PSX Closing Bell: Serenity now!

MG News | February 10, 2022 at 05:26 PM GMT+05:00

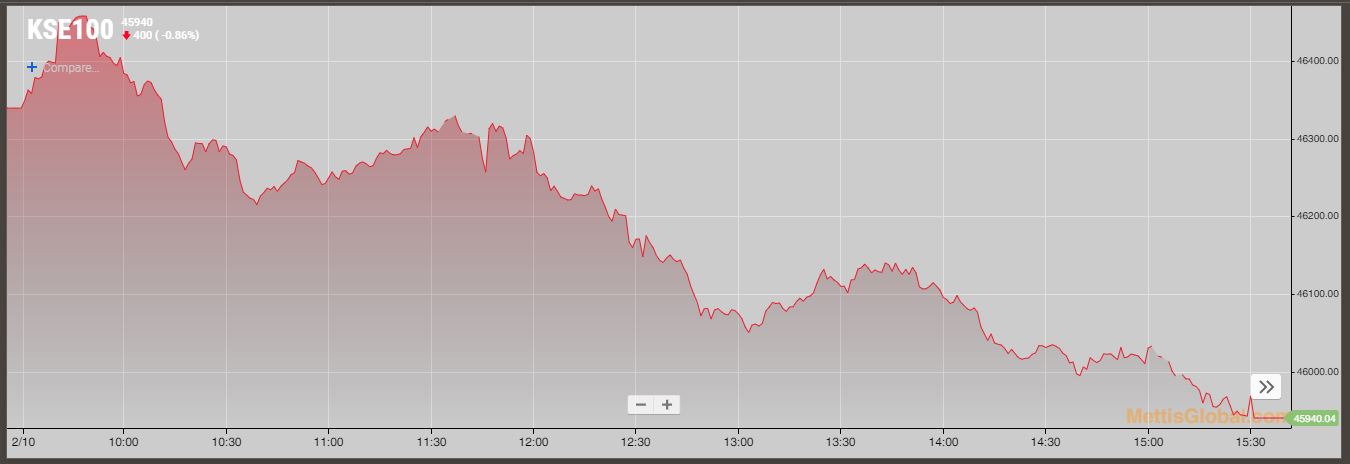

February 10, 2022 (MLN): The capital market on Thursday endured bearish sentiments throughout the session owing to the lack of fresh triggers which pushed the trading floor towards selling pressure.

As a result, the benchmark KSE-100 index plunged by 399.72 points or 0.86 percent to conclude the session at 45,940.04.

The Index traded in a range of 532.08 points or 1.15 percent of the previous close, showing an intraday high of 46,468.26 and a low of 45,936.18.

Of the 96 traded companies in the KSE100 Index 26 closed up 67 closed down, while 3 remained unchanged. The total volume traded for the index was 112.18 million shares.

Sector-wise, the index was let down by Commercial Banks with 121 points, Fertilizer with 63 points, Technology & Communication with 57 points, Oil & Gas Exploration Companies with 43 points and Cement with 35 points.

The most points taken off the index was by HBL which stripped the index of 34 points followed by MCB with 31 points, ENGRO with 29 points, HUBC with 24 points and SYS with 23 points.

Sectors propping up the index were Automobile Assembler with 18 points, Inv. Banks / Inv. Cos. / Securities Cos. with 9 points, Tobacco with 5 points, Oil & Gas Marketing Companies with 3 points and Sugar & Allied Industries with 1 point.

The most points added to the index was by INDU which contributed 11 points followed by DAWH with 8 points, PSO with 7 points, MTL with 6 points and BAFL with 5 points.

All share volume increased by 42.82 million to 285.97 million shares. Market cap decreased by Rs60.08 billion.

Total companies traded were 367 compared to 368 from the previous session. Of the scrips traded 123 closed up, 222 closed down while 22 remained unchanged.

Total trades increased by 13,105 to 118,831.

Value Traded decreased by 0.67 billion to Rs9.27 billion

| Company | Volume |

|---|---|

| Telecard | 45,410,917 |

| TPL Properties | 16,954,000 |

| Worldcall Telecom | 13,715,000 |

| TPL Corp | 11,263,000 |

| The Bank of Punjab | 10,525,000 |

| Unity Foods | 8,480,841 |

| Ghani Global Holdings | 7,483,500 |

| Dost Steels | 6,772,500 |

| Pakistan Telecommunication Company Ltd | 6,007,500 |

| Treet Corporation | 5,669,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 90,848,939 |

| Commercial Banks | 22,632,168 |

| Miscellaneous | 20,518,300 |

| Chemical | 20,422,500 |

| Food & Personal Care Products | 19,993,774 |

| Power Generation & Distribution | 16,035,090 |

| Engineering | 14,484,881 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 11,300,000 |

| Textile Composite | 11,016,811 |

| Fertilizer | 8,856,979 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves