PSX Closing Bell: Green River

By MG News | June 01, 2021 at 05:47 PM GMT+05:00

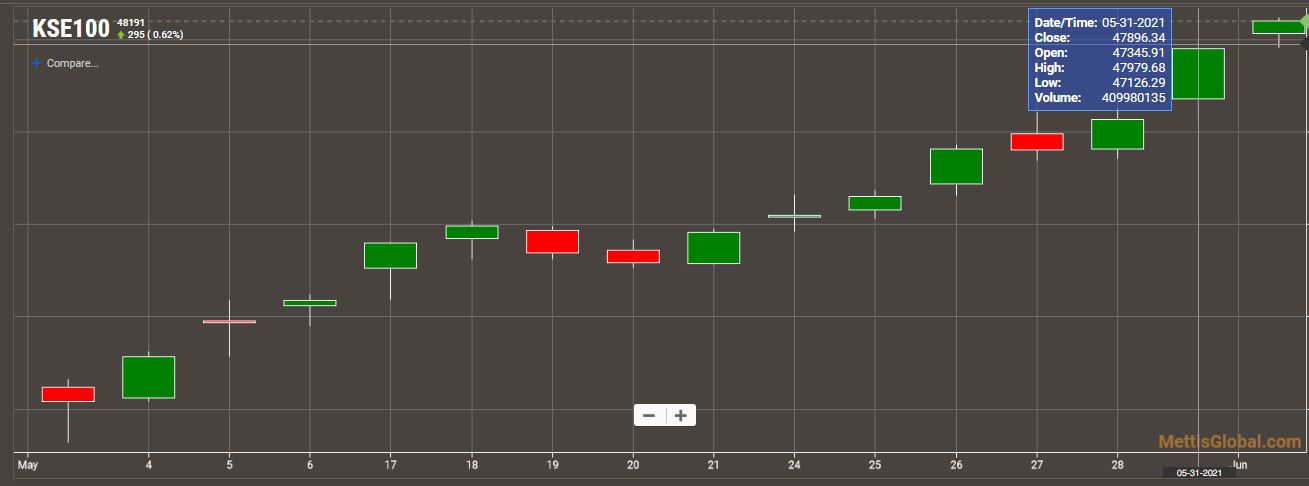

June 01, 2021 (MLN): Carrying forward the upward momentum, the benchmark KSE-100 Index on Tuesday reached another 4-year high, gaining 294.92 points to close the session at 48,191.26 as investors’ sentiments remained upbeat owing to lower-than-expected inflation figures.

Investors’ sentiments in the bourse were also buoyed due to a better-than-expected revenue collection of Rs 4,143 billion during the first eleven months of the current fiscal year.

Further, the market also gained impetus from the statement issued by the Ministry of Petroleum to keep the petroleum prices unchanged for the next fifteen days.

The Index remained positive throughout the session touching an intraday high of 48,241.55.

Of the 96 traded companies in the KSE100 Index 61 closed up 34 closed down, while 1 remained unchanged. Total volume traded for the index was 456.37 million shares.

Sectors propping up the index were Oil & Gas Exploration Companies with 83 points, Fertilizer with 57 points, Power Generation & Distribution with 25 points, Pharmaceuticals with 23 points and Food & Personal Care Products with 17 points.

The most points added to the index was by ENGRO which contributed 41 points followed by PPL with 39 points, LUCK with 22 points, HUBC with 22 points and OGDC with 21 points.

Sector wise, the index was let down by Automobile Assembler with 14 points, Oil & Gas Marketing Companies with 13 points, Sugar & Allied Industries with 1 points, Real Estate Investment Trust with 1 points and Leasing Companies with 1 points.

The most points taken off the index was by MEBL which stripped the index of 13 points followed by SNGP with 10 points, PSO with 10 points, FCCL with 8 points and TRG with 8 points.

All Share Volume decreased by 20.22 Million to 1392.04 Million Shares. Market Cap increased by Rs.48.61 Billion.

Total companies traded were 421 compared to 430 from the previous session. Of the scrips traded 258 closed up, 152 closed down while 11 remained unchanged.

Total trades decreased by 4,523 to 256,020.

Value Traded decreased by 1.56 Billion to Rs.30.49 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 354,077,000 |

| Byco Petroleum Pakistan | 94,618,000 |

| Silkbank | 86,096,000 |

| Pakistan Telecommunication Company Ltd | 58,938,500 |

| Pakistan International Bulk Terminal | 43,330,500 |

| Hascol Petroleum | 34,753,140 |

| Ghani Global Holdings | 34,033,000 |

| Hum Network | 27,646,500 |

| Dost Steels | 25,818,500 |

| Unity Foods | 25,347,183 |

| Sector | Volume |

|---|---|

| Technology & Communication | 501,953,864 |

| Commercial Banks | 115,350,319 |

| Refinery | 112,470,400 |

| Food & Personal Care Products | 93,766,833 |

| Chemical | 75,466,100 |

| Engineering | 62,418,821 |

| Transport | 54,239,700 |

| Oil & Gas Marketing Companies | 52,363,358 |

| Textile Spinning | 45,162,000 |

| Cement | 44,579,772 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,110.00 | 109,565.00 107,195.00 |

625.00 0.58% |

| BRENT CRUDE | 66.58 | 67.20 65.92 |

-0.22 -0.33% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.95 | 65.82 64.50 |

-0.57 -0.87% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|