PSX Closing Bell: Mirror Symmetry

MG News | January 25, 2022 at 05:35 PM GMT+05:00

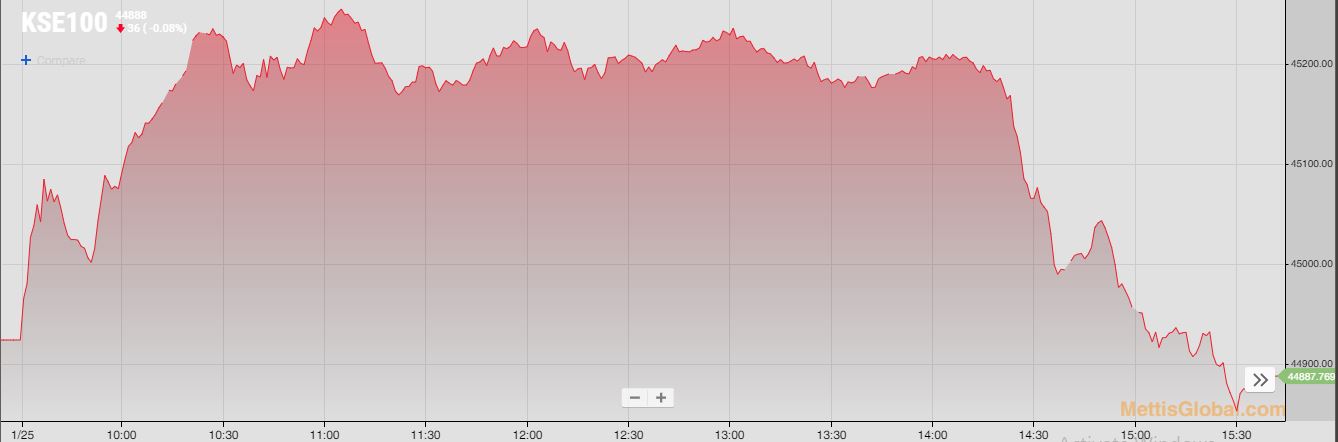

January 25, 2022 (MLN): The capital market on Tuesday opened on a positive note as investors welcomed the SBP’s decision to keep the policy rate unchanged at 9.75% till March 2022 and the index touched an intraday high of 45,255.92 points.

However, the trading floor succumb to the selling pressure in the later hours which led the benchmark KSE 100 index to settle in red at the 44,887.77 mark after shedding 36.14 points.

Of the 93 traded companies in the KSE100 Index 44 closed up 43 closed down, while 6 remained unchanged. The total volume traded for the index was 97.01 million shares.

Sector-wise, the index was let down by Technology & Communication with 91 points, Oil & Gas Exploration Companies with 39 points, Chemical with 22 points, Insurance with 8 points and Power Generation & Distribution with 6 points.

The most points taken off the index was by TRG which stripped the index of 49 points followed by SYS with 41 points, COLG with 22 points, ENGRO with 19 points and BAHL with 13 points.

Sectors propping up the index were Cement with 98 points, Oil & Gas Marketing Companies with 13 points, Textile Composite with 12 points, Engineering with 8 points and Food & Personal Care Products with 6 points.

The most points added to the index was by LUCK which contributed 54 points followed by FFC with 18 points, CHCC with 13 points, BAFL with 11 points and MLCF with 11 points.

All Share Volume increased by 46.83 million to 207.04 million shares. Market Cap decreased by Rs13.02 billion.

Total companies traded were 333 compared to 325 from the previous session. Of the scrips traded 148 closed up, 161 closed down while 24 remained unchanged.

Total trades increased by 15,936 to 100,023.

Value traded increased by 2.37 billion to Rs8.12 billion

| Company | Volume |

|---|---|

| Waves Singer Pakistan | 20,025,500 |

| TRG Pakistan | 11,114,882 |

| Treet Corporation | 9,380,000 |

| Cnergyico PK | 8,821,178 |

| Worldcall Telecom | 8,510,500 |

| Kot Addu Power Company | 7,713,500 |

| TPL Properties | 7,288,500 |

| Hascol Petroleum | 6,343,500 |

| Saif Power | 5,529,000 |

| Telecard | 5,286,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 39,592,562 |

| Cable & Electrical Goods | 21,786,650 |

| Food & Personal Care Products | 21,424,671 |

| Power Generation & Distribution | 21,013,553 |

| Commercial Banks | 16,281,505 |

| Cement | 11,774,439 |

| Refinery | 11,459,288 |

| Oil & Gas Marketing Companies | 10,722,797 |

| Miscellaneous | 8,520,000 |

| Engineering | 7,232,496 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction