S&P 500 falls into bear market

MG News | June 14, 2022 at 12:51 PM GMT+05:00

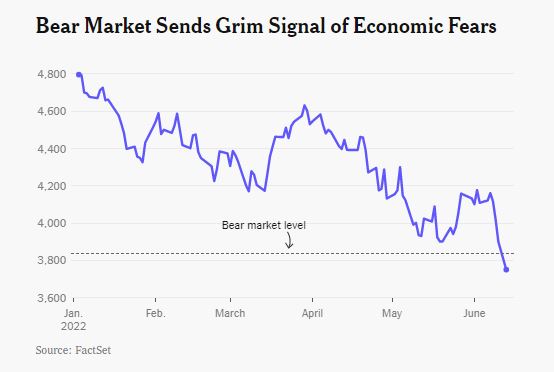

June 14, 2022 (MLN): Stocks dropped around the world, investors dumped government bonds, and cryptocurrencies crashed as the U.S. stock market fell more than 20 percent from its January high, as reported by The New York Times.

Three weeks ago, Wall Street narrowly escaped a bear market, with stocks rebounding at the last minute from a brutal drop that had brought the S&P 500 down 20 percent from a record high in January. The next few weeks offered a glimmer of hope that the worst of the losses might be over.

That glimmer is now gone.

On Monday, the S&P fell 3.9 percent, closing the day nearly 22 percent below its Jan. 3 peak and firmly in a bear market — a rare and grim marker of investors’ growing concerns for the economy.

A crucial report on Friday showed inflation in the United States was accelerating and creeping into every corner of the economy. Earlier last week, the World Bank issued a dire warning that global growth may be choked, especially as the war in Ukraine drags on.

Together, the data undercut optimism that the Federal Reserve, as it raises interest rates, would be able to keep price gains under control without damaging the American economy and sending ripples throughout the globe.

Monday’s trading ended with reports that the Fed is likely to discuss making its biggest interest-rate increase since 1994 when policymakers meet this week.

“The Fed needs to hike policy rates more aggressively if it has any hope of bringing inflation down,” said Seema Shah, chief global strategist at Principal Global Investors. “If it’s going to have to tighten even more, then the chance of a recession is higher.”

Large stock declines like this one — just the seventh bear market in the last 50 years — usually accompany a tectonic shift in the outlook for the economy and batter people’s retirement accounts. While one does not cause the other, recessions have historically followed bear markets.

The last time stocks fell this much was at the start of the coronavirus pandemic, and before that, it was during the 2007-8 global financial crisis, which toppled some of the world’s largest banks.

The bear market in 2020, however, lasted only a relatively short six months. Stock analysts worry this decline will drag on longer.

The New York Times further added that concerns about the U.S. economy weighed on stock markets in Australia, Japan, and China, which all opened lower. In Australia, the key stock index fell 5 percent on Tuesday morning, plunging to its lowest levels in two years. Japan’s Nikkei stock index was down 1.6 percent, and China’s Shanghai Composite Index dropped about 1 percent in early trading.

Stocks are dropping now because companies and consumers face rising costs nearly everywhere they turn and investors fear that the Fed will clobber the economy as it tries to get inflation under control. The central bank has already raised interest rates twice this year, and Wall Street is bracing for interest rates — which were close to zero in March — to rise as high as 3 percent by September. The last time the federal funds rate was that high was during the Great Recession, it added.

The tightening from higher policy rates filters through the economy to make borrowing of all kinds — from mortgages to business debt — more expensive. That slows down the housing market, keeps consumers from spending and discourages corporate expansion.

But interest rates are a blunt tool, and their impact on the economy is delayed, making it difficult for the Fed to know if it has gone too far before it is too late.

Monday’s selling — the worst daily decline in a month — hit several corners of the financial markets. Every major U.S. stock sector ended lower, as did benchmark indexes in Europe and Asia. Oil prices and government bonds similarly dipped. And Bitcoin fell below $24,000, an 18-month low. The cryptocurrency has lost around half its value this year.

On Wednesday, the Fed is set to release its latest economic projections, which investors are likely to parse closely. They may be reassured if the central bank projects a path for interest rate increases that is more moderate than expected.

But for investors to really stop worrying, they’ll have to see inflation slowing in the coming months, said Lauren Goodwin, an economist and portfolio strategist at New York Life Investments.

Another unanswered question for investors is the impact of the Fed’s other policy changes. After buying government bonds to help keep cash pumping through the financial system, an emergency measure that began early in the pandemic, the central bank is reversing course, it noted.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile