SBP releases payment systems review for 2QFY24

MG News | March 13, 2024 at 04:54 PM GMT+05:00

March 13, 2024 (MLN): State Bank of Pakistan (SBP) has released its Quarterly Payment Systems Review for the second quarter of the fiscal year 2023-24, which showcases significant progress in Pakistan's payment ecosystem.

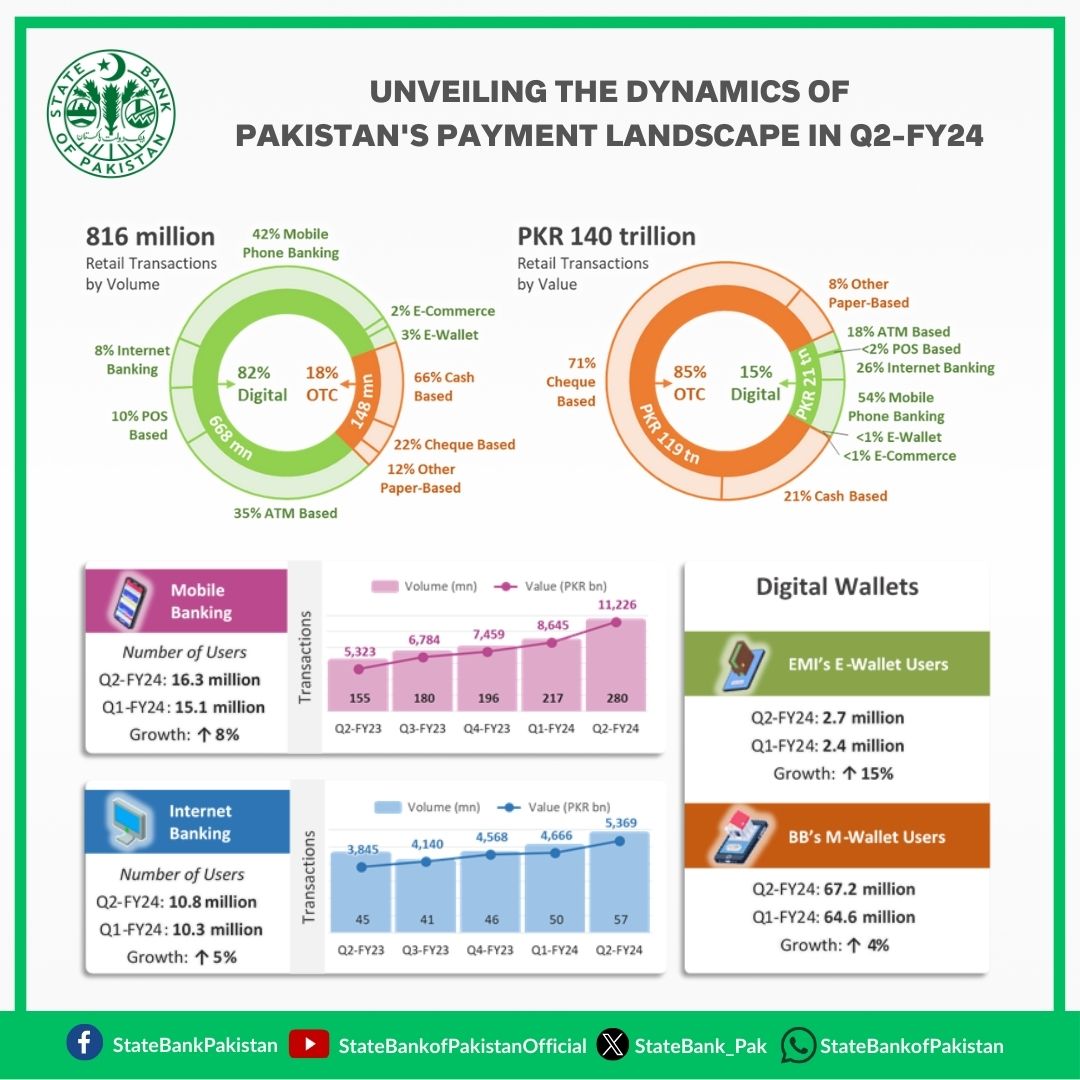

The user base of the payments infrastructure experienced growth in the second quarter of fiscal year 2023-24.

Mobile and Internet Banking remains the preferred mode of digital transactions for Pakistanis.

Mobile and Internet Banking Users reached 16 million and 11m indicating a quarterly growth rate of 8% and 5%, respectively.

Encouragingly, the number of e-wallets registered with EMIs also increased by 15% to 2.7m during the quarter marking a more than twofold increase in last four quarters.

In addition, over 67m m-wallets were registered with Branchless Banking (BB) service providers.

During Q2-FY24, retail transactions processed by Banks, MFBs and EMIs, witnessed a quarterly growth of 15%, a significant increase compared to the 5% growth in the previous quarter.

During the quarter under review, volume of digital transactions constituted 82% of the overall retail transactions, compared to 80% during the previous quarter.

However, in terms of value, over-the-counter (OTC) transactions constituted 85% share of the overall retail transactions.

In the same quarter, more than 90% of the retail fund transfers and 73% of bill payments/mobile top-ups were conducted using digital channels.

Last quarter, this share was 88% and 68% respectively.

Raast (Instant Payment System) and PRISM (Real Time Gross Settlement System) significantly contributed to the digital financial services nationwide.

Raast, an instant payment solution in Pakistan, played a pivotal role by facilitating 107m funds transfer transactions free of cost, totaling more than Rs2 trillion in Q2-FY24.

In the same quarter, RTGS processed 1.5m large-value payments, amounting to Rs273tr.

Breaking down the values of RTGS, 29% were attributed to funds transfer settlements, 70% to government securities settlements, and 1% to clearing transactions settlements.

Pakistan’s payments infrastructure consists of 33 Banks, 11 Microfinance Banks (MFBs), 5 Payment

System Operators/Service Providers (PSOs/PSPs), 5 Electronic Money Institutions (EMIs), the Real-Time

Gross Settlement System PRISM, Raast Instant Payment System, and various Fintechs.

As of the end of the 2nd quarter of the fiscal year 2023-24, Banks and MFBs were offering their services through a network of 18,178 branches, 18,441 ATMs, 121,987 POS machines, and E-commerce payment gateways serving 7,630 registered e-merchants.

In addition, 16 banks and MFBs were also providing Branchless Banking (BB) services, broadening the accessibility of banking services.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,840.00 | 120,695.00 116,090.00 |

-3395.00 -2.82% |

| BRENT CRUDE | 68.85 | 69.41 68.60 |

-0.36 -0.52% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.71 | 67.13 66.22 |

-0.27 -0.40% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|