Revised salaried tax rates shake middle-income brackets

MG News | June 12, 2024 at 08:35 PM GMT+05:00

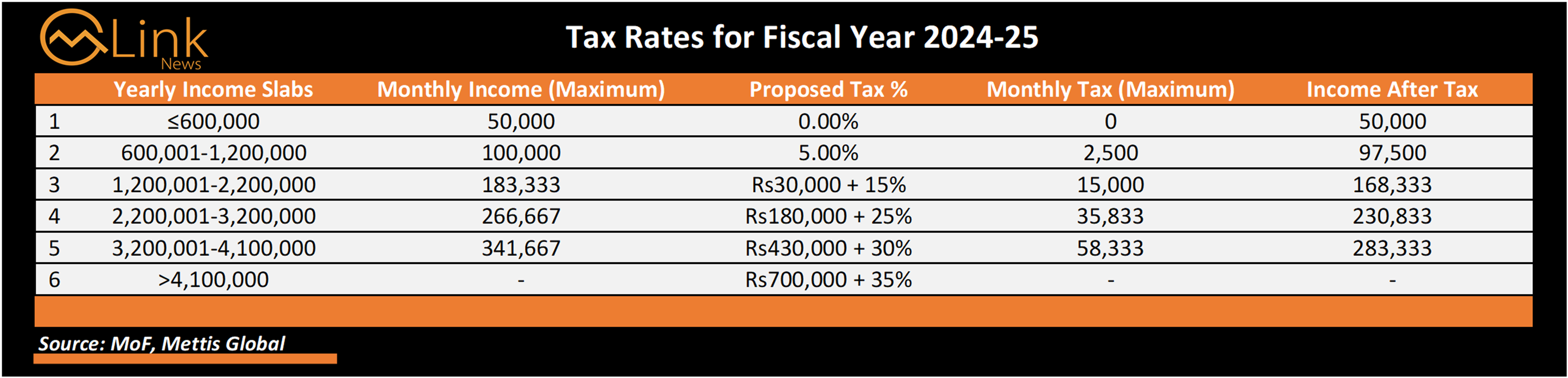

June 12, 2023 (MLN): Almost all income tax slabs for salaried individuals have been revised, resulting in significantly higher taxation across all income levels, as per the amended Finance Bill 2024.

| New | Previous | |||

|---|---|---|---|---|

| Taxable Income | Tax % | Taxable Income | Tax % | |

| 1 | ≤600,000 | 0 | ≤600,000 | 0 |

| 2 | 600,001-1,200,000 | 5% of amount exceeding Rs600,000 | 600,001-1,200,000 | 2.5% of amount exceeding Rs600,000 |

| 3 | 1,200,001-2,200,000 | Rs30,000 + 15% of amount exceeding Rs1,200,000 | 1,200,001-2,400,000 | Rs15,000 + 12.5% of amount exceeding Rs1,200,000 |

| 4 | 2,200,001-3,200,000 | Rs180,000 + 25% of amount exceeding Rs2,200,000 | 2,400,001-3,600,000 | Rs165,000 + 22.5% of amount exceeding Rs2,400,000 |

| 5 | 3,200,001-4,100,000 | Rs430,000 + 30% of amount exceeding Rs3,200,000 | 3,600,001-6,000,000 | Rs435,000 + 27.5% of amount exceeding Rs3,600,000 |

| 6 | >4,100,000 | Rs700,000 + 35% of amount exceeding Rs4,100,000 | >6,000,000 | Rs1,095,000 + 35% of amount exceeding Rs6,000,000 |

The income tax exemption for the first slab, which includes annual salaries of up to Rs600,000, will remain unchanged.

However, other income slabs have been changed, with the maximum income tax slab category reduced significantly from Rs6 million to Rs4.1 million.

-

No tax for income below Rs600,000 per year (Rs50,000 per month).

-

Tax for income between Rs600,001 to Rs1,200,000 per year (Rs50,000 to Rs100,000 per month) will be 5% (prev. 2.5%) of the amount exceeding Rs600,000.

-

Tax for those earning between Rs1,200,001 to Rs2,200,000 (Rs100,000 to Rs183,333 per month) will be Rs30,000 plus 15% of the amount exceeding Rs1.2m.

-

People earning Rs2,200,001 to Rs3,200,000 a year (Rs183,333 to Rs266,667 per month) will pay Rs180,000 plus 25% of the amount exceeding Rs2.2m.

-

Those earning Rs3,200,001 to Rs4,100,000 a year (Rs266,667 to Rs341,667 per month) will pay Rs430,000 plus 30% of the amount exceeding Rs3.2m.

-

For individuals earning more than Rs4,100,000 a year (more than Rs341,667 per month) will pay Rs700,000 plus 35% of the amount exceeding Rs4.1m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves