PSX Closing Bell: Chains Shattered, Gains Gathered

MG News | December 09, 2024 at 04:00 PM GMT+05:00

December 09, 2024 (MLN): Bears broke free from their chains and initiated selling at the start of today’s trading session. However, the bulls had their reasons to step in, ultimately driving the index to yet another favorable close.

The benchmark KSE-100 Index concluded the trading session at 109,970.38, showing an increase of 916.43 points or 0.84%.

This marks the ninth consecutive daily rise of the stock market, taking the calendar year's returns to 76.09%, while for the fiscal year, they stand at 40.19%.

Last week, KSE-100 posted a gain of 7.59% or 7,697pts, the seventh addition to the rally and the highest weekly gain since April 2020, when it surged 12.49%.

In USD terms, the index recorded a remarkable rise of 7.61%, marking the highest USD percentage gain of this magnitude since last year.

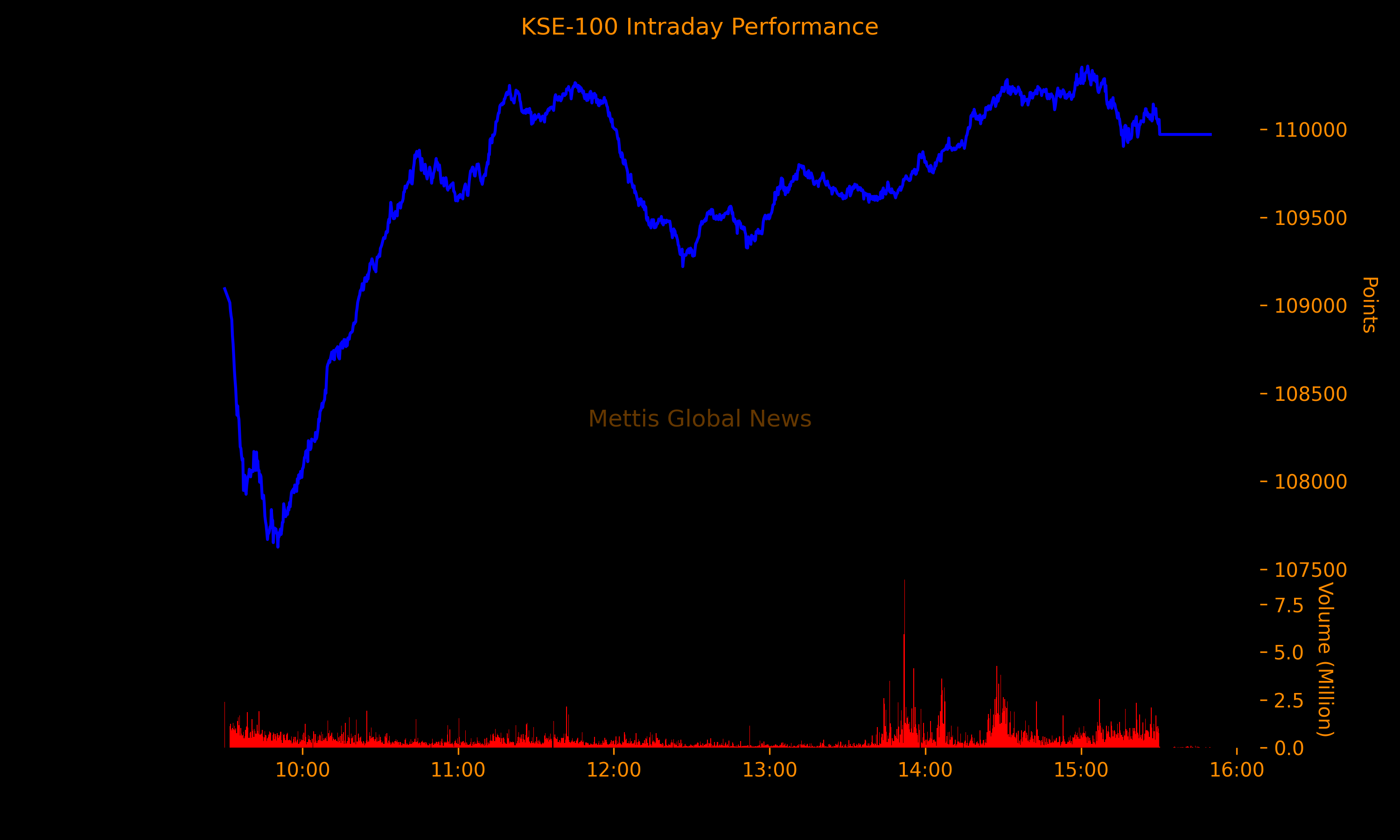

The index traded in a range of 2,732.94 points showing an intraday high of 110,358.85 (+1,304.90) and a low of 107,625.91 (-1,428.04) points.

The total volume of the KSE-100 Index was 719.55 million shares.

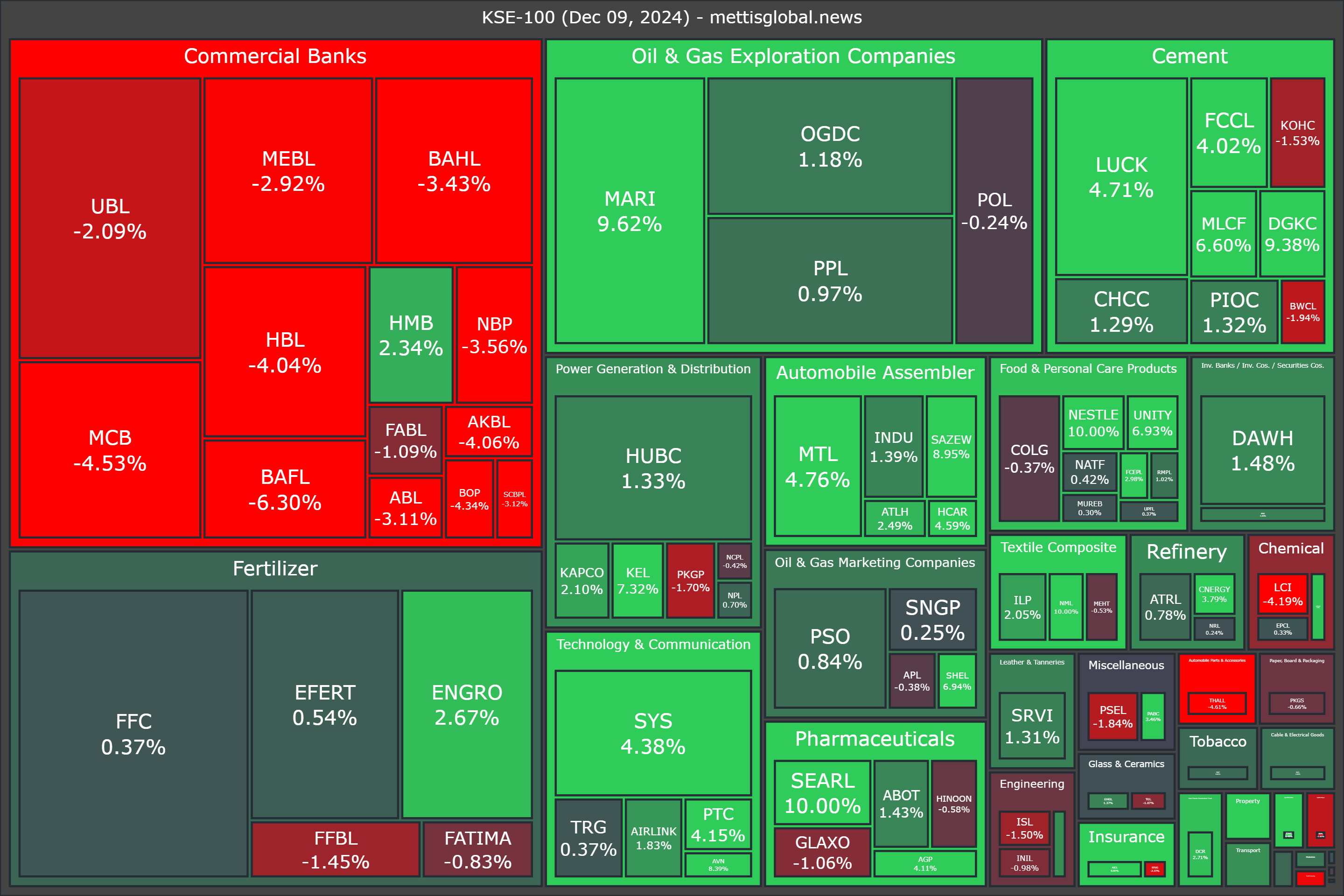

Of the 100 index companies 65 closed up, 35 closed down, while 0 were unchanged.

Top gainers during the day were NML (+10.00%), NESTLE (+10.00%), SEARL (+10.00%), AICL (+9.97%), and MARI (+9.62%).

On the other hand, top losers were BAFL (-6.30%), THALL (-4.61%), MCB (-4.53%), BOP (-4.34%), and LCI (-4.19%).

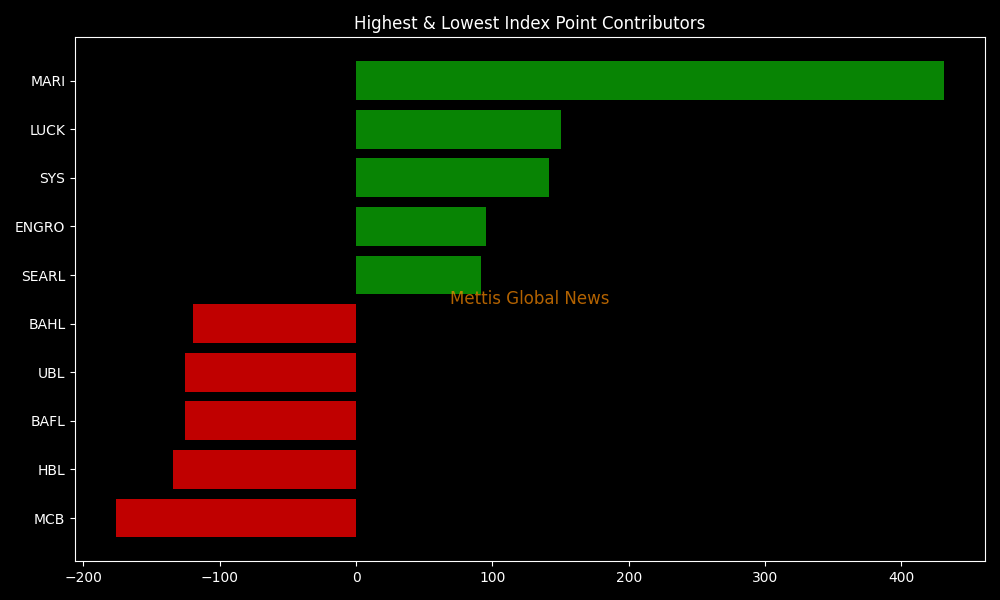

In terms of index-point contributions, companies that propped up the index were MARI (+431.05pts), LUCK (+150.26pts), SYS (+141.79pts), ENGRO (+95.11pts), and SEARL (+91.65pts).

Meanwhile, companies that dragged the index lower were MCB (-175.80pts), HBL (-134.57pts), BAFL (-125.32pts), UBL (-125.23pts), and BAHL (-119.64pts).

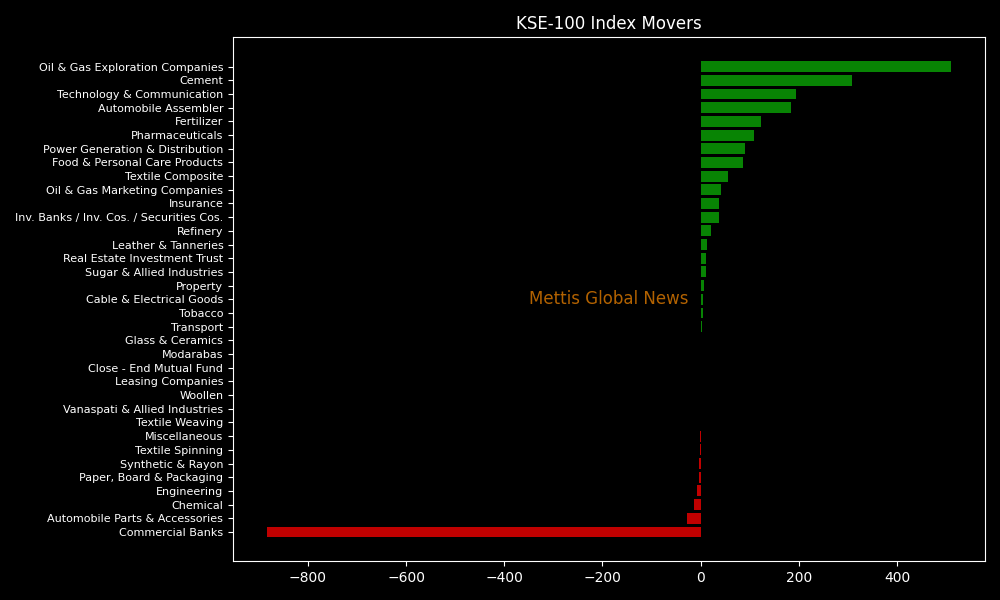

Sector-wise, KSE-100 Index was supported by Oil & Gas Exploration Companies (+509.71pts), Cement (+308.92pts), Technology & Communication (+195.13pts), Automobile Assembler (+183.61pts), and Fertilizer (+122.61pts).

While the index was let down by Commercial Banks (-883.27pts), Automobile Parts & Accessories (-28.23pts), Chemical (-13.85pts), Engineering (-6.65pts), and Paper, Board & Packaging (-3.75pts).

Commercial banks faced a negative slide today after the government announced the formation of a high-level committee to address the Advances-to-Deposit Ratio (ADR) issue.

The committee's Terms of Reference (ToRs) include a thorough review of the existing legal framework governing fiscal measures related to ADR.

It will explore alternative tax schemes targeting bank profits derived from investments in government securities, aiming to ensure equitable revenue generation.

In the broader market, the All-Share Index closed at 69,584.95 with a net gain of 856.31 points or 1.25%.

Total market volume was 1,597.87 million shares compared to 1,697.84m from the previous session while traded value was recorded at Rs60.25 billion showing an increase of Rs2.76bn.

There were 546,301 trades reported in 466 companies with 278 closing up, 157 closing down, and 31 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KEL | 6.16 | 7.32% | 164,514,973 |

| WTL | 1.83 | 4.57% | 161,906,262 |

| CNERGY | 7.13 | 3.79% | 113,022,299 |

| BOP | 10.37 | -4.34% | 69,102,443 |

| TELE | 9.9 | 11.24% | 53,532,581 |

| HASCOL | 15.01 | 6.15% | 48,408,477 |

| POWER | 9.61 | 1.37% | 39,075,852 |

| TPLP | 12.74 | 8.98% | 38,491,391 |

| PAEL | 35.1 | 1.04% | 37,152,308 |

| GGL | 14.76 | 9.99% | 31,252,731 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction