PSX Closing Bell: High & Dry

MG News | May 12, 2022 at 05:52 PM GMT+05:00

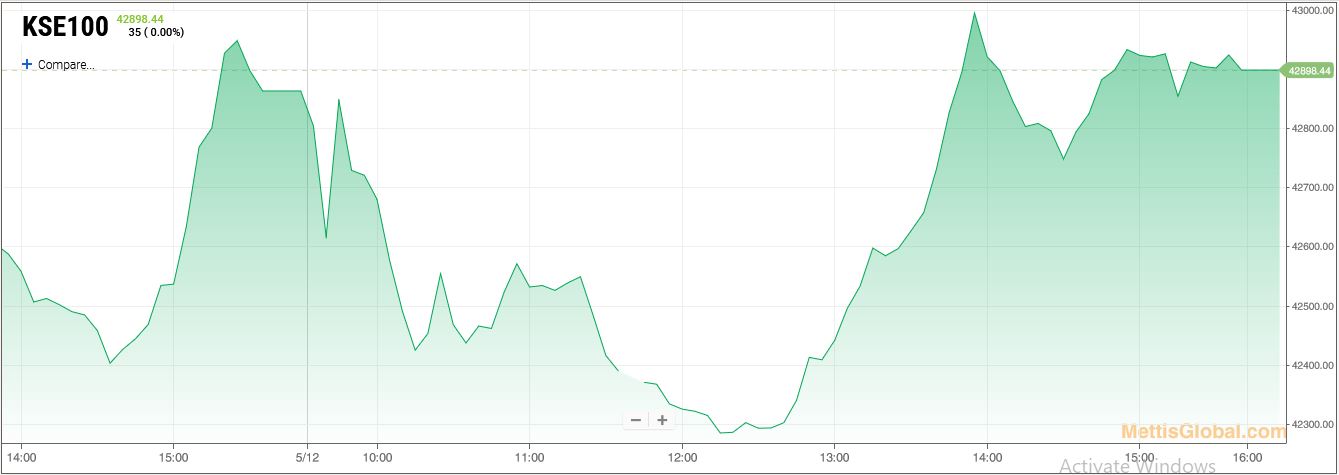

May 12, 2022 (MLN): Following yesterday’s bearish trend, the domestic equity market opened on a negative note on the backdrop of weak macroeconomic fundamentals and increasing political noise.

However, in the last trading hour investor opted for value hunting which helped the benchmark KSE-100 index to close in positive territory, a market closing note by Arif Habib said.

Accordingly, the KSE-100 index ended the trading session on Thursday with a 35.29 point or 0.08 percent gain to close at 42,898.44.

The Index traded in a range of 755.31 points or 1.76 percent of the previous close, showing an intraday high of 43,028.58 and a low of 42,273.27.

Of the 93 traded companies in the KSE100 Index 50 closed up 39 closed down, while 4 remained unchanged. The total volume traded for the index was 102.13 million shares.

Sectors propping up the index were Cement with 56 points, Chemical with 26 points, Refinery with 16 points, Oil & Gas Marketing Companies with 15 points and Technology & Communication with 15 points.

The most points added to the index was by EPCL which contributed 22 points followed by PSO with 18 points, LUCK with 15 points, PIOC with 12 points and DGKC with 11 points.

Sector wise, the index was let down by Fertilizer with 54 points, Commercial Banks with 43 points, Oil & Gas Exploration Companies with 24 points, Inv. Banks / Inv. Cos. / Securities Cos. with 12 points and Insurance with 4 points.

The most points taken off the index was by UBL which stripped the index of 26 points followed by EFERT with 19 points, FFC with 17 points, ENGRO with 15 points and DAWH with 14 points.

All Share Volume decreased by 54.04 Million to 284.50 Million Shares. Market Cap decreased by Rs.3.94 Billion.

Total companies traded were 336 compared to 359 from the previous session. Of the scrips traded 180 closed up, 137 closed down while 19 remained unchanged.

Total trades decreased by 6,311 to 119,298.

Value Traded decreased by 1.73 Billion to Rs.7.80 Billion

| Company | Volume |

|---|---|

| Treet Corporation | 27,626,500 |

| TPL Properties | 18,899,871 |

| Telecard | 16,855,000 |

| Worldcall Telecom | 16,441,000 |

| Ghani Global Holdings | 15,909,414 |

| G3 Technologies | 15,134,000 |

| Cnergyico PK | 13,992,916 |

| Hum Network | 11,633,500 |

| Pakistan Refinery | 9,683,375 |

| Pak Elektron | 8,362,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 62,502,953 |

| Chemical | 38,570,225 |

| Food & Personal Care Products | 37,920,971 |

| Refinery | 27,987,635 |

| Miscellaneous | 21,354,771 |

| Commercial Banks | 19,805,522 |

| Cement | 14,507,061 |

| Cable & Electrical Goods | 10,488,500 |

| Power Generation & Distribution | 6,933,856 |

| Textile Composite | 5,363,560 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction