PSX Closing Bell: Fugue state

MG News | September 13, 2021 at 05:33 PM GMT+05:00

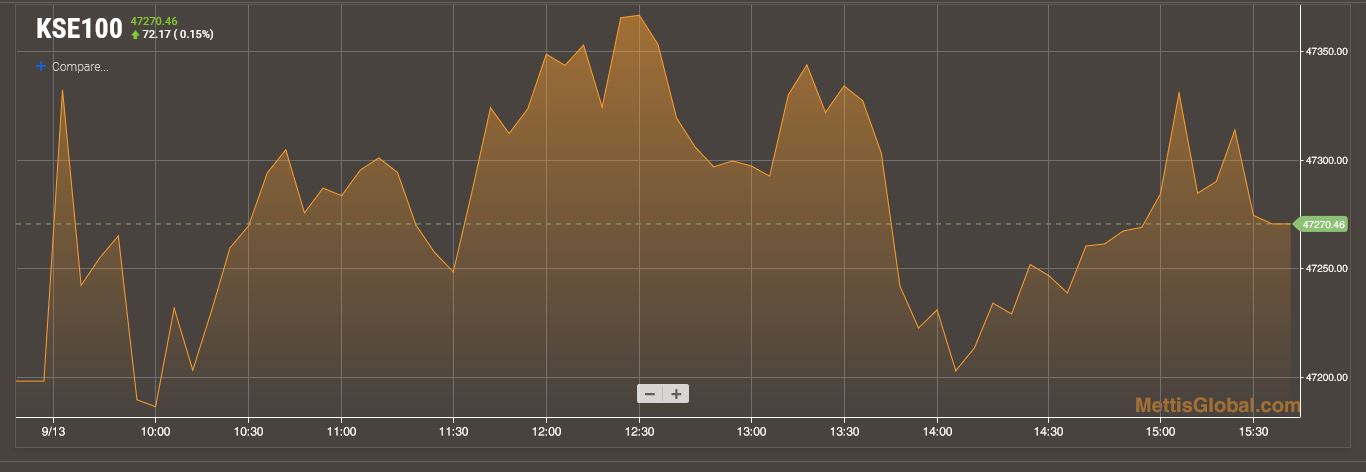

September 13, 2021 (MLN): The local bourse witnessed volatile session today as the benchmark KSE-100 index oscillated between green and red zone, posting intraday high of 47,370 points and an intraday low of 47,168 points to ultimately settle at 47,270 level, up by 0.15% or 72 points DoD.

Expectations of a hike in interest rate in the upcoming monetary policy scheduled for 20th September (Monday) coupled with expectations of higher CPI due to 13.7% WoW increase in SPI kept the market gains in check, Topline Securities in a market closing note said.

The Index traded in a range of 208.22 points or 0.44 percent of previous close.

Of the 94 traded companies in the KSE100 Index 40 closed up 52 closed down, while 2 remained unchanged. Total volume traded for the index was 130.02 million shares.

Sectors propping up the index were Commercial Banks with 85 points, Oil & Gas Exploration Companies with 21 points, Power Generation & Distribution with 20 points, Pharmaceuticals with 16 points and Oil & Gas Marketing Companies with 15 points.

The most points added to the index was by UBL which contributed 66 points followed by HBL with 33 points, AGP with 20 points, COLG with 18 points and HUBC with 18 points.

Sector wise, the index was let down by Technology & Communication with 44 points, Cement with 17 points, Fertilizer with 12 points, Inv. Banks / Inv. Cos. / Securities Cos. with 10 points and Automobile Parts & Accessories with 8 points.

The most points taken off the index was by TRG which stripped the index of 36 points followed by MEBL with 35 points, BAHL with 14 points, PIOC with 8 points and MLCF with 8 points.

All Share Volume decreased by 31.61 Million to 395.84 Million Shares. Market Cap increased by Rs.21.23 Billion.

Total companies traded were 519 compared to 528 from the previous session. Of the scrips traded 209 closed up, 290 closed down while 20 remained unchanged.

Total trades decreased by 4,641 to 137,051.

Value Traded decreased by 1.99 Billion to Rs.16.19 Billion

| Company | Volume |

|---|---|

| Byco Petroleum Pakistan | 44,967,500 |

| Service Fab(R) | 42,152,500 |

| TPL Properties | 41,074,500 |

| Telecard | 28,384,500 |

| TPL Corp | 21,273,000 |

| Worldcall Telecom | 16,748,500 |

| Citi Pharma Ltd. | 8,456,000 |

| Pakistan Refinery | 8,218,500 |

| TRG Pakistan | 6,784,796 |

| United Bank | 6,691,583 |

| Sector | Volume |

|---|---|

| Technology & Communication | 86,056,996 |

| Refinery | 57,951,962 |

| Textile Weaving | 45,835,000 |

| Miscellaneous | 45,022,900 |

| Commercial Banks | 33,669,684 |

| Food & Personal Care Products | 16,499,430 |

| Cement | 14,248,987 |

| Pharmaceuticals | 13,330,474 |

| Chemical | 10,135,160 |

| Power Generation & Distribution | 8,101,169 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction