PSX Closing Bell: Glass Jaw..

MG News | September 17, 2021 at 10:07 PM GMT+05:00

September 17, 2021 (MLN): The capital market on Friday remained positive in the first half of the session as the investors were under the influence of PKR’s gaining momentum in the interbank market.

However, the bears took lead in the later hours owing to the data of Current Account Balance (CAB) released by the State Bank of Pakistan, as per which, CAB posted a deficit of $1.47billion in August 2021, compared to a surplus of $225million in the corresponding month last year. In the previous month, CAB posted a deficit of $814mn, suggesting that the deficit jumped notably by 81% MoM mainly attributable to an increase in imports.

In addition, the news of the postponement of the cricket series between Newzealand and Pakistan due to security threats has also smashed the investor’s confidence in the local bourse.

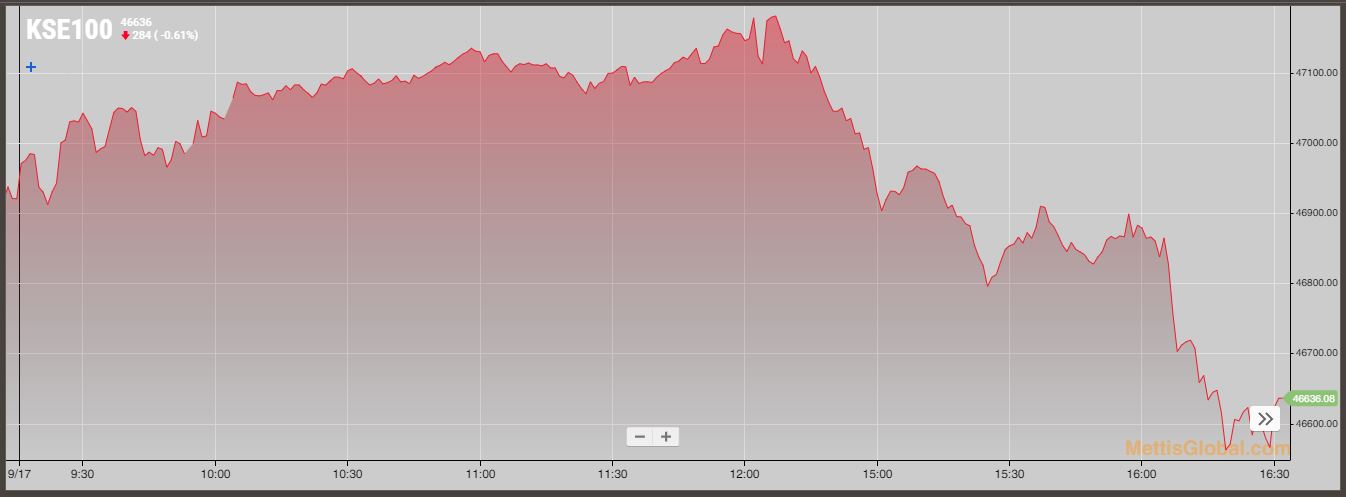

Resultantly, the benchmark KSE100 index lost 284.38 points to close the trade at 46,636.08.

The Index traded in a range of 628.35 points or 1.34 percent of previous close, showing an intraday high of 47,183.08 and a low of 46,554.73.

Of the 98 traded companies in the KSE100 Index 34 closed up 60 closed down, while 4 remained unchanged. Total volume traded for the index was 163.22 million shares.

Sector wise, the index was let down by Cement with 73 points, Commercial Banks with 58 points, Technology & Communication with 57 points, Oil & Gas Marketing Companies with 27 points and Power Generation & Distribution with 19 points.

The most points taken off the index was by LUCK which stripped the index of 59 points followed by MEBL with 37 points, ENGRO with 29 points, TRG with 29 points and SYS with 28 points.

Sectors propping up the index were Fertilizer with 13 points, Automobile Assembler with 8 points, Refinery with 6 points, Textile Spinning with 2 points and Synthetic & Rayon with 2 points.

The most points added to the index was by FFC which contributed 43 points followed by NBP with 20 points, MTL with 17 points, KTML with 10 points and BAHL with 9 points.

All Share Volume decreased by 17.89 Million to 387.29 Million Shares. Market Cap decreased by Rs.43.89 Billion.

Total companies traded were 525 compared to 518 from the previous session. Of the scrips traded 173 closed up, 327 closed down while 25 remained unchanged.

Total trades decreased by 3,943 to 126,616.

Value Traded decreased by 0.27 Billion to Rs.16.24 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 42,415,000 |

| TRG Pakistan | 25,234,230 |

| Byco Petroleum Pakistan | 20,913,000 |

| TPL Properties | 20,907,500 |

| The Bank of Punjab | 19,419,500 |

| Telecard | 18,065,500 |

| TPL Corp | 11,383,000 |

| Unity Foods | 11,085,536 |

| BankIslami Pakistan | 11,053,500 |

| Silkbank | 10,042,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 110,781,230 |

| Commercial Banks | 61,249,021 |

| Miscellaneous | 28,593,900 |

| Refinery | 25,633,226 |

| Food & Personal Care Products | 24,093,266 |

| Cement | 23,496,037 |

| Oil & Gas Marketing Companies | 13,351,791 |

| Textile Spinning | 11,610,100 |

| Engineering | 9,681,809 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 9,547,931 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves