PSX Closing Bell: Deadlock

MG News | March 03, 2022 at 05:16 PM GMT+05:00

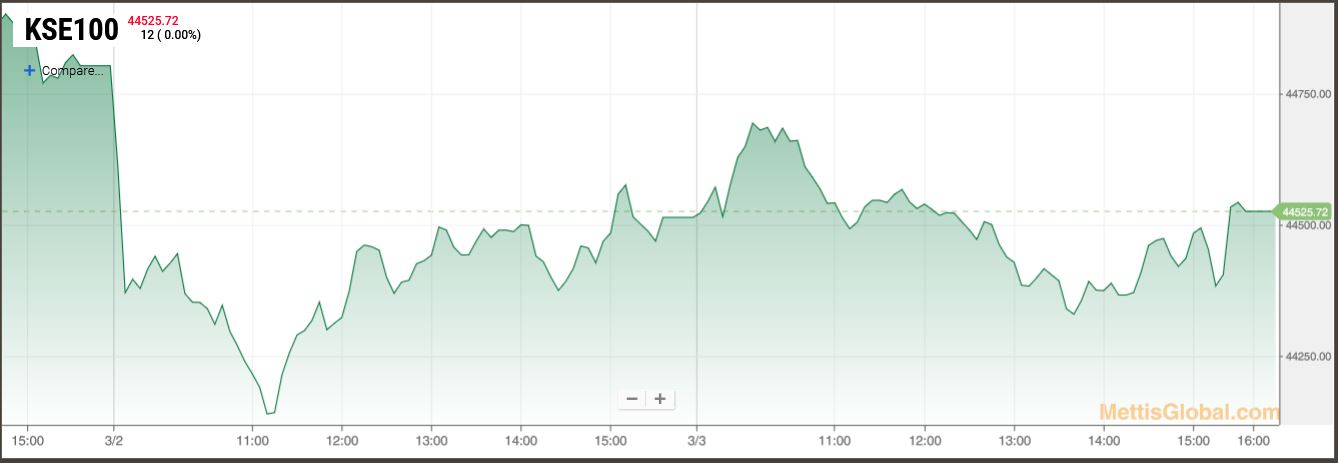

March 03, 2022 (MLN): A tug of war between the bulls and bears witnessed at local bourse today, with the indices moved both ways amid mixed trading activities until finally landing in green by gaining just 11 points i.e. around 0.03% higher than the previous session and closed at 44,525 mark.

Market opened under pressure as inflationary concerns arise due to higher fuel prices and overheated commodities cycle. However, in the last trading hour, value buying was observed mainly in the E&P sector, a closing note by Arif Habib Limited said.

Cement sector stayed in the red zone due to mounting international coal prices. Moreover, trade deficit declined for the third consecutive month in February, clocking in at $3.1 billion compared to a deficit of $3.4bn in the previous month.

The Index traded in a range of 393.72 points or 0.88 percent of previous close, showing an intraday high of 44,706.46 and a low of 44,312.74.

Of the 95 traded companies in the KSE100 Index 26 closed up 63 closed down, while 6 remained unchanged. Total volume traded for the index was 107.74 million shares.

Sectors propping up the index were Oil & Gas Exploration Companies with 132 points, Power Generation & Distribution with 22 points, Fertilizer with 13 points, Inv. Banks / Inv. Cos. / Securities Cos. with 9 points and Automobile Assembler with 4 points.

The most points added to the index was by PPL which contributed 53 points followed by POL with 41 points, OGDC with 31 points, HUBC with 26 points and UBL with 14 points.

Sector wise, the index was let down by Cement with 48 points, Technology & Communication with 18 points, Food & Personal Care Products with 14 points, Engineering with 12 points and Textile Composite with 12 points.

The most points taken off the index was by LUCK which stripped the index of 23 points followed by SYS with 19 points, MEBL with 18 points, PSO with 14 points and NESTLE with 11 points.

All Share Volume decreased by 46.37 Million to 188.67 Million Shares. Market Cap decreased by Rs.6.65 Billion.

Total companies traded were 358 compared to 354 from the previous session. Of the scrips traded 116 closed up, 209 closed down while 33 remained unchanged.

Total trades decreased by 21,524 to 99,935.

Value Traded decreased by 1.98 Billion to Rs.7.36 Billion

| Company | Volume |

|---|---|

| TRG Pakistan | 15,140,398 |

| Oil & Gas Development Company | 11,658,343 |

| Fauji Cement Company | 8,871,500 |

| Flying Cement(R) | 8,851,500 |

| K-Electric | 7,600,000 |

| Telecard | 7,293,324 |

| Unity Foods | 6,820,888 |

| Pakistan Petroleum | 6,786,944 |

| Dewan Farooque Motors | 6,259,500 |

| TPL Properties | 5,647,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 37,757,405 |

| Cement | 28,374,953 |

| Oil & Gas Exploration Companies | 19,103,493 |

| Food & Personal Care Products | 14,754,959 |

| Power Generation & Distribution | 12,359,092 |

| Commercial Banks | 9,408,261 |

| Chemical | 9,326,140 |

| Automobile Assembler | 6,938,464 |

| Engineering | 6,599,261 |

| Oil & Gas Marketing Companies | 6,550,259 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction