PSX Closing Bell: A Journey in the Dark

MG News | June 21, 2022 at 05:11 PM GMT+05:00

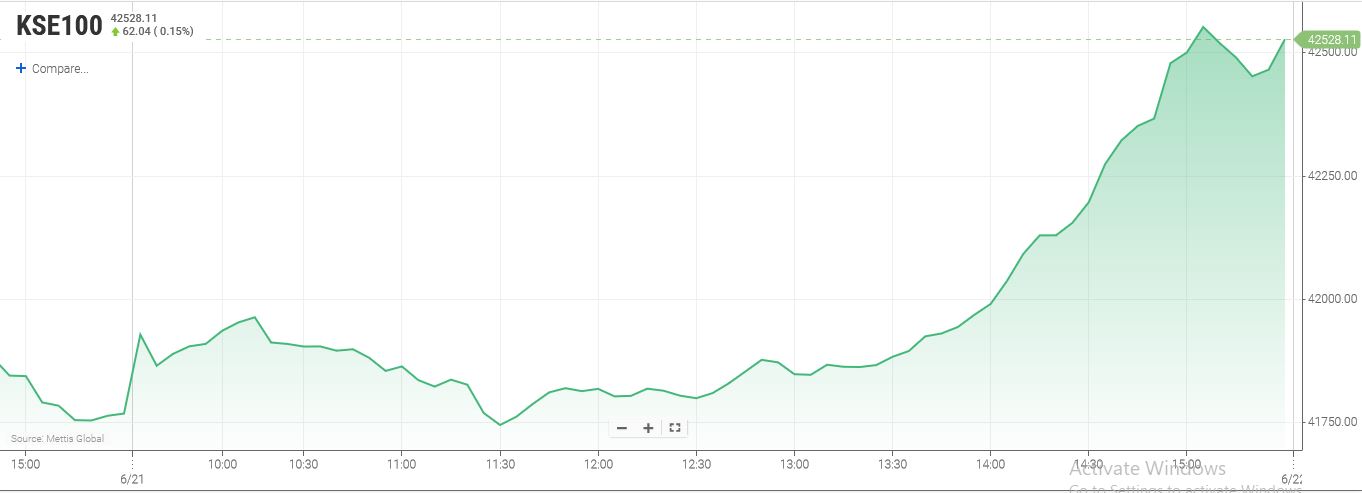

June 21, 2022 (MLN): Taking cues from the government on resumption hopes of the International Monetary Fund (IMF) program in a day or two, bulls tightened their grip on Pakistan Stock Exchange as KSE-100 Index gained 748.97 points to close at 42,525.95-mark.

The discussion between Pakistan and the IMF for the resumption of the loan program is expected to start tonight, official sources from Finance Ministry told.

After the removal of subsidies on petroleum products, the government is expecting a positive breakthrough from IMF.

The Index traded in a range of 824.06 points or 1.97 percent of the previous close, showing an intraday high of 42,569.33 and a low of 41,745.27.

Of the 95 traded companies in the KSE100 Index 82 closed up 10 closed down, while 3 remained unchanged. Total volume traded for the index was 135.28 million shares.

Sectors propping up the index were Technology & Communication with 137 points, Oil & Gas Exploration Companies with 95 points, Cement with 86 points, Commercial Banks with 76 points and Fertilizer with 72 points.

The most points added to the index was by SYS which contributed 65 points followed by TRG with 57 points, LUCK with 33 points, MARI with 32 points and FFC with 32 points.

Sector wise, the index was let down by Real Estate Investment Trust with 1 points and Textile Spinning with 1 points.

The most points taken off the index was by UBL which stripped the index of 14 points followed by MUREB with 3 points, IGIHL with 3 points, AKBL with 2 points and DCR with 1 point.

All Share Volume increased by 138.48 Million to 300.59 Million Shares. Market Cap increased by Rs.98.39 Billion.

Total companies traded were 341 compared to 318 from the previous session. Of the scrips traded 268 closed up, 49 closed down while 24 remained unchanged.

Total trades increased by 46,264 to 126,292.

Value Traded increased by 4.56 Billion to Rs.9.47 Billion

| Company | Volume |

|---|---|

| TPL Properties | 23,685,957 |

| Pakistan Refinery | 20,652,776 |

| Cnergyico PK | 17,865,120 |

| Hum Network | 15,723,500 |

| Unity Foods | 15,404,477 |

| Worldcall Telecom | 11,860,000 |

| Telecard | 10,015,000 |

| Pak Elektron | 8,153,500 |

| Ghani Global Holdings | 8,143,359 |

| G3 Technologies | 7,806,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 60,184,471 |

| Refinery | 42,472,925 |

| Miscellaneous | 25,012,057 |

| Food & Personal Care Products | 24,551,457 |

| Chemical | 23,853,878 |

| Cement | 19,662,221 |

| Commercial Banks | 19,543,634 |

| Oil & Gas Marketing Companies | 13,348,971 |

| Power Generation & Distribution | 12,729,334 |

| Cable & Electrical Goods | 9,592,100 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction