PSX Closing Bell: A Muddy Road

By MG News | December 06, 2021 at 05:57 PM GMT+05:00

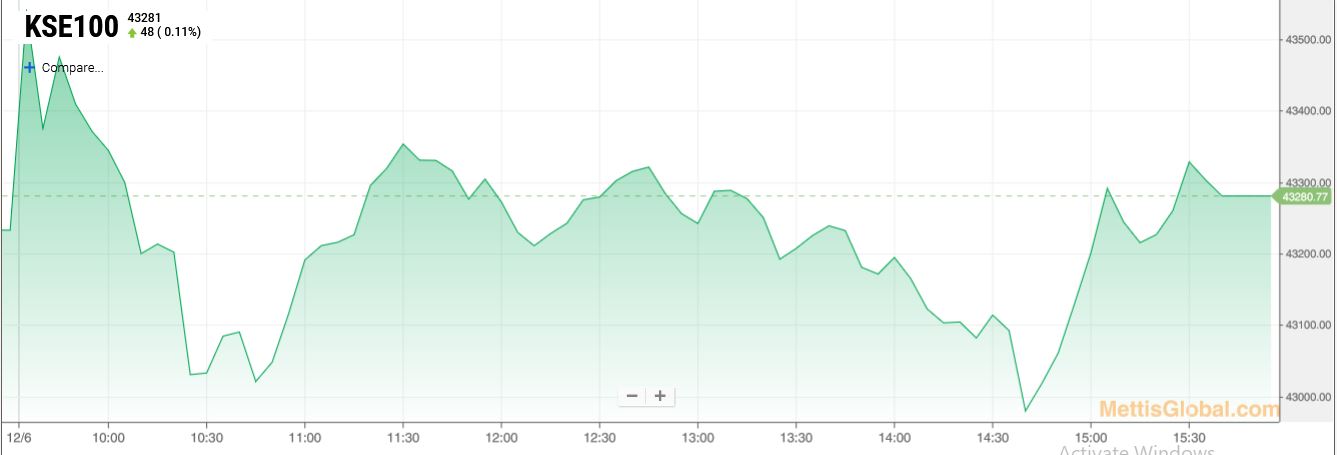

December 6, 2021 (MLN): The benchmark KSE-100 remained range bound today due to lack of fresh triggers. However, it managed to close in green by gaining only 48 points and ended the trading at 43,281 points, as investors welcomed the arrival of $3bn deposit from Saudi which is likely to give some support to the country’s FX reserves and depreciating local currency.

The index traded in a range of 579.80 points or 1.34 percent of previous close, recording an intraday high of 43,556.27 (up 323pts) during initial hours of trade. It then fell to day’s low of 42,972, losing 261 pts falling below the 43,000 mark.

Of the 91 traded companies in the KSE100 Index 36 closed up 51 closed down, while 4 remained unchanged. Total volume traded for the index was 74.06 million shares.

Sectors propping up the index were oil & gas exploration companies with 124 points, technology & communication with 83 points, power generation & distribution with 26 points, chemical with 10 points and cement with 8 points.

The most points added to the index was by PPL which contributed 60 points followed by SYS with 46 points, TRG with 36 points, POL with 32 points and OGDC with 20 points.

Sector wise, the index was let down by commercial banks with 75 points, fertilizer with 40 points, food & personal care products with 24 points, textile composite with 17 points and engineering with 13 points.

The most points taken off the index was by UBL which stripped the index of 35 points followed by HBL with 32 points, ENGRO with 19 points, NML with 19 points and FFC with 13 points.

All share volume decreased by 110.82 million to 176.91 million shares. Market cap increased by Rs.4.25 billion.

Total companies traded were 314 compared to 330 from the previous session. Of the scrips traded 122 closed up, 175 closed down while 17 remained unchanged.

Total trades decreased by 29,058 to 90,039.

Value traded decreased by 4.20 billion to Rs.6.08 billion

|

Company |

Volume |

|---|---|

|

Worldcall Telecom |

16,586,500 |

|

Telecard |

12,574,500 |

|

TRG Pakistan |

11,192,124 |

|

Unity Foods |

10,481,742 |

|

Hascol Petroleum |

10,146,645 |

|

Treet Corporation |

9,971,500 |

|

K-Electric |

7,561,000 |

|

Byco Petroleum Pakistan |

7,160,000 |

|

TPL Properties |

6,794,000 |

|

Ghani Global Holdings |

5,060,000 |

|

Sector |

Volume |

|---|---|

|

Technology & Communication |

49,124,999 |

|

Food & Personal Care Products |

26,409,062 |

|

Oil & Gas Marketing Companies |

14,089,604 |

|

Refinery |

10,733,815 |

|

Power Generation & Distribution |

10,236,916 |

|

Miscellaneous |

8,793,500 |

|

Commercial Banks |

8,061,714 |

|

Chemical |

6,853,470 |

|

Cement |

5,695,464 |

|

Textile Composite |

5,232,950 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,455.00 | 106,490.00 105,440.00 |

705.00 0.67% |

| BRENT CRUDE | 67.14 | 67.29 67.05 |

0.03 0.04% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.46 | 65.65 65.34 |

0.01 0.02% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI