PSX Closing Bell: The Narrow Way

MG News | December 08, 2021 at 05:45 PM GMT+05:00

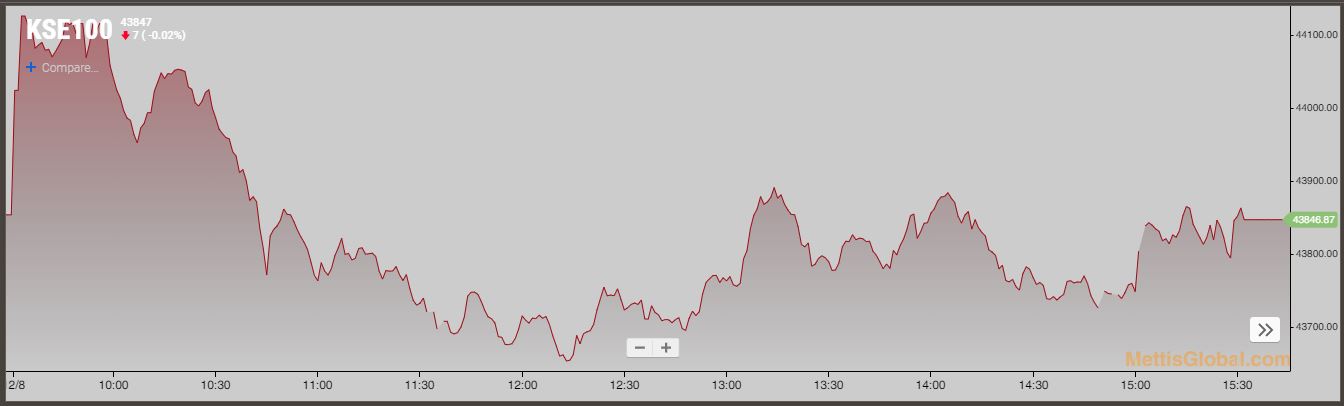

December 08, 2021 (MLN): The capital market observed a range-bound trading session on Wednesday owing to the lack of positive triggers as it traded in a range of only 486.68 points, witnessing an intraday high of 44,138.97 and a low of 43,652.29.

Following yesterday’s gaining momentum, the trading floor opened on a positive note but in the later hours, the market succumbed to profit-taking activity as the nervousness was prevailing across the board on the back of gloomy macros.

Resultantly, the benchmark KSE-100 index concluded the session in the red while losing 6.62 points to close at 43,846.87.

Of the 95 traded companies in the KSE100 Index, 36 closed up 56 closed down, while 3 remained unchanged. The total volume traded for the index was 73.49 million shares.

Sector-wise, the index was let down by cement with 83 points, fertilizer with 32 points, pharmaceuticals with 14 points, engineering with 13 points, and refinery with 10 points.

The most points taken off the index was by LUCK which stripped the index of 36 points followed by ENGRO with 24 points, MEBL with 18 points, HMB with 16 points, and PIOC with 11 points.

Sectors propping up the index were technology & communication with 103 points, oil & gas exploration companies with 43 points, commercial banks with 16 points, power generation & distribution with 8 points, and automobile assembler with 3 points.

The most points added to the index were by TRG which contributed 73 points followed by MARI with 30 points, SYS with 27 points, UBL with 23 points, and OGDC with 13 points.

All share volume increased by 3.80million to 233.18million shares. Market cap decreased by Rs11.50billion.

Total companies traded were 350 compared to 347 from the previous session. Of the scrips traded 134 closed up, 196 closed down while 20 remained unchanged.

Total trades decreased by 6,424 to 101,662.

Value Traded decreased by 1.37billion to Rs.7.01billion

| Company | Volume |

|---|---|

| Hascol Petroleum | 57,473,762 |

| Telecard | 21,823,000 |

| Treet Corporation | 11,110,500 |

| Unity Foods | 9,754,378 |

| Byco Petroleum Pakistan | 8,999,000 |

| TPL Properties | 8,741,500 |

| Worldcall Telecom | 6,948,500 |

| Ghani Global Holdings | 5,352,000 |

| TRG Pakistan | 5,195,864 |

| Hum Network | 4,987,000 |

| Sector | Volume |

|---|---|

| Oil & Gas Marketing Companies | 59,886,854 |

| Technology & Communication | 46,438,847 |

| Food & Personal Care Products | 27,178,198 |

| Refinery | 12,171,942 |

| Miscellaneous | 12,071,800 |

| Commercial Banks | 8,876,155 |

| Cement | 8,746,399 |

| Oil & Gas Exploration Companies | 7,322,480 |

| Chemical | 6,921,700 |

| Power Generation & Distribution | 6,570,767 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves