Potential sale: Fauji Meat Limited to be acquired by a potential acquirer

MG News | October 29, 2019 at 04:35 PM GMT+05:00

October 29, 2019 (MLN): Fauji Fertilizer Bin Qasim Limited (FFBL) has been approached by a potential acquirer that has expressed its intention to enter into negotiations or discussion with the company for the proposed acquisition of majority voting shares in FFBL’s subsidiary, Fauji Meat Limited (FML).

FML was incorporated in 2013 as a subsidiary of FFBL, owns the largest and most technologically advanced slaughtering plant, having the capacity of 200 tons of meat (170 tons beef and 30 tons mutton) in both Frozen and chilled categories. The plant is spread over 47 acres of land with animal holding capacity of 800 for cattle and 400 for sheep and goat.

With regards to holdings, FFBL holds 83% stake in FML while the remaining 17% is with Fauji Foundation. The company has commenced its commercial operations during the first quarter of 2017.

According to a research note by Foundation Securities, FML has an asset size of Rs 8.2 billion out of which Rs 6.6 billion is of Plant and Machinery while Cost on FFBL’s book is Rs3.7 billion.

For exports, the company has built an ecosystem of over 22 countries in a short span of 5 years. Recently, it started to cater the domestic market under the brand name of “Zabeeha”.

In 1HCY19, FML has recorded sales of Rs 1.1 billion, up 219% YoY. However, its profitability remained in red with a net loss of Rs 683mn (contribution in FFBL: LPS of Rs0.61/sh) mainly due to low volume operations causing less absorption of fixed cost, says the report.

However, it is too early to evaluate the impact of this acquisition on FFBL, as the clarity regarding the purchase price of FML is ambiguous, but improvement in core business would unleash the potential of diversification drive, the report added.

In addition, better positioning of local manufacturers both in DAP and Urea amid improved farmer agronomics would allow them to charge higher prices acquisition.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

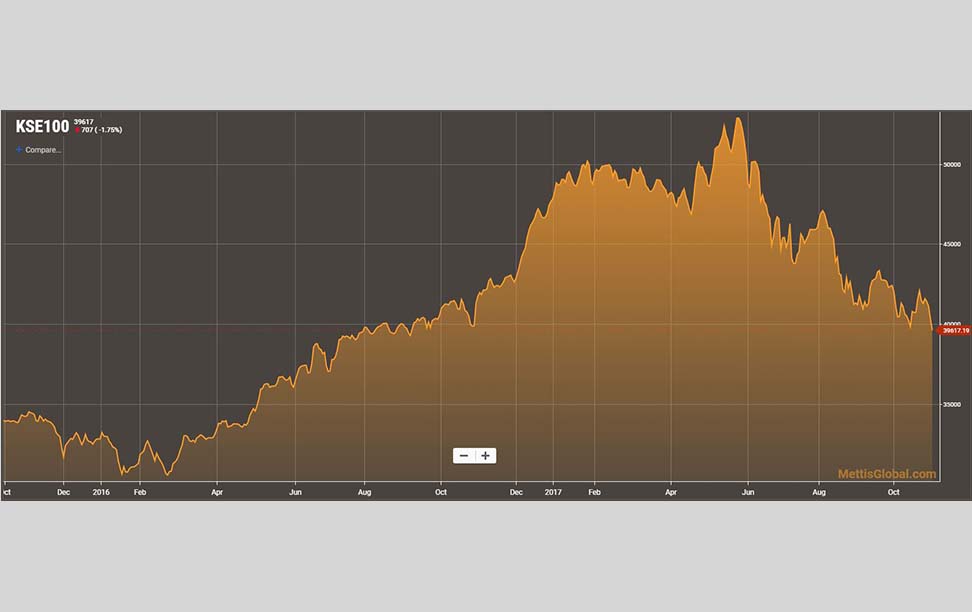

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction