PSX Closing Bell: When the Sun Rose Again

MG News | July 28, 2022 at 05:51 PM GMT+05:00

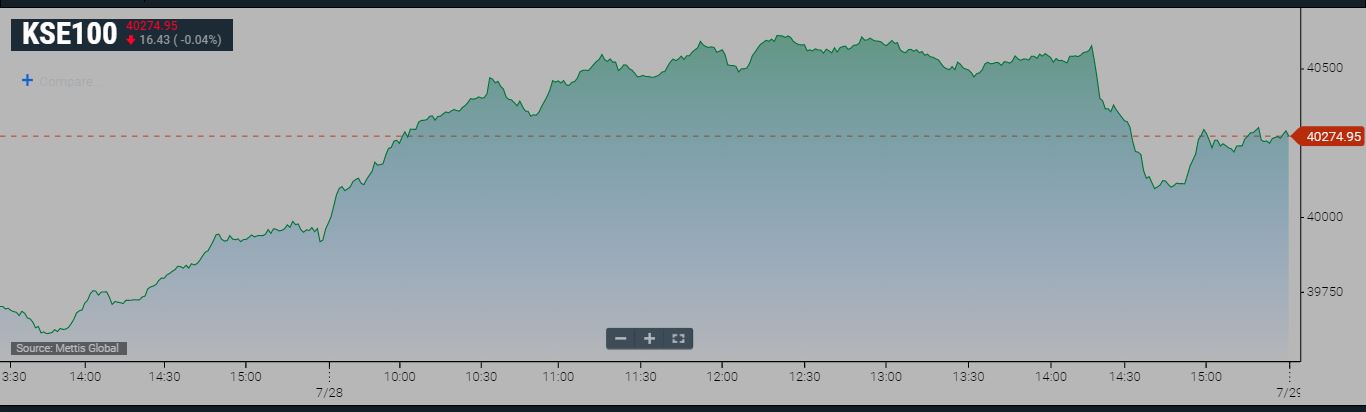

July 28, 2022 (MLN): The capital market on Thursday witnessed a bullish momentum on the back of clarity on the political front and the benchmark KSE-100 Index managed to accumulate 304 points to settle the session at the 40,276.64 mark, witnessing an intraday high of 40,628.67.

However, the announcements of corporate earnings, affected by higher tax rates alongwith lower payouts created pressure on the index in the later hours of today's session.

Shayan Jan, Equity Trader at Intermarket Securities told Mettis Global that overall momentum getting stronger as the IMF deal is around the corner and there is no aggression in politics at the moment.

For the sector-specific lense, he added that the IT sector is the major driver for today's positivity at the local bourse as investors cheered the IT exports number released by SBP yesterday.

Of the 96 traded companies in the KSE100 Index 61 closed up 29 closed down, while 6 remained unchanged. Total volume traded for the index was 119.04 million shares.

Sectors propping up the index were Commercial Banks with 154 points, Technology & Communication with 93 points, Oil & Gas Exploration Companies with 65 points, Power Generation & Distribution with 25 points and Oil & Gas Marketing Companies with 18 points.

The most points added to the index was by TRG which contributed 54 points followed by MCB with 40 points, HBL with 37 points, BAHL with 36 points and POL with 35 points.

Sector wise, the index was let down by Fertilizer with 61 points, Automobile Assembler with 32 points, Engineering with 5 points, Chemical with 4 points and Insurance with 3 points.

The most points taken off the index was by EFERT which stripped the index of 55 points followed by INDU with 26 points, EPCL with 21 points, ENGRO with 15 points and MTL with 5 points.

All Share Volume increased by 129.69 million to 251.27 million shares. Market cap increased by Rs37.94 billion.

Total companies traded were 344 compared to 321 from the previous session. Of the scrips traded 215 closed up, 104 closed down while 25 remained unchanged.

Total trades increased by 49,751 to 128,259.

Value Traded increased by 5.20 billion to Rs9.35 billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 32,615,500 |

| TPL Properties | 20,376,827 |

| Lotte Chemical Pakistan | 16,952,144 |

| TRG Pakistan | 10,772,640 |

| Cnergyico PK | 10,226,502 |

| Unity Foods | 8,156,772 |

| Engro Fertilizers | 8,106,151 |

| Pakistan Refinery | 8,062,618 |

| Telecard | 7,592,500 |

| Ghani Global Holdings | 7,537,753 |

| Sector | Volume |

|---|---|

| Technology & Communication | 72,523,266 |

| Chemical | 39,881,164 |

| Miscellaneous | 21,326,327 |

| Refinery | 20,836,645 |

| Food & Personal Care Products | 14,824,399 |

| Commercial Banks | 12,870,719 |

| Fertilizer | 10,907,384 |

| Power Generation & Distribution | 9,942,954 |

| Cement | 9,451,028 |

| Oil & Gas Marketing Companies | 6,476,424 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,535.00 | 118,705.00 117,905.00 | 915.00 0.78% |

| BRENT CRUDE | 72.77 | 72.82 72.74 | -0.47 -0.64% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.37 | 70.41 70.18 | 0.37 0.53% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|