PSX Closing Bell: The Thrill is Gone

By MG News | June 18, 2021 at 06:50 PM GMT+05:00

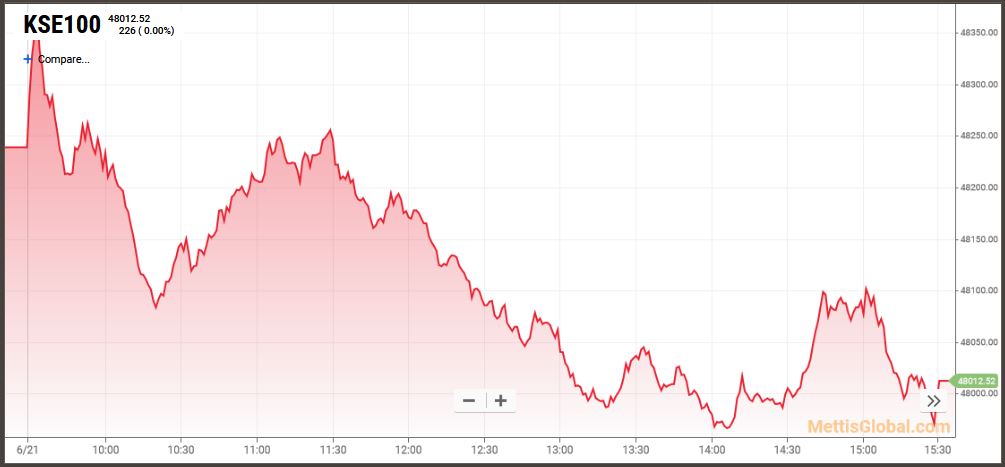

July 18, 2021 (MLN): Following a three-day losing streak, the benchmark KSE-100 took a breather as it gained 81 points, after losing 567 points in the past three sessions, consolidating the day’s session at 48,238 level.

The positive trend in stocks mainly stemmed from easing commodity prices internationally.

However, concerns of redemption with some mutual funds maintained selling pressure, a closing note by Arif Habib Limited cited.

The index remained range-bound, as it traded between its intraday high of 48,411.72 and a low of 48,023.53.

Of the 94 traded companies in the KSE100 Index, 54 closed up 39 closed down, while 1 remained unchanged. Total volume traded for the index was 304.37 million shares.

Sectors propping up the index were Cement with 58 points, Refinery with 39 points, Technology & Communication with 19 points, Fertilizer with 17 points and Insurance with 14 points.

The most points added to the index was by LUCK which contributed 31 points followed by NRL with 20 points, POL with 20 points, TRG with 19 points and FFC with 14 points.

Sector-wise, the index was let down by Commercial Banks with 77 points, Food & Personal Care Products with 16 points, Automobile Assembler with 10 points, Power Generation & Distribution with 6 points and Glass & Ceramics with 3 points.

The most points taken off the index was by HBL which stripped the index of 63 points followed by MTL with 15 points, OGDC with 14 points, MCB with 13 points and UNITY with 12 points.

All Share Volume decreased by 366.87 Million to 750.56 Million Shares. Market Cap increased by Rs.20.05 Billion.

Total companies traded were 405 compared to 413 from the previous session. Of the scrips traded 222 closed up, 163 closed down while 20 remained unchanged.

Total trades decreased by 18,804 to 174,087.

Value Traded increased by 1.06 Billion to Rs.20.67 Billion

| Company | Volume |

|---|---|

| Hum Network | 88,080,000 |

| Worldcall Telecom | 76,462,000 |

| Byco Petroleum Pakistan | 70,889,500 |

| Unity Foods | 53,688,269 |

| Silkbank | 44,191,000 |

| K-Electric | 32,301,500 |

| Pakistan International Bulk Terminal | 31,815,000 |

| Hascol Petroleum | 24,303,102 |

| First National Equities | 22,319,500 |

| Ghani Global Glass | 21,848,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 190,780,744 |

| Refinery | 100,185,800 |

| Food & Personal Care Products | 86,409,339 |

| Commercial Banks | 51,938,770 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 42,210,201 |

| Transport | 37,504,100 |

| Power Generation & Distribution | 36,804,210 |

| Cement | 33,812,080 |

| Oil & Gas Marketing Companies | 30,459,108 |

| Glass & Ceramics | 26,825,500 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,051.77 71.67M |

0.28% 365.11 |

| ALLSHR | 81,600.31 335.22M |

0.36% 295.06 |

| KSE30 | 40,052.98 30.37M |

0.27% 107.54 |

| KMI30 | 191,067.06 35.85M |

0.19% 369.01 |

| KMIALLSHR | 55,127.12 163.00M |

0.10% 52.97 |

| BKTi | 34,936.35 5.79M |

1.06% 367.95 |

| OGTi | 28,574.23 2.81M |

-0.57% -165.12 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,555.00 | 110,525.00 109,375.00 |

-860.00 -0.78% |

| BRENT CRUDE | 68.42 | 68.89 68.38 |

-0.38 -0.55% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

-0.75 -0.76% |

| ROTTERDAM COAL MONTHLY | 108.45 | 109.80 108.45 |

-0.55 -0.50% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.74 | 67.18 66.69 |

-0.26 -0.39% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

FX Reserves

FX Reserves

CPI

CPI