PSX Closing Bell: Little Triggers

MG News | April 14, 2022 at 06:08 PM GMT+05:00

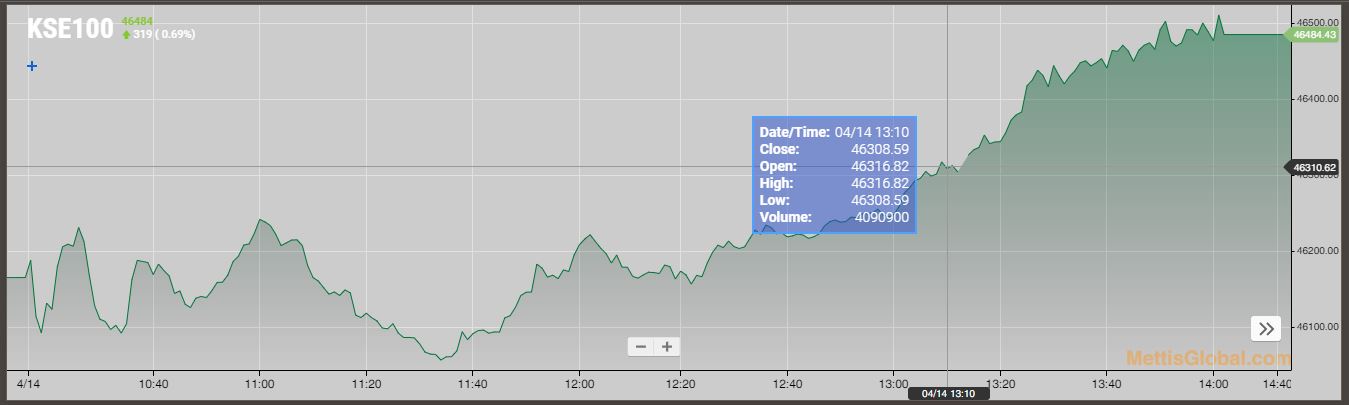

April 14, 2022 (MLN): The domestic equity market on Thursday witnessed a lacklustre session during the initial trading hours however, the bourse gained bullish momentum in the later hours on the expectation of a strong earnings season ahead.

The investors also cherished the gaining streak of PKR and $2.8 billion of inflows in terms of remittances during March 2022.

Resultantly, the benchmark KSE100 index gained 318.93 points to close the trading session at 46,484.43.

The Index traded in a range of 456.45 points or 0.99 percent of the previous close, showing an intraday high of 46,510.11 and a low of 46,053.66.

Of the 95 traded companies in the KSE100 Index 69 closed up 24 closed down, while 2 remained unchanged. The total volume traded for the index was 211.50 million shares.

Sectors propping up the index were Fertilizer with 76 points, Refinery with 60 points, Cement with 59 points, Chemical with 38 points and Inv. Banks / Inv. Cos. / Securities Cos. with 18 points.

The most points added to the index were by ENGRO which contributed 63 points followed by EPCL with 45 points, CNERGY with 37 points, MLCF with 24 points and DAWH with 14 points.

Sector-wise, the index was let down by Commercial Banks with 17 points, Oil & Gas Exploration Companies with 15 points and Leather & Tanneries with 2 points.

The most points taken off the index was by COLG which stripped the index of 18 points followed by MEBL with 14 points, BAFL with 12 points, PPL with 8 points and OGDC with 7 points.

All Share Volume increased by 20.36 Million to 494.94 Million Shares. Market Cap increased by Rs.43.46 Billion.

Total companies traded were 343 compared to 362 from the previous session. Of the scrips traded 206 closed up, 118 closed down while 19 remained unchanged.

Total trades decreased by 18,289 to 130,689.

Value Traded decreased by 0.67 Billion to Rs.11.68 Billion

| Company | Volume |

|---|---|

| Cnergyico PK | 99,122,084 |

| Worldcall Telecom | 36,948,000 |

| Flying Cement Company | 33,865,500 |

| Telecard | 32,971,000 |

| Maple Leaf Cement Factory | 22,780,489 |

| G3 Technologies | 21,307,500 |

| Pakistan Refinery | 21,014,500 |

| Treet Corporation | 20,754,000 |

| Ghani Global Holdings | 17,478,000 |

| Hum Network | 14,290,000 |

| Sector | Volume |

|---|---|

| Refinery | 124,457,697 |

| Technology & Communication | 104,742,421 |

| Cement | 70,580,624 |

| Chemical | 47,375,570 |

| Food & Personal Care Products | 41,680,567 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 13,984,100 |

| Miscellaneous | 13,414,446 |

| Commercial Banks | 7,760,477 |

| Engineering | 7,079,476 |

| Power Generation & Distribution | 6,684,964 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,613.57 201.89M | 0.87% 1201.32 |

| ALLSHR | 86,507.73 371.30M | 0.94% 804.77 |

| KSE30 | 42,675.34 84.18M | 1.00% 420.50 |

| KMI30 | 196,832.16 85.78M | 1.40% 2722.57 |

| KMIALLSHR | 57,428.44 160.41M | 1.26% 714.77 |

| BKTi | 37,924.53 14.04M | 0.25% 93.19 |

| OGTi | 28,337.88 35.93M | 3.27% 897.25 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,525.00 | 119,785.00 117,905.00 | 1905.00 1.62% |

| BRENT CRUDE | 72.40 | 72.82 72.16 | -0.84 -1.15% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.02 | 70.41 69.80 | 0.02 0.03% |

| SUGAR #11 WORLD | 16.52 | 16.52 16.45 | 0.07 0.43% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey