SRB has not been collecting sales tax on mobile phone services since last six months under the court’s order which created an unfavorable and disadvantageous situation yet the Board was trying hard and was likely to achieve Rs120 billion target. “Currently around 29,000 taxpayers are registered with SRB and this number continues to rise every year”, he added.

“SRB provides numerous online facilities to taxpayers including E-Registration, E-filing, E-Notices to non-filers, E-Payments through online banking, and Call Center Facility etc. “The Board is also integrated with NADRA, PRAL and other institutions while our system is completely centralized”, he said, adding that the success of SRB can be attributed to its automation and trained staff who provide full assistance to taxpayers and have also been promptly responding to all the queries.

In response to concerns expressed by Chairman BMG over issuance of notices to KCCI, Chairman SRB assured that they will come up with some kind of solution to this particular issue so that no further notices are issued to Karachi Chamber which, as an entity, is neither involved nor a source for any commercial activity.

Referring to Taxation issues being faced by indenters, tour operators and the construction sector, Chairman SRB said that all these taxation issues can be discussed further and amicably resolved while relief can be announced in the next budget. In this regard, he advised KCCI and other stakeholders to sit with SRB in order to come up with mutually acceptable solutions that result in providing relief to existing taxpayers and prove favorable in bringing more people into the tax net.

Chairman BMG & Former President KCCI Siraj Kassam Teli, while appreciating Chairman SRB for resolving numerous issues being brought to his notice by KCCI from time to time, stated that the SRB staff has been sending notices to Karachi Chamber which were not making any sense as KCCI is a not for profit organization and purely a trade body where all the activities are taking place for the welfare of business and industrial community. Therefore, the SRB has to understand KCCI’s role and immediately stop sending notices to the Chamber which will not be acceptable under any circumstance.

Referring to Rs100 billion revenue collected by SRB in 2017-18, he said that Chief Minister Sindh Syed Murad Ali Shah must disclose and publicize all the details about the overall expenditure of these funds. “We have no issues if these funds are being spent on Hyderabad, Larkana, Nawabshah, Sukkur or any other city as it is our province but the Sindh government should enhance allocation to Karachi from these funds being gathered by SRB and the city must get its due share”, he added.

He also advised Chairman SRB to unveil city-wise breakup of revenue collection by SRB which should also be publicized as it was of no harm and a legitimate demand.

Siraj Teli said that Karachi has been mistreated and neglected by numerous governments who came into power from time to time either from Punjab or even Sindh province. “We don’t want utilization of entire revenue being generated from Karachi on this city but we only demand its due and rightful share. Taxes are charged around the world with an intention to subsequently utilize them on providing facilities to public and Karachiites have also been submitting huge amount of taxes but unfortunately these taxes are not visible anywhere and we don’t know where these funds were being used”, he added

Speaking on the occasion, President KCCI Junaid Esmail Makda stressed that rate of Sindh Sales Tax on Services (SST) should be in single digit with input tax credit facility made available while export oriented and struggling industries should be exempted from SST.

He was of the opinion that SST on Security Services provided by private security agencies has created an anomaly, making this business unviable in Sindh which also needs to be reviewed.

He further stressed the need to exempt indenters from SST as they are not providing local services rather, export of service to foreign principals and paying 5% withholding tax to Federal Government. “SST on Travel Agents and Tour Operators should be uniform across Pakistan while all Tour Operators /Travel Agents dealing in religious tourism / pilgrims may also be exempted from SST”, he added.

Referring to Sindh Workers Welfare Fund, he said that SWWF is levied on income and has no nexus with labor or worker. It is imposed on "Total Income" of an employer instead of pertaining specifically to that earned in Sindh. “It is therefore ultra vires and should either be made inoperative or struck down till the correction of referred flaws”, he added.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

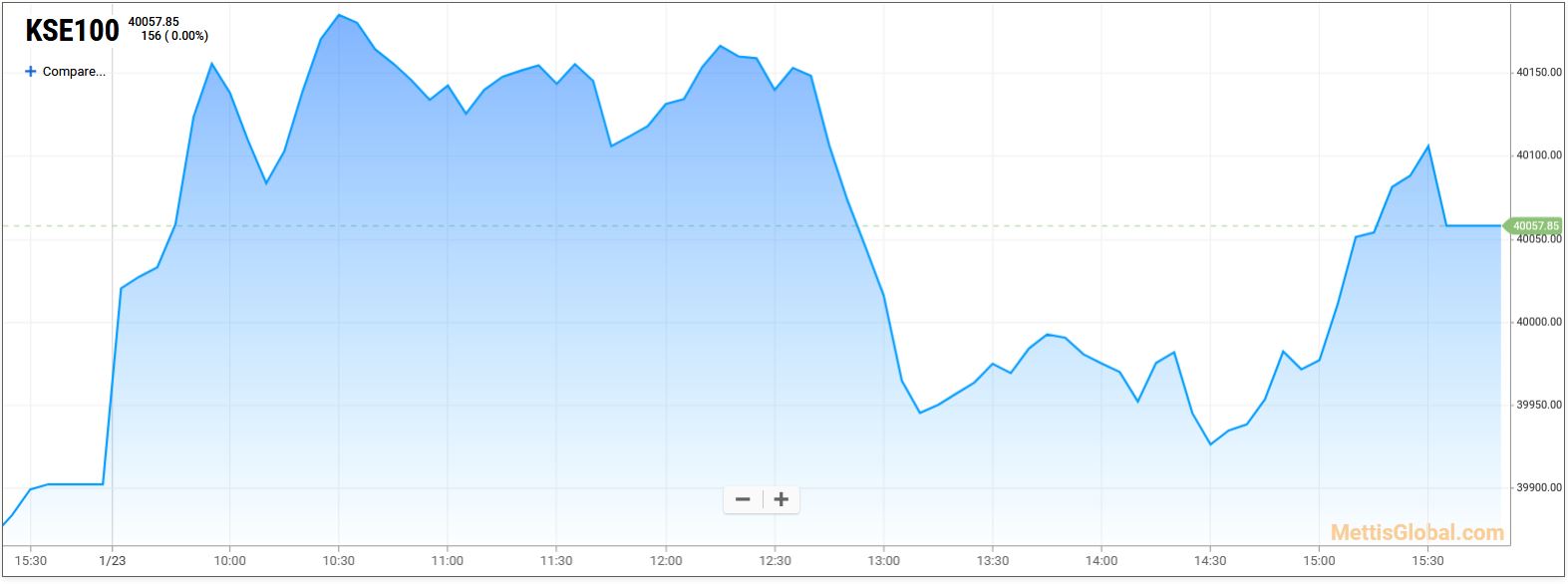

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves