PSX Closing Bell: Crimson Tide

MG News | September 24, 2021 at 07:01 PM GMT+05:00

September 24, 2021 (MLN): The local bourse extended a bearish spell on Friday owing to the lack of positive triggers and a roll-over week.

The State Bank of Pakistan (SBP) has revised Prudential Regulations (PRs) for consumer financing to moderate imports and demand growth which has compelled investors to behave cautiously.

In addition, SBP has also asked commercial banks to provide information about imports worth $500,000. Prior to the revision, the banks had to submit information up to $1 million worth of imports.

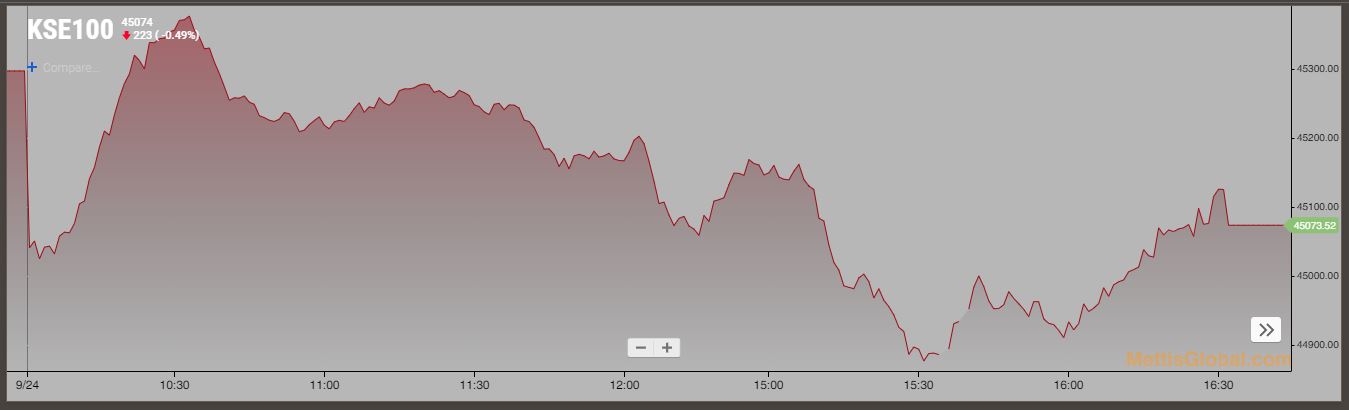

These events have significantly sidelined the investors’ interest and succumbed the trading floor into profit booking activity which resulted in the benchmark KSE-100 index losing 223.36 points to close at 45,073.52.

The Index traded in a range of 563.30 points or 1.24 percent of the previous close, showing an intraday high of 45,421.70 and a low of 44,858.40.

Of the 95 traded companies in the KSE100 Index 28 closed up 64 closed down, while 3 remained unchanged. Total volume traded for the index was 186.69 million shares.

Sector wise, the index was let down by Commercial Banks with 63 points, Cement with 61 points, Automobile Assembler with 27 points, Technology & Communication with 20 points and Textile Composite with 16 points.

The most points taken off the index was by TRG which stripped the index of 26 points followed by MCB with 26 points, CHCC with 19 points, INDU with 18 points and FFBL with 13 points.

Sectors propping up the index were Oil & Gas Exploration Companies with 25 points, Chemical with 22 points, Automobile Parts & Accessories with 8 points, Inv. Banks / Inv. Cos. / Securities Cos. with 5 points and Real Estate Investment Trust with 1 points.

The most points added to the index was by COLG which contributed 23 points followed by HUBC with 14 points, ENGRO with 13 points, OGDC with 12 points and AGP with 11 points.

All Share Volume decreased by 74.24 Million to 369.54 Million Shares. Market Cap decreased by Rs.41.43 Billion.

Total companies traded were 510 compared to 514 from the previous session. Of the scrips traded 146 closed up, 351 closed down while 13 remained unchanged.

Total trades decreased by 13,933 to 121,843.

Value Traded decreased by 0.60 Billion to Rs.11.78 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 39,708,500 |

| Unity Foods | 36,178,100 |

| Byco Petroleum Pakistan | 29,571,500 |

| Hum Network | 18,889,000 |

| K-Electric | 14,915,000 |

| Fauji Fertilizer Bin Qasim | 13,510,500 |

| Azgard Nine | 12,717,000 |

| Ghani Global Holdings | 11,757,000 |

| Treet Corporation | 9,855,500 |

| TRG Pakistan | 8,708,970 |

| Sector | Volume |

|---|---|

| Technology & Communication | 88,319,970 |

| Food & Personal Care Products | 56,152,010 |

| Refinery | 36,645,521 |

| Power Generation & Distribution | 19,841,362 |

| Chemical | 19,836,860 |

| Commercial Banks | 19,717,780 |

| Textile Composite | 17,997,850 |

| Cement | 15,455,511 |

| Fertilizer | 15,138,482 |

| Glass & Ceramics | 9,059,200 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction