PSX Closing Bell: System of a Down

MG News | May 19, 2022 at 05:45 PM GMT+05:00

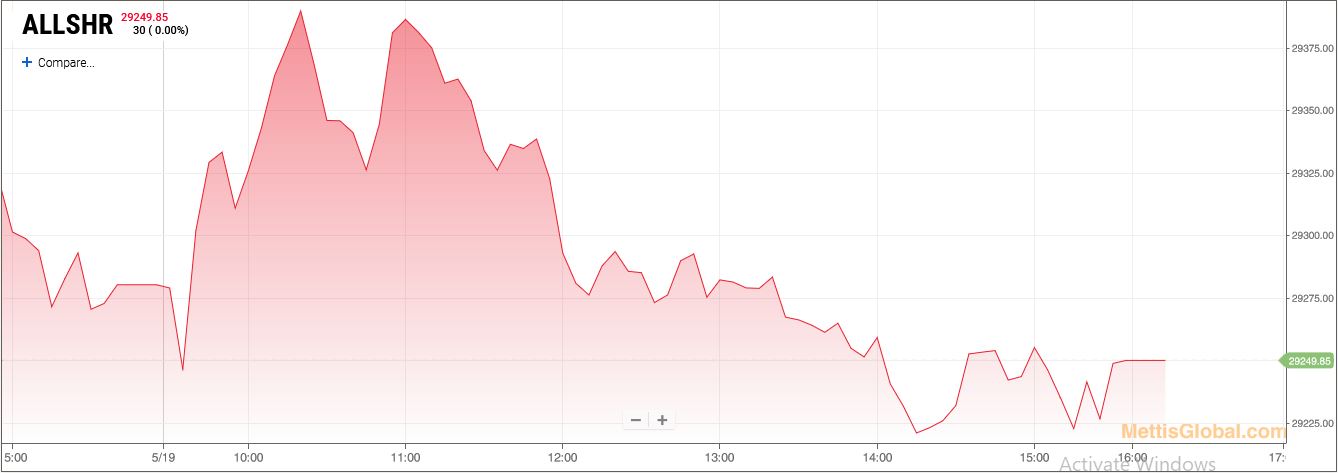

May 19, 2022 (MLN): After yesterday’s recovery, the capital markets witnessed a choppy trading session as market participants adopted a cautious stance over ongoing political uncertainty, delay in the resumption of the IMF program and PKR/USD parity closing at 200.

Despite a 29bps reduction in cut-off yields in yesterday’s auction, the benchmark KSE-100 Index failed to sustain last day’s momentum, the Pearl securities cited in its market wrap.

Consequently, the KSE-100 index ended the sluggish day with a 43.43 point or 0.10 percent decline to close at 42,983.45.

The Index traded in a range of 313.12 points or 0.73 percent of the previous close, showing an intraday high of 43,258.59 and a low of 42,945.47.

Of the 93 traded companies in the KSE100 Index 37 closed up 52 closed down, while 4 remained unchanged. The total volume traded for the index was 82.18 million shares.

Sector wise, the index was let down by Oil & Gas Exploration Companies with 39 points, Cement with 17 points, Commercial Banks with 15 points, Inv. Banks / Inv. Cos. / Securities Cos. with 10 points and Technology & Communication with 8 points.

The most points taken off the index was by HBL which stripped the index of 14 points followed by PPL with 13 points, MARI with 12 points, POL with 11 points and LUCK with 11 points.

Sectors propping up the index were Fertilizer with 37 points, Chemical with 25 points, Power Generation & Distribution with 7 points, Textile Composite with 4 points and Automobile Assembler with 4 points.

The most points added to the index was by EPCL which contributed 26 points followed by ENGRO with 15 points, EFERT with 13 points, FFC with 13 points and HUBC with 9 points.

All Share Volume decreased by 91.70 Million to 187.10 Million Shares. Market Cap decreased by Rs.8.28 Billion.

Total companies traded were 334 compared to 345 from the previous session. Of the scrips traded 122 closed up, 195 closed down while 17 remained unchanged.

Total trades decreased by 31,355 to 83,292.

Value Traded decreased by 1.83 Billion to Rs.5.08 Billion

| Company | Volume |

|---|---|

| Ghani Global Holdings | 15,096,576 |

| Worldcall Telecom | 13,387,500 |

| Silkbank | 13,098,500 |

| Telecard | 9,597,000 |

| Cnergyico PK | 7,515,538 |

| Fauji Cement Company | 6,986,500 |

| Unity Foods | 6,453,476 |

| Engro Polymer & Chemicals | 5,889,790 |

| Pakistan International Bulk Terminal | 5,254,500 |

| Pak Elektron | 5,100,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 37,531,315 |

| Chemical | 30,578,928 |

| Commercial Banks | 21,756,134 |

| Cement | 14,251,551 |

| Refinery | 11,650,008 |

| Food & Personal Care Products | 10,485,820 |

| Engineering | 9,814,476 |

| Cable & Electrical Goods | 7,024,000 |

| Glass & Ceramics | 6,723,004 |

| Miscellaneous | 6,392,445 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,775.00 | 120,695.00 116,090.00 |

-3460.00 -2.88% |

| BRENT CRUDE | 68.78 | 69.41 68.60 |

-0.43 -0.62% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.63 | 67.13 66.22 |

-0.35 -0.52% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|