PSX Closing Bell: Off the Charts

MG News | March 27, 2024 at 02:21 PM GMT+05:00

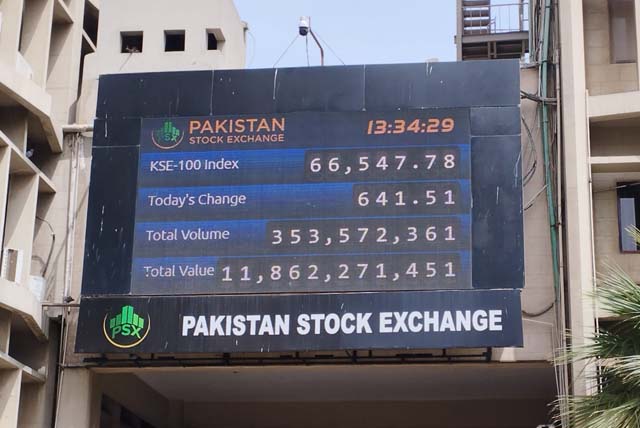

March 27, 2024 (MLN): The Pakistan Stock Exchange's (PSX) benchmark KSE-100 index closed at an all-time high of 66,547.78.

To note, after a record high closing of 66,427 in mid-December, the index experienced a significant correction, dropping as much as 12.4% from its highs.

The rebound back past its record highs, after 3.5 months, has been fueled by better than expected conclusion of general elections, expectations for interest rate cuts and fresh inflows from the IMF following the Staff-Level Agreement for the final tranche of $1.1 billion.

The Index closed Wednesday's session with a gain of 641.51 points or 0.97%.

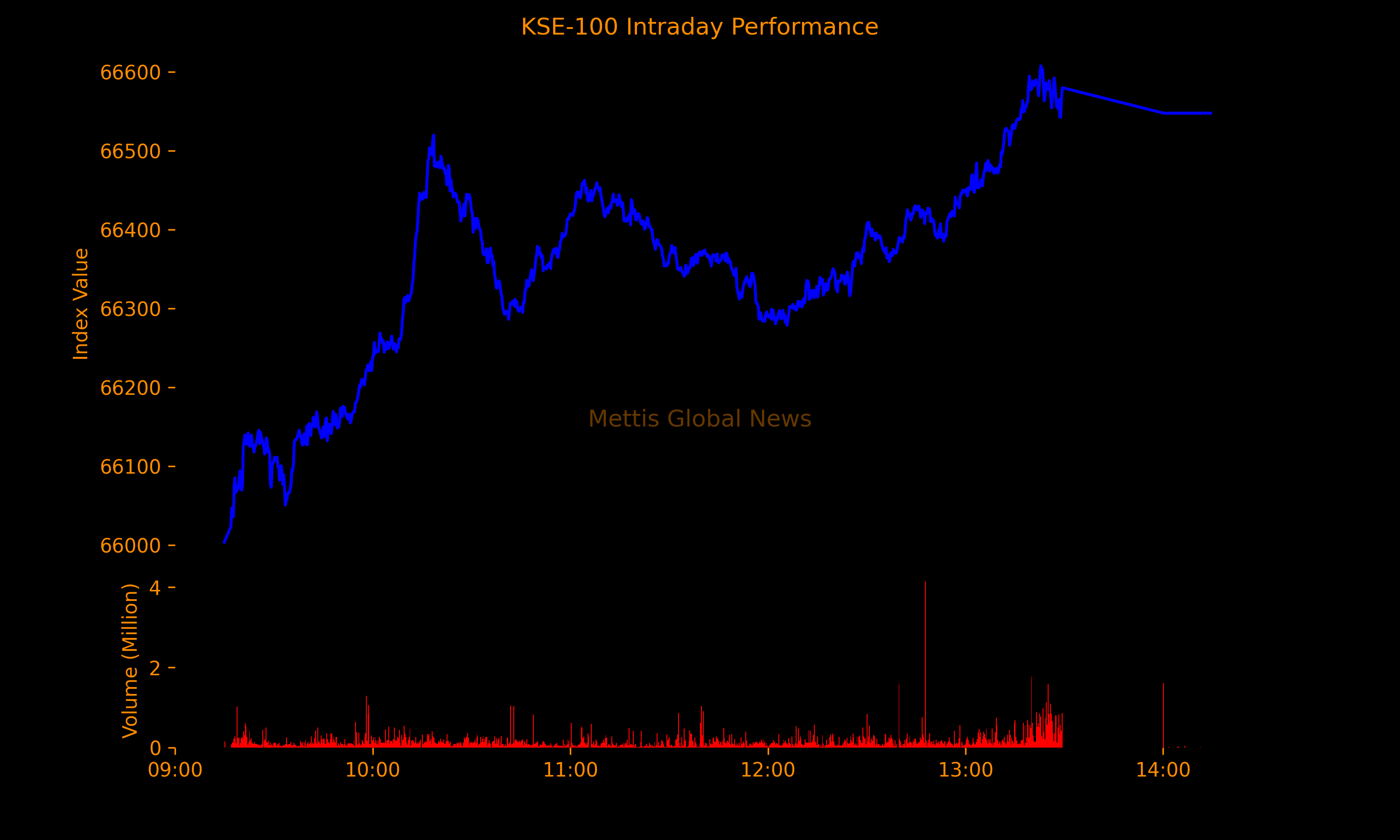

The index remained positive throughout the day, showing an intraday high of 66,607.88 (+701.60) and a low of 66,003.44 (+97.16) points.

The total volume of the KSE-100 index was 189.118 million shares.

Mohammad Aurangzeb will visit the stock exchange on Friday for the first time after becoming the Finance Minister.

"Importance is being given to Aurangzeb's visit to stock exchange," said stock brokers.

The local currency has also remained stable and hovers around a five-month high.

Meanwhile, the government’s efforts to restructure and privatize Pakistan International Airlines Corp (PSX: PIAA) have also played a due role in boosting the investors’ sentiments.

PIA's stock price has seen a surge of 7.93x over the past year, while the year-to-date (YTD) increase stands at 3.87x.

“The significant progress on privatization, coupled with the potential new deal with the IMF, has propelled the benchmark KSE 100 index close to its all-time high closing of 66,427, seen in December 2023,” said Mohammad Sohail, CEO Topline Securities.

“Additionally, foreign fund buying, as indicated by NCCPL data, continues to bolster share prices, which are currently trading at an attractive PE of less than 4,” he added.

Of the 100 index companies 66 closed up, 27 closed down, 5 were unchanged, while 2 remained untraded.

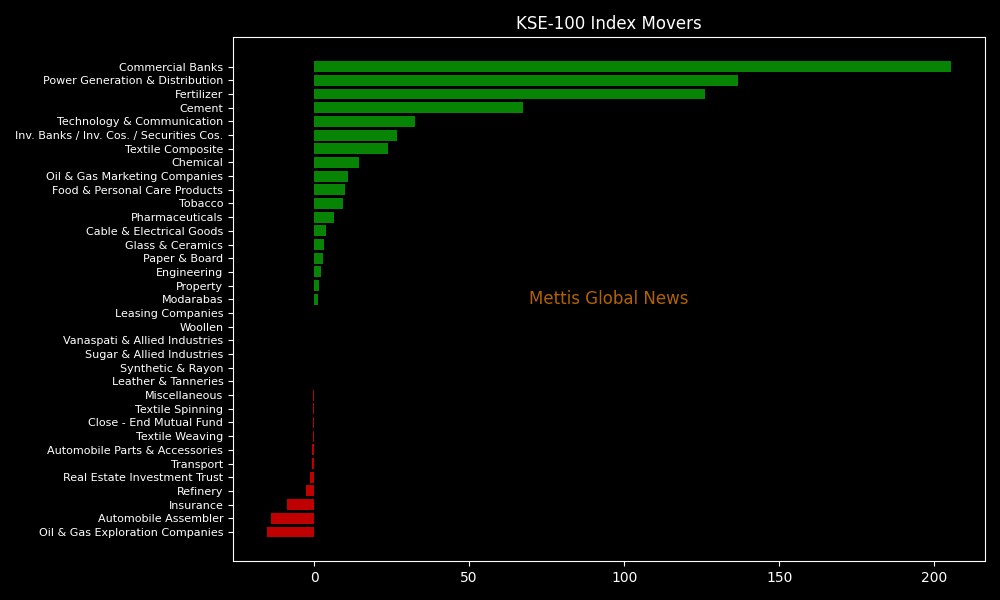

KSE-100 index was supported by Commercial Banks with 205.32, Power Generation & Distribution with 136.79, Fertilizer with 125.9, Cement with 67.39, and Technology & Communication with 32.6 points.

On the contrary, the index was let down by Oil & Gas Exploration Companies with 15.12, Automobile Assembler with 13.84, Insurance with 8.73, Refinery with 2.61, and Real Estate Investment Trust with 1.22 points.

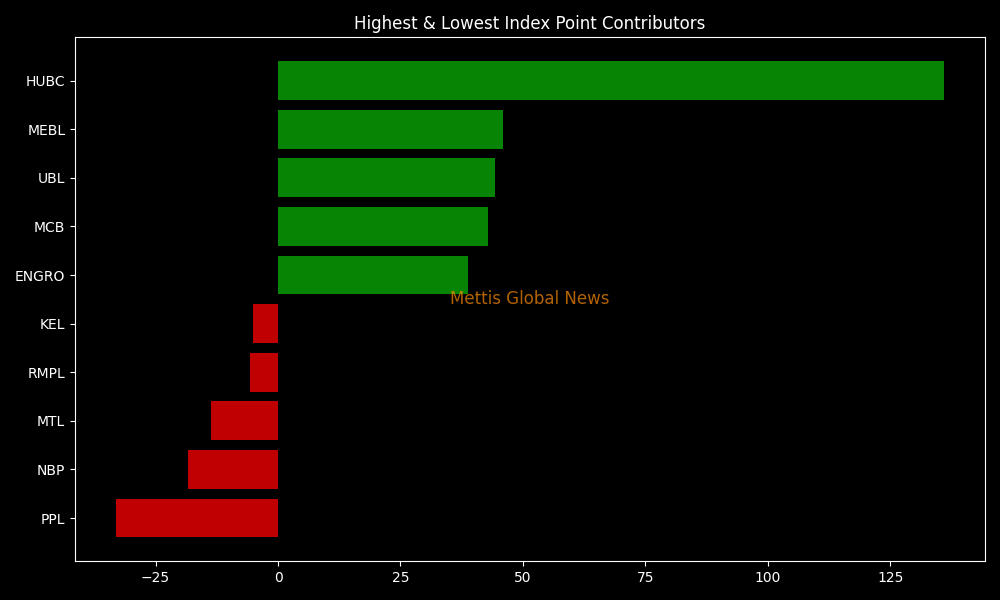

Companies adding points to the index were HUBC with 135.87, MEBL with 45.89, UBL with 44.37, MCB with 42.76, and ENGRO with 38.81 points.

Meanwhile, companies that dragged the index lower were PPL with 32.98, NBP with 18.45, MTL with 13.73, RMPL with 5.81 and KEL with 5.18 points.

In the broader market, the All-Share index closed at 44,075.12 with a net gain of 390.81 points.

Total market volume was 354.597 million shares compared to 303.710 from the previous session while traded value was recorded at Rs11.88 billion showing a decrease of Rs0.2bn.

There were 136,922 trades reported in 344 companies with 178 closing up, 151 closing down and 15 remaining unchanged.

| Company | Volume |

|---|---|

| LOTCHEM | 42,831,026 |

| TELE | 29,177,124 |

| PTC | 24,701,735 |

| TOMCL | 18,792,000 |

| HASCOL | 16,036,000 |

| TRG | 14,931,452 |

| AGL | 11,649,000 |

| CNERGY | 10,555,262 |

| WTL | 8,908,331 |

| PAKRI | 8,863,000 |

To note, the KSE-100 has gained 25,095 points or 60.54% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 4,097 points, equivalent to 6.56%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction