PSX Closing Bell: On The Edge

MG News | May 08, 2025 at 04:17 PM GMT+05:00

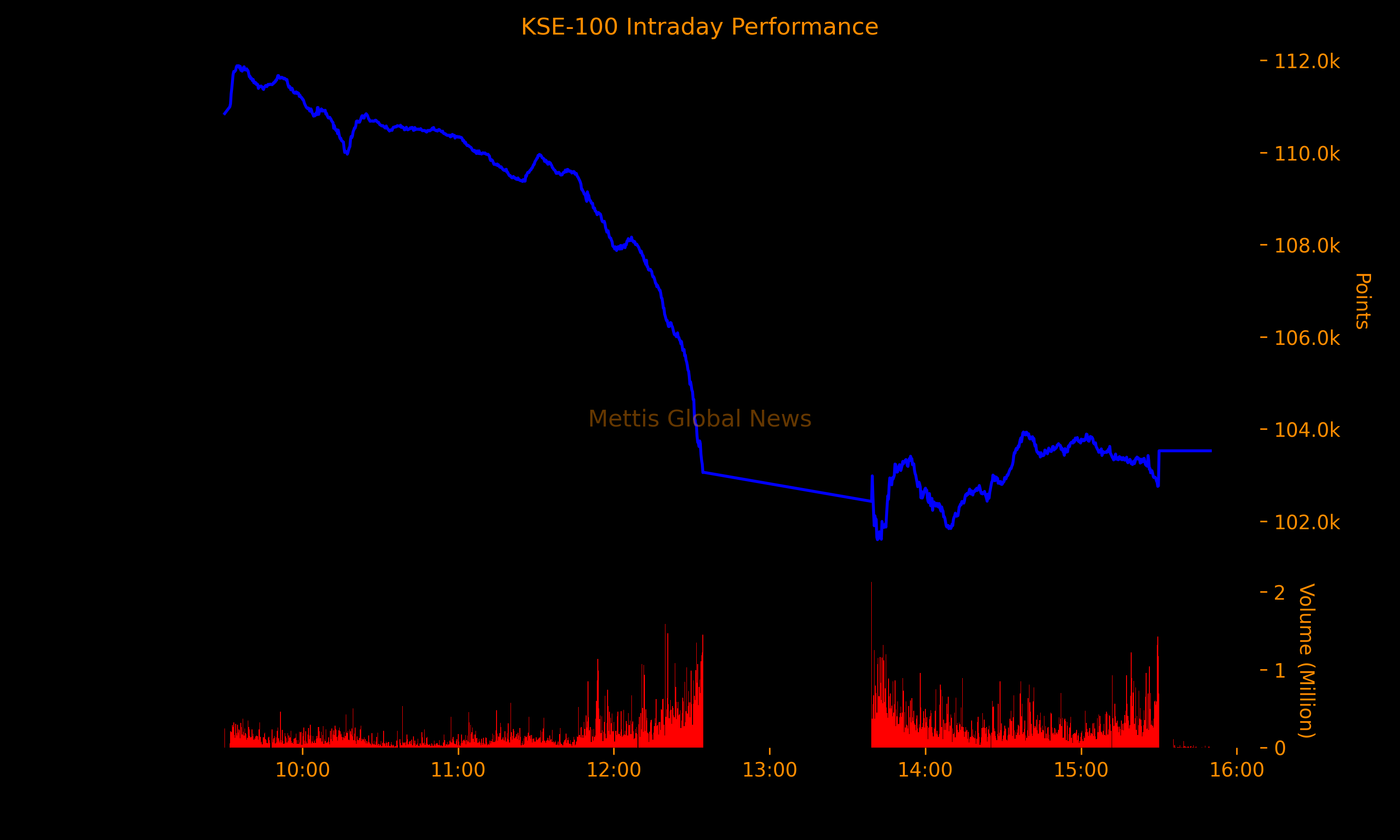

May 08, 2025 (MLN): The benchmark KSE-100 Index concluded Thursday's trading session at 103,526.81, showing a decrease of 6,482.21 points or 5.89%.

The sharp decline came after reports surfaced of escalating conflict between India and Pakistan, with Indian drones reportedly intercepted in Karachi and Lahore. The market reacted swiftly, with investors rushing to dump shares amid fears of a full-blown military confrontation.

Trading volumes surged as the news broke, and heavy sell-offs were witnessed across all key sectors, with defense-related uncertainties adding to investor anxiety. As a result, the market halted at 12:39 pm.

The index traded in a range of 10,282.12 points showing an intraday high of 111,881.02 (+1,872.00) and a low of 101,598.90 (-8,410.12) points.

The total volume of the KSE-100 Index was 308.03 million shares.

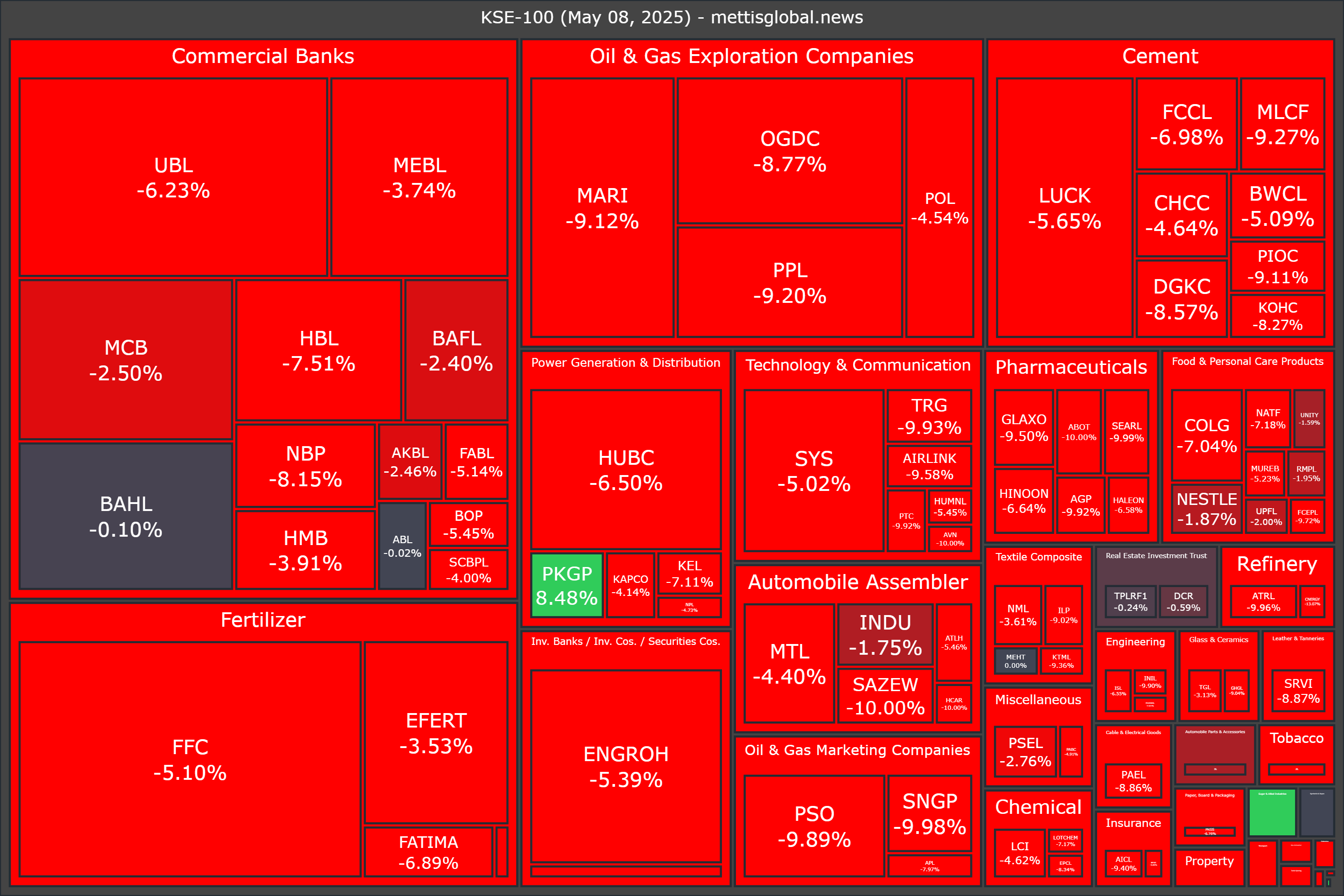

Of the 100 index companies 3 closed up, 95 closed down, while 2 were unchanged.

Top losers during the day were CNERGY (-13.07%), PIBTL (-10.01%), BNWM (-10.00%), ABOT (-10.00%), and HCAR (-10.00%).

On the other hand, top gainers were PKGP (+8.48%), PGLC (+6.61%), and JDWS (+3.08%).

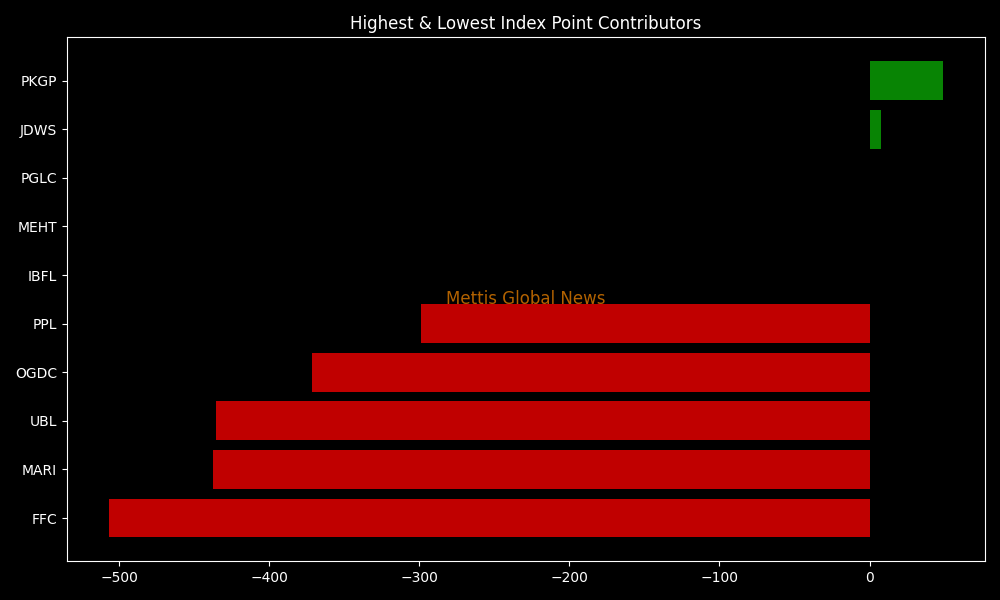

In terms of index-point contributions, companies that dragged the index lower were FFC (-507.20pts), MARI (-437.85pts), UBL (-435.91pts), OGDC (-371.37pts), and PPL (-298.64pts).

Meanwhile, companies that added points to the index were PKGP (+49.15pts), JDWS (+7.34pts), PGLC (+0.45pts).

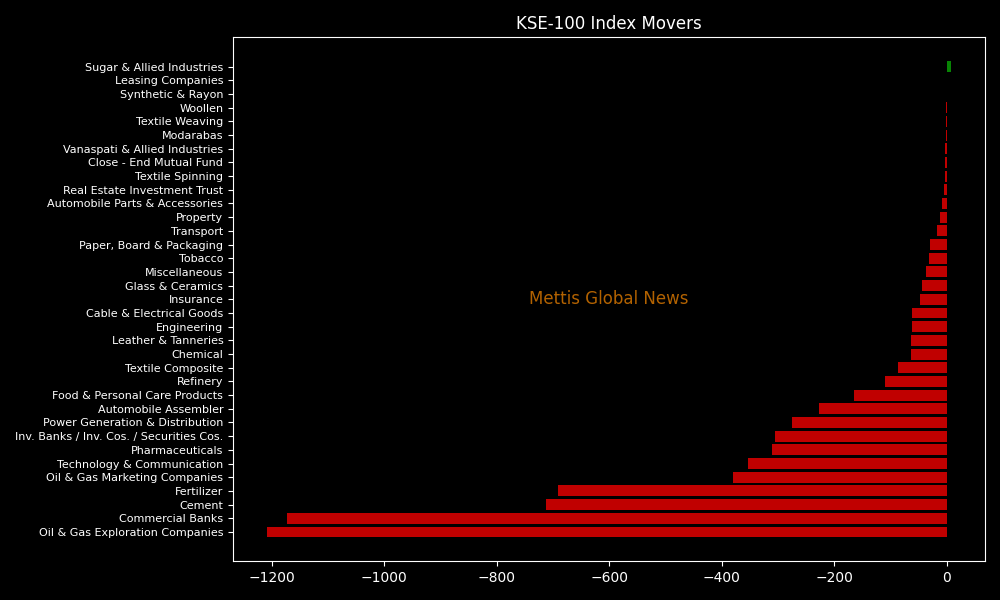

Sector-wise, KSE-100 Index was let down by Oil & Gas Exploration Companies (-1208.51pts), Commercial Banks (-1172.67pts), Cement (-712.14pts), Fertilizer (-690.77pts), and Oil & Gas Marketing Companies (-380.64pts).

While the index was supported by Sugar & Allied Industries (+7.34pts), Leasing Companies (+0.45pts), Synthetic & Rayon (+0.00pts), Woollen (-0.46pts), and Textile Weaving (-0.71pts).

In the broader market, the All-Share Index closed at 64,527.99 with a net loss of 4,173.22 points or 6.07%.

Total market volume was 653.55 million shares compared to 550.08m from the previous session while traded value was recorded at Rs35.44 billion showing an increase of Rs5.32bn.

There were 331,484 trades reported in 450 companies with 35 closing up, 373 closing down, and 42 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.1 | -9.84% | 93,253,525 |

| KOSM | 3.94 | -19.10% | 28,484,361 |

| KEL | 3.92 | -7.11% | 27,065,550 |

| BOP | 8.68 | -5.45% | 26,764,712 |

| FCCL | 39.86 | -6.98% | 19,664,828 |

| CNERGY | 5.72 | -13.07% | 19,599,374 |

| MLCF | 60.87 | -9.27% | 19,535,579 |

| SSGC | 29.22 | -10.01% | 15,067,745 |

| PIBTL | 7.1 | -10.01% | 14,901,402 |

| FFL | 12.21 | -9.82% | 13,416,966 |

To note, the KSE-100 has gained 25,082 points or 31.97% during the fiscal year, whereas it has decreased 11,600 points or 10.08% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction