Policy effectiveness will be key for emerging markets as debt burdens rise: Moody’s

MG News | September 01, 2020 at 11:40 AM GMT+05:00

September 1, 2020: Moody's Investors Service says in a new report that debt burdens of the 19 large emerging market sovereigns (EM19) will remain higher than pre-pandemic levels over the next few years, with policy credibility and buffers to drive credit quality in coming years.

"We expect government debt in the EM19 to rise by almost 10 percentage points of GDP on average by the end of 2021 from 2019 levels, driven primarily by wider primary deficits, although some are also likely to see higher interest payments contributing to higher debt," says Christian Fang, a Moody's Assistant Vice President and Analyst.

Government debt in Brazil (Ba2 stable), India (Baa3 negative) and South Africa (Ba1 negative) will rise to among the highest levels across the EM19, above 80% of GDP by 2021. While the weakening in debt affordability will be generally modest, it will deteriorate from already weak levels for India, Indonesia (Baa2 stable) and South Africa.

Beyond the immediate shock, exposure to commodities, tourism and sectors vulnerable to lasting changes in behaviors, as well as weak global demand and productivity growth pose medium-term risks for some EM19 countries. For India, Mexico (Baa1 negative), South Africa and Turkey (B1 negative), fragile financial systems and/or contingent liabilities will compound this risk.

Credit differentiation will be determined by the effectiveness of policies to adjust to longer-term shifts, and the availability of deep and stable financing sources to anchor borrowing costs. Moody's expects growth, in general, will rebound and primary deficits will narrow over the next few years. But Chile (A1 negative), Indonesia, Mexico, Romania (Baa3 negative), Saudi Arabia (A1 negative), South Africa, and Turkey face significant policy challenges, as growth increases and falling deficits prove insufficient to stabilize debt burdens, much less reverse them.

The ability to tap sovereign wealth assets and domestic savings to support domestic demand or counter the effects of wider primary deficits can help mitigate the deterioration in credit quality for some of the EM19 sovereigns.

Moody’s

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,605.00 | 118,705.00 117,905.00 | 985.00 0.84% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.35 | 70.37 70.18 | 0.35 0.50% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

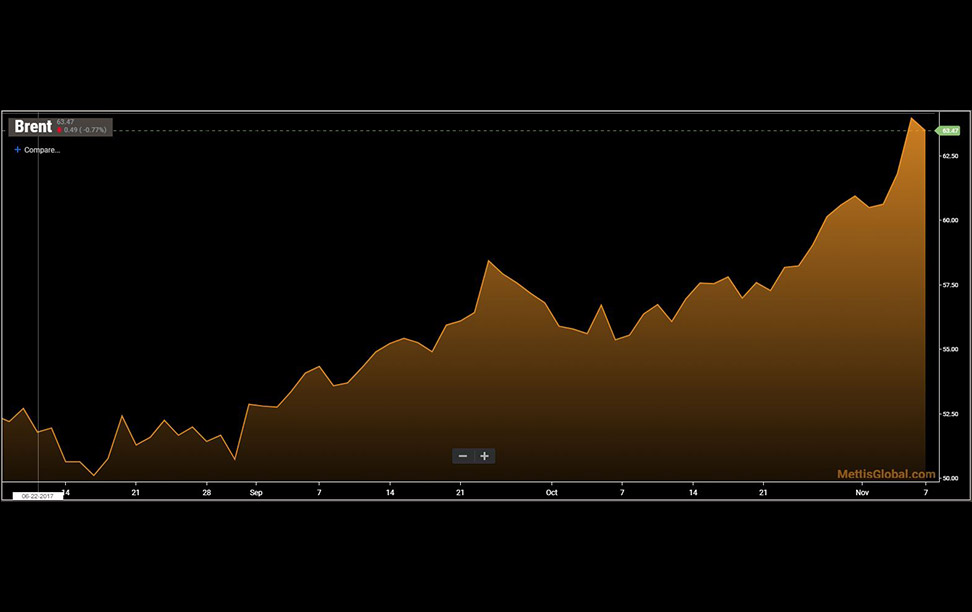

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|