PSX Closing Bell: Slip N' Slide

MG News | March 18, 2022 at 05:44 PM GMT+05:00

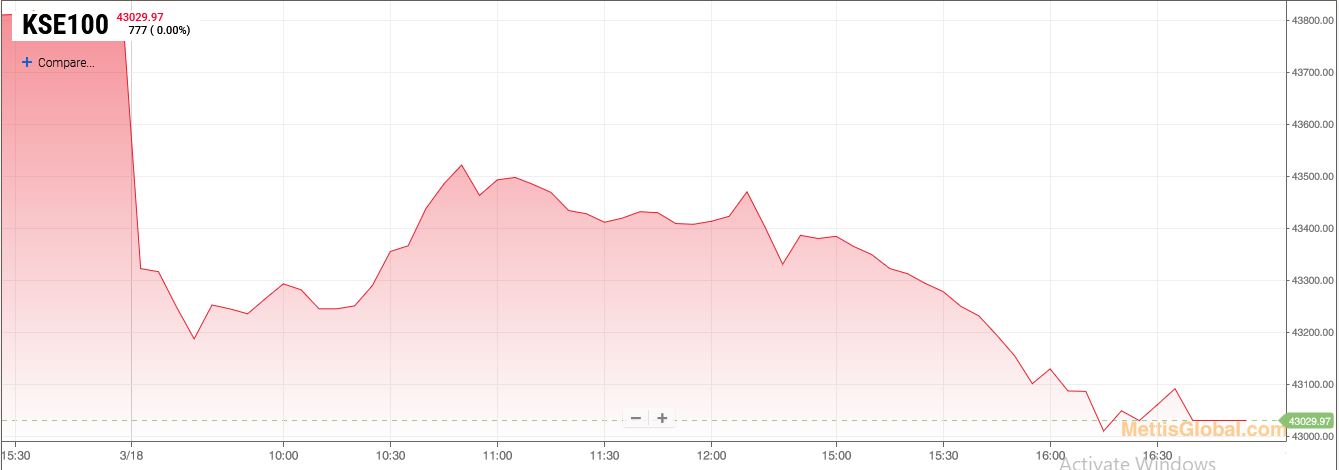

March 18, 2022 (MLN): The capital market witnessed another bearish session on the last trading day of the week and closed in red due to uncertainty on the political front.

Investors’ confidence was knocked by the political noise as parliament is moving closer to a vote of confidence motion.

The benchmark KSE100 index ended the trading session with a 777.26 point or 1.77 percent decline to close at 43,029.97. The index remained negative throughout the session touching an intraday low of 42,987.86.

Of the 95 traded companies in the KSE100 Index 17 closed up 76 closed down, while 2 remained unchanged. Total volume traded for the index was 92.33 million shares.

Sector wise, the index was let down by Commercial Banks with 158 points, Technology & Communication with 150 points, Oil & Gas Exploration Companies with 140 points, Cement with 113 points and Oil & Gas Marketing Companies with 54 points.

The most points taken off the index was by SYS which stripped the index of 77 points followed by PPL with 73 points, HBL with 64 points, TRG with 61 points and OGDC with 54 points.

Sectors propping up the index were Fertilizer with 36 points, Real Estate Investment Trust with 3 points and Insurance with 1 points.

The most points added to the index was by EFERT which contributed 36 points followed by FFC with 35 points, BAHL with 10 points, MUREB with 7 points and HMB with 5 points.

All Share Volume increased by 31.93 Million to 180.44 Million Shares. Market Cap decreased by Rs.130.72 Billion.

Total companies traded were 335 compared to 335 from the previous session. Of the scrips traded 64 closed up, 256 closed down while 15 remained unchanged.

Total trades increased by 31,346 to 89,113.

Value Traded increased by 3.40 Billion to Rs.6.39 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 13,488,500 |

| Ghani Global Holdings | 10,053,500 |

| K-Electric | 8,827,000 |

| Pak Elektron(R) | 7,249,000 |

| Telecard | 7,183,381 |

| TRG Pakistan | 6,482,099 |

| Sui Northern Gas Pipelines | 6,110,583 |

| TPL Properties | 5,731,632 |

| Cnergyico PK | 5,201,417 |

| Fauji Cement Company | 5,031,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 38,441,909 |

| Commercial Banks | 16,718,731 |

| Chemical | 15,587,894 |

| Cement | 14,153,589 |

| Power Generation & Distribution | 13,261,622 |

| Oil & Gas Marketing Companies | 10,824,451 |

| Cable & Electrical Goods | 10,381,550 |

| Fertilizer | 8,851,084 |

| Miscellaneous | 8,201,832 |

| Food & Personal Care Products | 7,901,830 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,195.00 | 119,440.00 118,260.00 | 900.00 0.76% |

| BRENT CRUDE | 71.80 | 73.17 71.75 | -0.71 -0.98% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 68.53 | 69.79 68.45 | -0.68 -0.98% |

| SUGAR #11 WORLD | 16.44 | 16.58 16.44 | -0.15 -0.90% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|