Refinery sector turns profitable in first quarter of FY24

Abdur Rahman | November 02, 2023 at 01:59 PM GMT+05:00

November 02, 2023 (MLN): The refinery sector turned around in the first quarter of FY24, recording a profit after tax of Rs16.18 billion as compared to a loss of Rs3.3bn incurred in the same period last year (SPLY).

The refinery sector includes; Attock Refinery Limited (PSX: ATRL), National Refinery Limited (PSX: NRL), Pakistan Refinery Limited (PSX: PRL), and Cnergyico PK Limited (PSX: CNERGY).

As per the results compiled by Mettis Global of the income statements of these four refinery companies, the sector saw a slight increase of 5.20% YoY in its sales, worth Rs308.58bn as compared to Rs293.32bn in SPLY.

This was coupled with a decline in the cost of sales by 3.93% YoY, improving the gross profit substantially by 4.83x YoY to Rs33.46bn in 1QFY24.

On the expense side, the company observed a decrease in selling and distribution Expenses by 37.05% YoY while other expenses rose by 2.45x YoY to clock in at Rs400.28m and Rs3.4bn respectively during the review period.

During the review period, other income of the sector increased by 78.78% YoY to stand at Rs4.71bn in 1QFY24 as compared to Rs2.64bn in SPLY.

The sector's finance costs dipped by 35.64% YoY and stood at Rs4.9bn as compared to Rs7.61bn in 1QFY24.

On the tax front, the sector paid a significantly larger tax worth Rs12.05bn against the Rs2.13bn paid in the corresponding period of last year, depicting a rise of 5.66x YoY.

| Unconsolidated (un-audited) Financial Results for Quarter ended 30 September 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Sales | 308,584,208 | 293,322,458 | 5.20% |

| Cost of sales | (275,129,066) | (286,396,204) | -3.93% |

| Gross Profit | 33,455,142 | 6,926,254 | 383.02% |

| Selling And Distribution Expenses | (400,282) | (635,915) | -37.05% |

| Administrative Expenses | (1,237,256) | (1,094,856) | 13.01% |

| Other income | 4,714,118 | 2,636,803 | 78.78% |

| Other operating expenses | (3,399,637) | (1,385,600) | 145.35% |

| Profit Before Interest And Tax | 33,132,085 | 6,446,686 | 413.94% |

| Finance cost | (4,901,922) | (7,612,667) | -35.61% |

| Others | (1,078) | (5,068) | -78.73% |

| Profit before taxation | 28,229,085 | (1,171,049) | - |

| Taxation | (12,047,008) | (2,129,765) | 465.65% |

| Net profit for the period | 16,182,077 | (3,300,814) | - |

Amount in thousand except for EPS

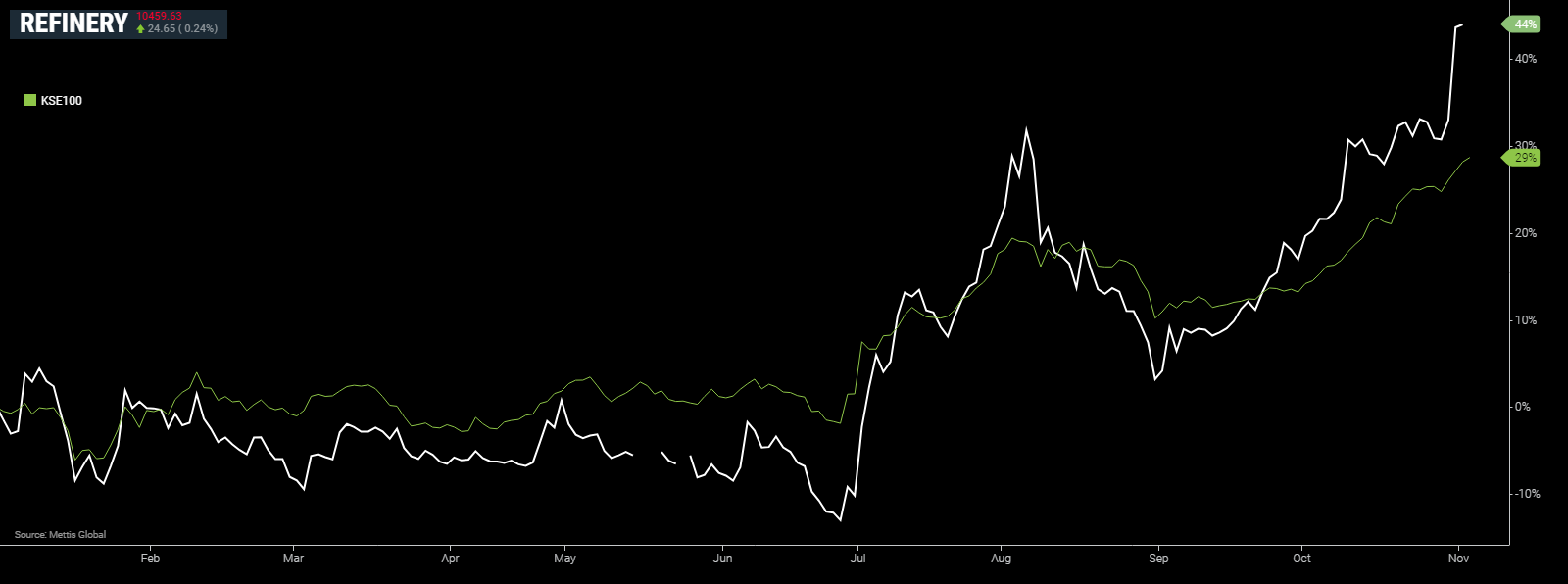

Refinery Sector vs. KSE100 YTD Performance

It is worth mentioning that the government has approved the Pakistan Refinery Policy 2023 for existing brownfield refineries in August 2023.

The policy offers fiscal incentives for the upgrade of existing refineries, subject to certain terms and conditions.

ATRL

During the quarter under review, the company earned profit after tax of Rs11.22bn.

Improvement in spreads between prices of products and crude oil continued. This development was in line with the global trend in the refining industry.

As per the company’s transmission report, ATRL remained steadfast in its commitment to use every opportunity for improvement in business processes and profitability.

The consequent profitability has helped the company to absorb the escalating operational costs.

During this quarter, the company supplied 457,000 Metric Tons of various petroleum products while operating at 81% of the capacity as compared to 448,000 Metric Tons and 79% capacity in SPLY.

After corrective actions by the government against the smuggling of petroleum products, the pressure on the company’s sales of HSD was reduced, and the company was able to sell normal volumes.

NRL

The fuel segment of the company experienced a significant turnaround in its financial performance, with the company earning a profit of Rs3.2bn.

Improvement in fuel segment profitability was mainly attributed to a consistent increase in petroleum product prices in the international market during the quarter, which resulted in improved gross refinery margins.

The performance was further improved with the help of effective measures taken by government authorities that relieved pressure on the exchange rate, thereby resulting in exchange gains in the current quarter.

Additionally, the measures taken by the government to address vulnerabilities along porous borders resulted in the restoration of demand for petroleum products to a certain extent.

NRL recently embarked on a significant change by producing Very Low Sulphur Furnace Oil (VLSFO), commonly known as “Bunker Fuel” after necessary changes in the crude mix and adjustments in the production process.

Furthermore, following the successful resumption of normal operations at the Hydro Production Unit (HPU), the company also initiated the production and sale of High-Speed Diesel (HSD) compliant with PAK-V specifications.

PRL

The financial year began with positive refining margins which complemented the company’s operational strategy and helped the Refinery generate a profit after tax of Rs4.48bn despite the continued devaluation of the Pak Rupee and challenges in obtaining confirmation of crude oil LCs.

During the quarter, the company achieved another milestone of the highest-ever monthly production and sale of High-Speed Diesel (HSD) of ~560,000 barrels and ~ 632,000 barrels respectively in September 2023.

As per the company’s transmission report, the company remains committed to executing the Refinery Expansion and Upgrade Project (REUP) which will double Refinery’s crude processing capacity from 50,000 barrels per day to 100,000 barrels per day.

Work on Front-End Engineering Design (FEED) of REUP is progressing as per the agreed timeline with targeted completion by September 2024 and as the next step license and engineering agreements have been signed with technology licensors.

The search for the right potential strategic investor continues and PRL is engaged with potential investors in this regard.

CNERGY

CNERGY was the only company in the sector that incurred a loss worth Rs2.54bn during the quarter, as the company continued to battle with an extremely low refinery throughput which had a highly adverse impact on its financial health.

The company's net sales decreased, reflecting very low refinery throughput in the current quarter.

Moreover, CNERGY’s gross profit diminished on the back of significant inventory losses in the first quarter of the year 2022 due to severe rainfall and flash flooding in the area surrounding the refinery.

The increase of KIBOR rates from 15% in the same period last year to 23% in the current period also increased the company's finance costs.

The company is currently focused on enhancing its performance and has initiated various measures to increase refinery throughput, which is crucial for driving profitability.

One notable step was the adoption of processing crude oil on open credit.

As part of this strategy, the company successfully negotiated a shipment of crude oil, which recently arrived at the company's single point mooring facility.

This crude oil will be processed in the ensuing month, further supporting its efforts to improve performance.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction