PSX Closing Bell: Slide Away

By MG News | January 19, 2022 at 07:10 PM GMT+05:00

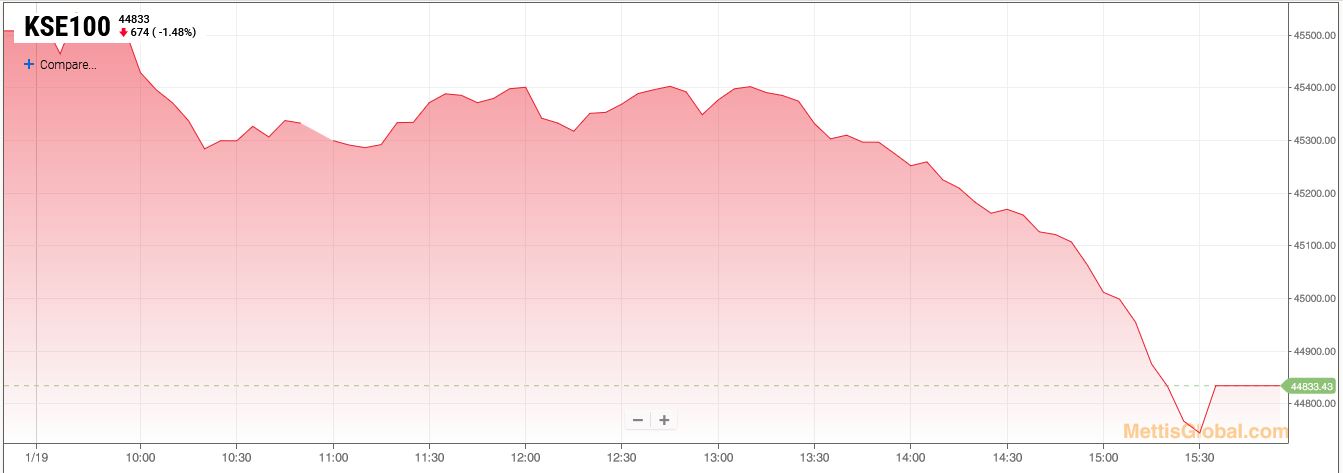

Jan 19, 2022 (MNL): The capital markets witnessed a bloodbath on Wednesday as the KSE-100 index shed 673.98 points or a 1.48 percent decline to settle at 44,833.43 due to alarming Covid-19 cases and higher international oil prices.

The market opened on a bleak note and stayed in the red zone throughout the day due to selling pressure from the mutual funds, a market closing note by Arif Habib said.

The Index traded in a range of 842.62 points or 1.85 percent of the previous close, showing an intraday high of 45,578.56 and a low of 44,735.94.

Of the 92 traded companies in the KSE100 Index, 5 closed up 83 closed down, while 4 remained unchanged. The total volume traded for the index was 100.82 million shares.

Sector wise, the index was let down by Cement with 101 points, Technology & Communication with 99 points, Commercial Banks with 73 points, Oil & Gas Exploration Companies with 50 points and Fertilizer with 48 points.

The most points taken off the index was by TRG which stripped the index of 94 points followed by LUCK with 39 points, PSO with 33 points, ENGRO with 22 points and MCB with 22 points.

Sectors propping up the index were Real Estate Investment Trust with 1 point.

The most points added to the index were by HMB which contributed 9 points followed by KAPCO with 8 points, BAFL with 1 point, DCR with 1 point and ICI with 1 point.

All Share Volume increased by 71.80 Million to 236.93 Million Shares. Market Cap decreased by Rs.99.92 Billion.

Total companies traded were 360 compared to 350 from the previous session. Of the scrips traded 56 closed up, 289 closed down while 15 remained unchanged.

Total trades increased by 22,146 to 114,786.

Value Traded increased by 1.10 Billion to Rs.8.66 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 27,328,000 |

| TRG Pakistan | 20,191,658 |

| Telecard | 18,792,500 |

| Cnergyico PK | 15,505,699 |

| Hascol Petroleum | 9,170,000 |

| Ghani Global Holdings | 6,998,000 |

| The Hub Power Company | 6,503,973 |

| Avanceon | 5,557,753 |

| Al Shaheer Corporation | 4,632,500 |

| Octopus Digital | 4,511,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 88,407,296 |

| Refinery | 19,661,279 |

| Power Generation & Distribution | 15,816,473 |

| Food & Personal Care Products | 15,326,798 |

| Chemical | 13,501,870 |

| Commercial Banks | 12,418,860 |

| Oil & Gas Marketing Companies | 11,738,621 |

| Cement | 8,720,336 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 8,522,000 |

| Oil & Gas Exploration Companies | 5,872,287 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,686.66 280.01M |

0.26% 342.63 |

| ALLSHR | 81,305.25 897.01M |

0.35% 281.26 |

| KSE30 | 39,945.45 114.02M |

0.09% 37.19 |

| KMI30 | 190,698.05 148.61M |

0.61% 1163.05 |

| KMIALLSHR | 55,074.15 495.43M |

0.53% 290.50 |

| BKTi | 34,568.40 28.73M |

-1.07% -372.33 |

| OGTi | 28,739.35 22.59M |

1.57% 443.29 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,875.00 | 110,525.00 109,735.00 |

-540.00 -0.49% |

| BRENT CRUDE | 68.48 | 68.89 68.42 |

-0.32 -0.47% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

-0.75 -0.76% |

| ROTTERDAM COAL MONTHLY | 108.45 | 109.80 108.45 |

-0.55 -0.50% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.78 | 67.18 66.72 |

-0.22 -0.33% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

Trade Balance

Trade Balance

CPI

CPI