PSX soars 16.6% in November, second-highest monthly return in a decade

Abdur Rahman | November 30, 2023 at 05:52 PM GMT+05:00

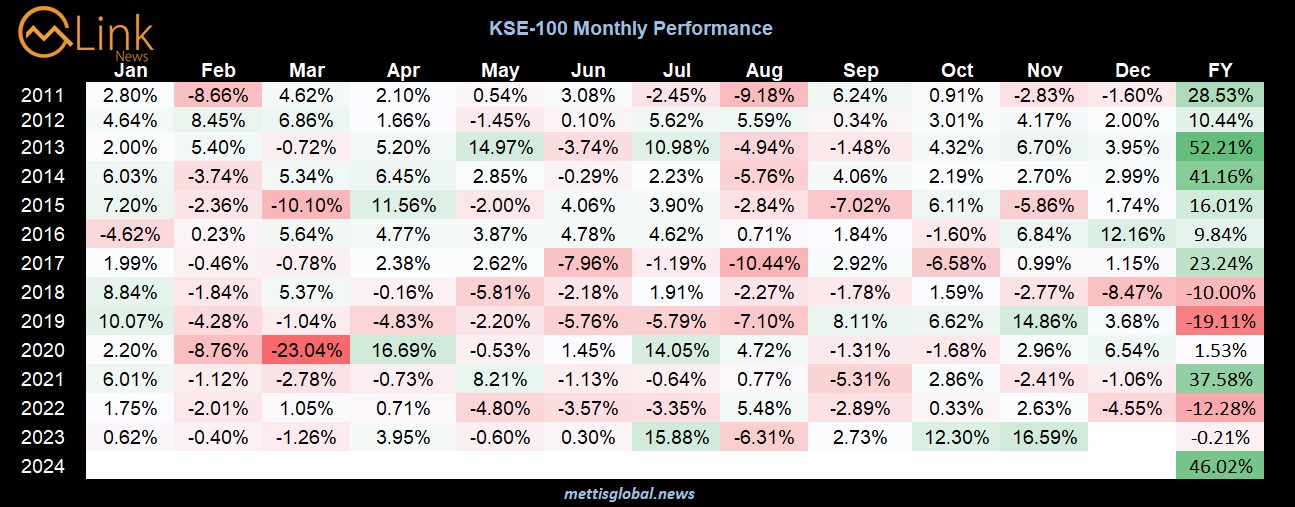

November 30, 2023 (MLN): The Pakistan Stock Exchange’s benchmark index closed the month of November at 60,531, gaining a staggering 8,611 points or 16.59% MoM.

This marks the second-highest return in percentage terms in over a decade, surpassed only by the Covid's abnormal return in April 2020.

The KSE-100 index once again achieved the highest monthly close in its history.

While in US Dollar terms, the index also returned substantial gains to the investors, maintaining its position as one of the top-performing markets worldwide.

.png)

The average KSE-100 daily volumes during the month surged by 53.08% MoM to 290.61 million shares as compared to the 189.43m shares in the previous month.

Similarly, the average daily traded value rose by 75.2% MoM to Rs14.99 billion compared to Rs8.56bn in the previous month.

The local stock market has been enjoying a bullish rally ever since the country reached a $3bn Stand-by Arrangement (SBA) with the International Monetary Fund (IMF) that saved the cash-strapped nation from a sovereign debt default.

Resultantly, investors' confidence has resurfaced amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency amid government-backed administrative efforts, and a possible slash in the interest rates.

The rally has been fueled by foreign investors's buying, with overseas traders injecting the highest in Pakistani stocks in 6 years during the month.

The KSE-100 has gained 19,079 points or 46.02% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 20,111 points, equivalent to 49.75% in the KSE-100.

Outlook

The local stock market can be anticipated to slow down its heightened activity over the next few months, following a period of strong trending enviroment.

The successful completion of the current IMF loan program is crucial to bridge an external financing gap of around $5.3bn in the current fiscal year.

Furthermore, the cash-strapped nation will need more loan programs. According to IMF estimates, the country's external financing requirements are projected to average $30bn annually for fiscal year 2025 to 2028.

On the economic front, the government-backed measures have helped the Pakistani Rupee (PKR) to remain somewhat stable during the past few months, however, expert fraternity is of the view that its troubles are far from over.

Meanwhile, inflationary pressures are anticipated to ease starting from January 2024, on the back of the high base effect, lagged impact of monetary tightening, and other administrative measures.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,920.00 | 120,695.00 116,090.00 |

-3315.00 -2.76% |

| BRENT CRUDE | 68.77 | 69.41 68.60 |

-0.44 -0.64% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.63 | 67.13 66.22 |

-0.35 -0.52% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|