PSX Closing Bell: Subverting Expectations

MG News | June 20, 2022 at 05:15 PM GMT+05:00

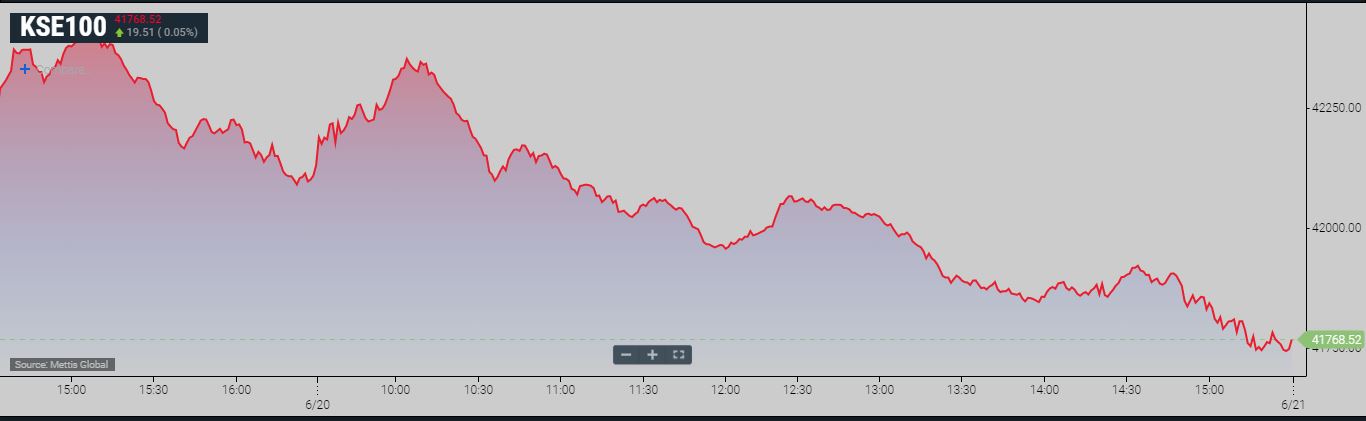

June 20, 2022 (MLN): Domestic equities turned negative today as investors remained cautious over constant PKR depreciation and clarity over IMF program.

The market opened on a positive note as FATF has indicated that after onsite inspection, Pakistan may be taken off the grey list in next plenary session to be held in Paris in Oct’22.

However, this positivity didn’t sustain at the bourse as delay in the resumption of the IMF program and continuous fligh of PKR against USD kept the market haywire.

“The market is ringing alarm bells for upcoming external loans and import payments in the coming months due to low FX reserves” analyst at Pearl Securities said.

The Index traded in a range of 620.30 points or 1.47 percent of previous close, showing an intraday high of 42,355.83 and a low of 41,735.53.

Of the 88 traded companies in the KSE100 Index 14 closed up 72 closed down, while 2 remained unchanged. Total volume traded for the index was 66.48 million shares.

Sector wise, the index was let down by Cement with 71 points, Technology & Communication with 63 points, Power Generation & Distribution with 51 points, Commercial Banks with 37 points and Oil & Gas Exploration Companies with 33 points.

The most points taken off the index was by HUBC which stripped the index of 45 points followed by SYS with 32 points, LUCK with 30 points, TRG with 27 points and BAHL with 15 points.

Sectors propping up the index were Paper & Board with 4 points, Tobacco with 3 points, Automobile Parts & Accessories with 2 points, Close - End Mutual Fund with 1 points and Vanaspati & Allied Industries with 1 points.

The most points added to the index was by UBL which contributed 17 points followed by MTL with 12 points, PKGS with 6 points, IGIHL with 6 points and SNGP with 5 points.

All Share Volume decreased by 120.82 Million to 162.11 Million Shares. Market Cap decreased by Rs.41.63 Billion.

Total companies traded were 318 compared to 353 from the previous session. Of the scrips traded 87 closed up, 220 closed down while 11 remained unchanged.

Total trades decreased by 44,156 to 80,028.

Value Traded decreased by 4.15 Billion to Rs.4.91 Billion

| Company | Volume |

|---|---|

| TPL Properties | 19,495,500 |

| Worldcall Telecom | 15,351,000 |

| Pakistan Refinery | 11,823,839 |

| Cnergyico PK | 11,142,329 |

| Unity Foods | 7,112,409 |

| TRG Pakistan | 6,155,820 |

| Hum Network | 5,429,000 |

| Sui Northern Gas Pipelines | 4,583,610 |

| Ghani Global Holdings | 3,955,687 |

| Yousaf Weaving Mills | 3,930,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 32,590,179 |

| Refinery | 24,642,578 |

| Miscellaneous | 20,151,800 |

| Food & Personal Care Products | 11,833,803 |

| Oil & Gas Marketing Companies | 11,756,805 |

| Commercial Banks | 9,406,059 |

| Chemical | 7,989,512 |

| Cement | 6,860,522 |

| Engineering | 4,671,039 |

| Textile Spinning | 4,587,300 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction