PSX Closing Bell: Silent Lucidity

MG News | May 13, 2022 at 05:44 PM GMT+05:00

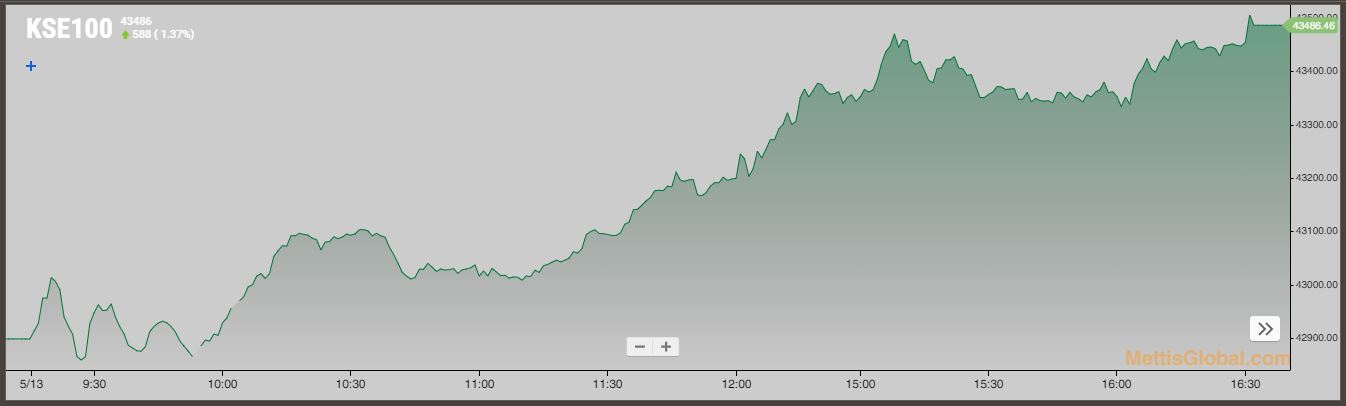

May 13, 2022 (MLN): Unlike previous session, the capital market on Friday opened on a positive note as investors cheered the news of upcoming funds from the Asian Development Bank (ADB) worth $2.5 billion for FY23, from which $1.5-2bn can be available in the ongoing calendar year.

The strong buying activity was witnessed across the board, making an intraday high of 43,505.75 right after the release of remittances data for the month of April 2022.

Remittances crossed the monthly mark of $3bn for the first time. Cumulatively, at $26.1bn, remittances grew by 7.6 % in the 10MFY22 to stand at $26bn compared to $24.22bn in 10MFY21.

Accordingly, the benchmark KSE-100 index ended the trading session with a gain of 588.02 points to close at 43,486.46.

Of the 95 traded companies in the KSE100 Index 79 closed up 13 closed down, while 3 remained unchanged. The total volume traded for the index was 100.46 million shares.

Sectors propping up the index were Commercial Banks with 136 points, Oil & Gas Exploration Companies with 127 points, Cement with 49 points, Automobile Assembler with 47 points, and Inv. Banks / Inv. Cos. / Securities Cos. with 37 points.

The most points added to the index were by OGDC which contributed 51 points followed by PPL with 38 points, MTL with 37 points, POL with 36 points, and BAHL with 36 points.

Sector wise, the index was let down by

The most points taken off the index was by TRG which stripped the index of 18 points followed by IGIHL with 5 points, BAFL with 3 points, NATF with 3 points and AVN with 2 points.

All Share Volume decreased by 76.39 Million to 208.11 Million Shares. Market Cap increased by Rs.93.59 Billion.

Total companies traded were 343 compared to 336 from the previous session. Of the scrips traded 236 closed up, 87 closed down while 20 remained unchanged.

Total trades decreased by 23,343 to 95,955.

Value Traded decreased by 0.83 Billion to Rs.6.97 Billion

| Company | Volume |

|---|---|

| Treet Corporation | 20,904,000 |

| Cnergyico PK | 20,897,533 |

| Pakistan Refinery | 14,950,748 |

| Lotte Chemical Pakistan | 11,699,839 |

| Worldcall Telecom | 8,639,500 |

| Unity Foods | 8,062,971 |

| Hum Network | 7,810,500 |

| G3 Technologies | 6,848,000 |

| Ghani Global Holdings | 6,746,210 |

| TPL Properties | 6,419,302 |

| Sector | Volume |

|---|---|

| Refinery | 42,385,145 |

| Food & Personal Care Products | 32,404,020 |

| Technology & Communication | 29,975,080 |

| Chemical | 29,717,676 |

| Cement | 13,449,779 |

| Commercial Banks | 6,841,229 |

| Miscellaneous | 6,682,002 |

| Oil & Gas Exploration Companies | 6,458,851 |

| Cable & Electrical Goods | 5,394,600 |

| Oil & Gas Marketing Companies | 4,857,294 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction