PSX Closing Bell: The Long Bright Dark

By MG News | October 08, 2021 at 08:47 PM GMT+05:00

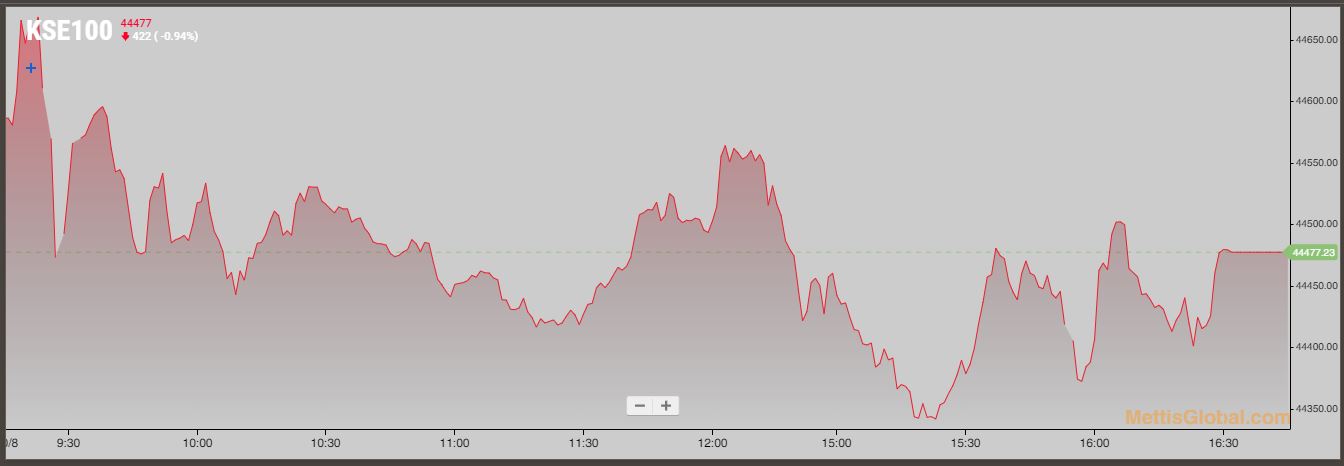

October 8, 2021 (MLN): Pakistan equities remained lackluster throughout the day in the absence of positive triggers as the benchmark KSE-100 index moved in a range of 332.33 points, witnessing an intraday high of 44,670.50 and a low of 44,338.17. The investors seemed concerned about the ongoing staff level review by the International Monetary Fund (IMF).

According to the market closing note by Abbasi and Company Limited, long steel industry players have raised the rebar prices by Rs3k/ton in both the North and South regions that has also dent the investor’s confidence.

Resultantly, the KSE-100 index plunged by 108.82 points to close at 44,477.23.

Of the 95 traded companies in the KSE100 Index 32 closed up 61 closed down, while 2 remained unchanged. Total volume traded for the index was 66.19 million shares.

Sector wise, the index was let down by Cement with 74 points, Power Generation & Distribution with 25 points, Fertilizer with 23 points, Pharmaceuticals with 21 points and Inv. Banks / Inv. Cos. / Securities Cos. with 13 points.

The most points taken off the index was by LUCK which stripped the index of 23 points followed by HUBC with 19 points, FFC with 17 points, CHCC with 15 points and TRG with 15 points.

Sectors propping up the index were Commercial Banks with 47 points, Technology & Communication with 20 points, Chemical with 13 points, Oil & Gas Exploration Companies with 12 points and Automobile Assembler with 8 points.

The most points added to the index was by SYS which contributed 39 points followed by HBL with 21 points, COLG with 17 points, BAHL with 16 points and MCB with 15 points.

All Share Volume decreased by 119.97 Million to 176.07 Million Shares. Market Cap increased by Rs.4.21 Billion.

Total companies traded were 550 compared to 558 from the previous session. Of the scrips traded 165 closed up, 369 closed down while 16 remained unchanged.

Total trades decreased by 34,969 to 74,730.

Value Traded decreased by 3.62 Billion to Rs.6.84 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 18,534,000 |

| Telecard | 14,159,500 |

| Silkbank | 9,331,500 |

| First Capital Securities Corporation | 9,222,000 |

| TPL Corp | 7,925,500 |

| Byco Petroleum Pakistan | 7,650,000 |

| Treet Corporation | 6,454,000 |

| Habib Bank | 5,834,015 |

| Hum Network | 5,311,500 |

| Fauji Fertilizer Bin Qasim | 4,816,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 52,488,293 |

| Commercial Banks | 23,037,134 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 15,608,629 |

| Food & Personal Care Products | 12,006,172 |

| Cement | 9,836,869 |

| Refinery | 8,692,806 |

| Fertilizer | 7,161,377 |

| Chemical | 6,575,140 |

| Power Generation & Distribution | 5,161,175 |

| Oil & Gas Exploration Companies | 4,671,031 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,480.00 | 106,565.00 105,440.00 |

730.00 0.69% |

| BRENT CRUDE | 67.13 | 67.29 67.05 |

0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.46 | 65.65 65.34 |

0.01 0.02% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI