PSX Closing Bell: Crank Up

By MG News | June 06, 2024 at 04:21 PM GMT+05:00

June 06, 2024 (MLN): Pakistan stocks extended their decline on Thursday, with the benchmark KSE-100 index losing 356.51 points or 0.48% to close at 73,862.93.

This takes the current week's decline to over 2,015 points or 2.7%. The sell-off comes amidst fears of an increase in Capital Gains Tax (CGT) or dividend tax in the upcoming budget for fiscal year 2024-25.

Economist Ali Khizar on social media platform X highlighted that the International Monetary Fund (IMF) has put forward stringent proposals for the fiscal year 2024-25 budget, leaving little room for government negotiation.

He stated, "The capital gains tax will likely be equalized to standard personal income (or corporate) income, as applicable, in the upcoming budget."

Additionally, Khizar said that income tax exemptions available on mutual funds and insurance products are likely to be eliminated.

Meanwhile, the highest bracket for personal income tax is likely to be at 45%, applicable to those earning over Rs500,000 per month.

Read: History shows CGT hikes don’t scare investors

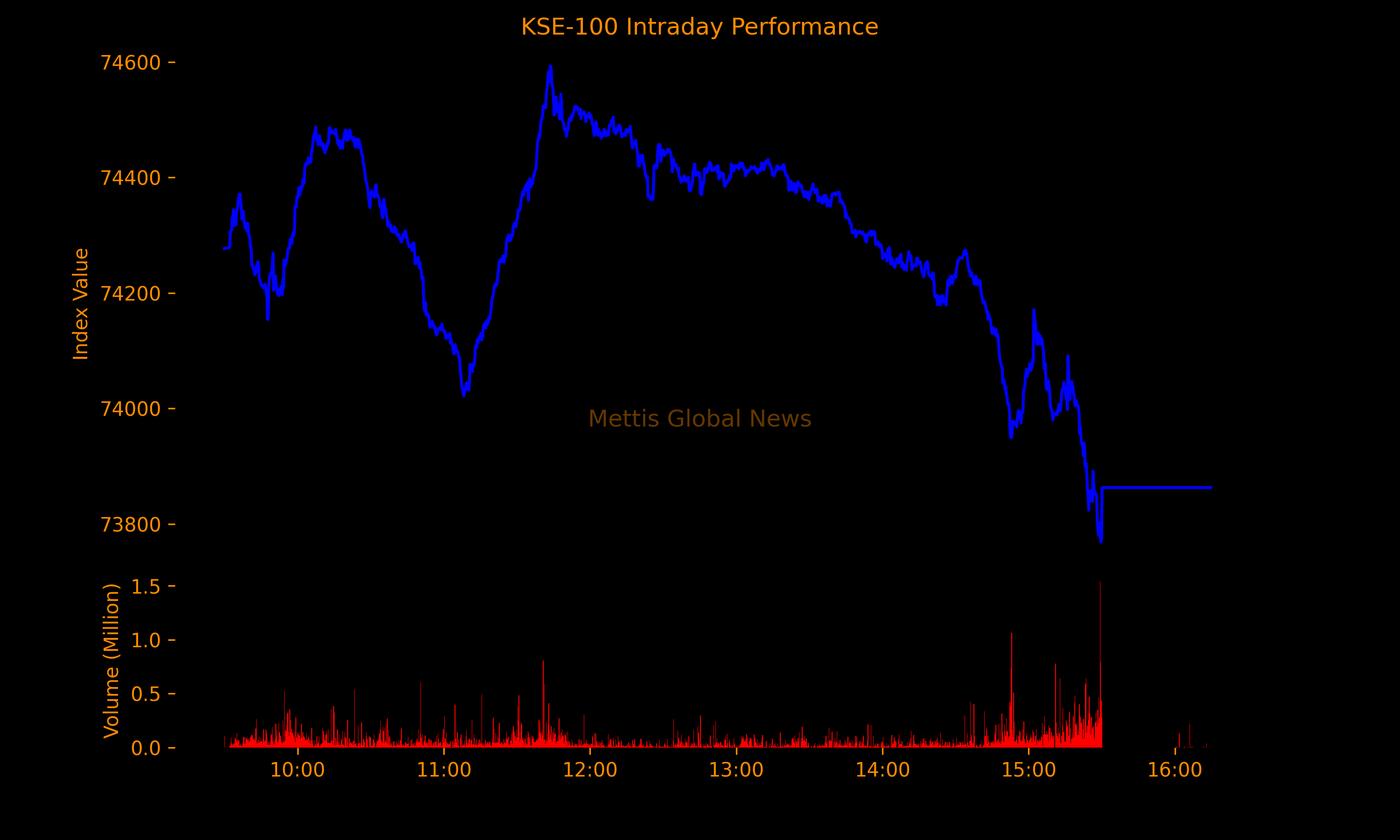

Throughout Thursday's trading session, the KSE-100 index traded in a range of 824.93 points showing an intraday high of 74,593.33 (+373.89) and a low of 73,768.40 (-451.04) points.

The total volume of the KSE-100 index was 112.79 million shares.

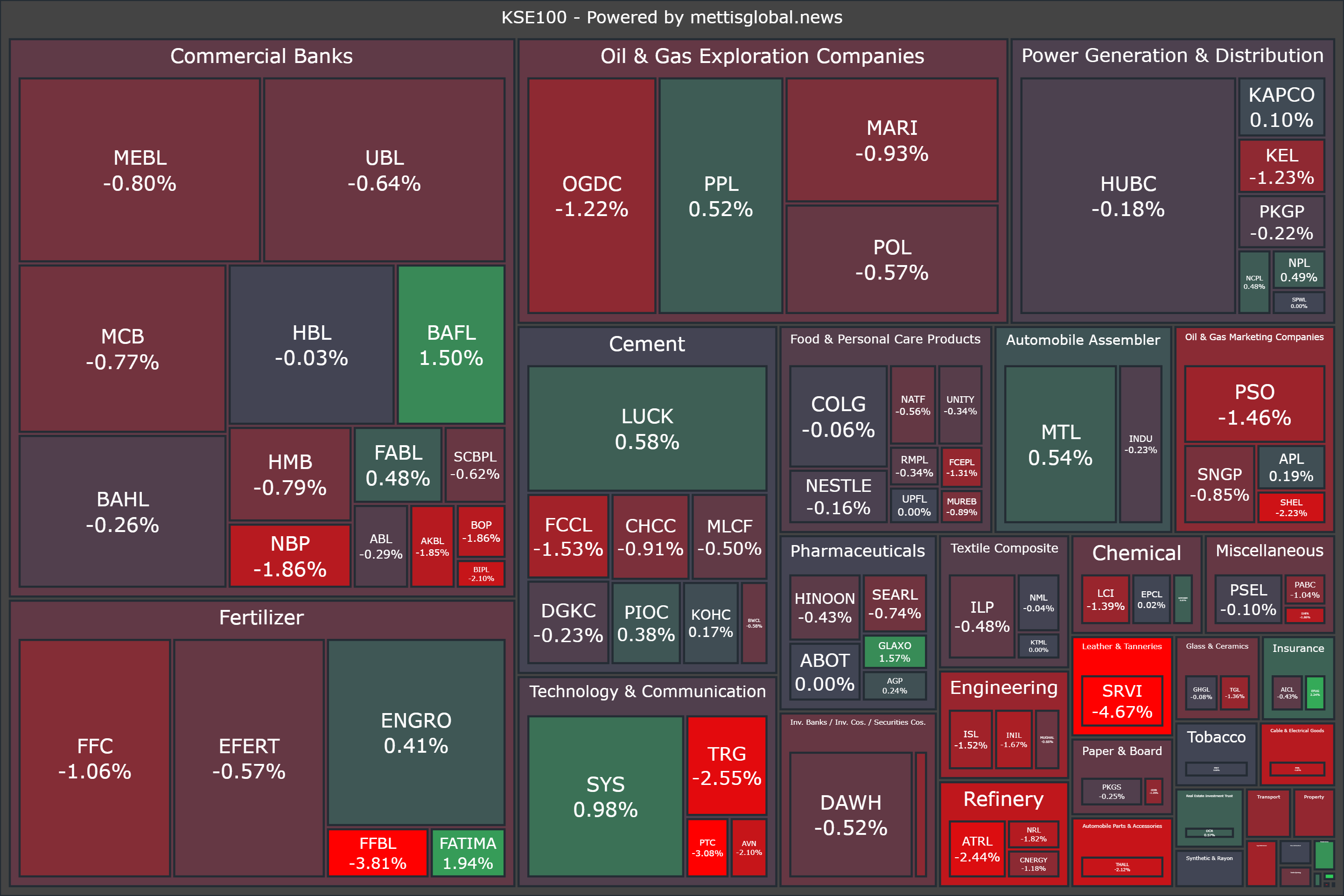

Of the 100 index companies 23 closed up, 69 closed down, while 8 were unchanged.

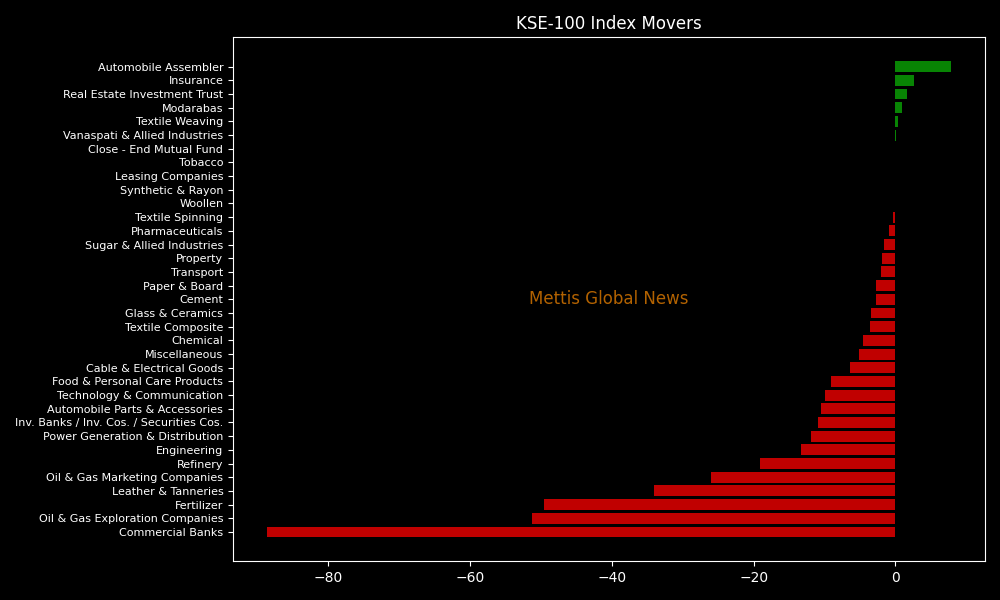

KSE-100 index was let down by Commercial Banks (88.6pts), Oil & Gas Exploration Companies (51.22pts), Fertilizer (49.53pts), Leather & Tanneries (34.02pts), and Oil & Gas Marketing Companies (25.97pts).

On the flip-side, the index was supported by Automobile Assembler (7.8pts), Insurance (2.67pts), Real Estate Investment Trust (1.59pts), Modarabas (0.86pts), and Textile Weaving (0.29pts).

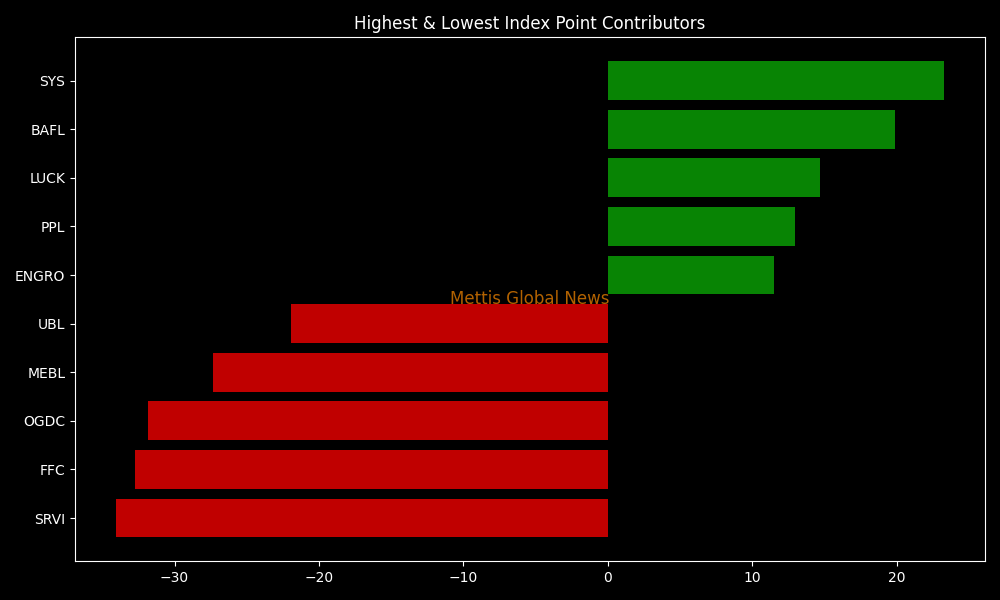

Companies that dragged the index lower were SRVI (34.02pts), FFC (32.74pts), OGDC (31.83pts), MEBL (27.36pts), and UBL (21.97pts).

On the other hand, companies that added points to the index were SYS (23.25pts), BAFL (19.88pts), LUCK (14.69pts), PPL (12.97pts), and ENGRO (11.53pts).

In the broader market, the All-Share index closed at 47,670.60 with a net loss of 292.10 points.

Total market volume was 352.74 million shares compared to 348.55m from the previous session while traded value was recorded at Rs12.31 billion showing a decrease of Rs4.09bn.

There were 191,137 trades reported in 449 companies with 134 closing up, 248 closing down and 67 remaining unchanged.

| Company | Volume |

|---|---|

| WTL | 17,606,340 |

| KOSM | 14,855,744 |

| DFML | 13,692,244 |

| FCCL | 12,072,224 |

| GGL | 11,128,153 |

| KEL | 11,072,894 |

| FFBL | 10,699,717 |

| PIAHCLA | 10,246,679 |

| GCIL | 9,917,672 |

| AMTEX | 9,552,983 |

To note, the KSE-100 has gained 32,410 points or 78.19% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 11,412 points, equivalent to 18.27%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,335.00 | 106,380.00 105,440.00 |

585.00 0.55% |

| BRENT CRUDE | 67.09 | 67.29 67.05 |

-0.02 -0.03% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.41 | 65.65 65.34 |

-0.04 -0.06% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI