PKR slides by 24 paisa against USD

MG News | February 24, 2022 at 04:14 PM GMT+05:00

February 24, 2022 (MLN): Enduring a topsy-turvy journey, the Pakistani rupee (PKR) has lost 24 paisa against the greenback in today's interbank session as the currency closed the trade at PKR 176.39.

On Wednesday, PKR had settled the trade at 176.16 per USD after gaining 7 paisa.

The rupee witnessed a volatile session, trading in a range of 70 paisa per USD observing an intraday high bid of 176.85 and an intraday low offer of 176.25.

Nothing much to add as pressure on PKR to stay, as oil prices are once again on the up due to ongoing Russia/Ukraine tension, Asad Rizvi, the former Treasury Head at Chase Manhattan said.

“Meanwhile, forward swaps have surged & against last week, 6-months is up by 40 paisa plus,” he noted.

The deteriorating situation between Russia and Ukraine has badly hit the currency markets as well. With regards to PKR, the situation in terms of rising oil prices will badly hurt the local unit’s value in the coming days as brent oil surged to $100 a barrel for the first time since 2014.

Meanwhile, the local unit has lost Rs18.84 against the USD from July’21 to date, Whereas, the rupee appreciated by 0.12 paisa in CY22, with the month-to-date (MTD) position showing a gain of 0.18%, as per data compiled by Mettis Global.

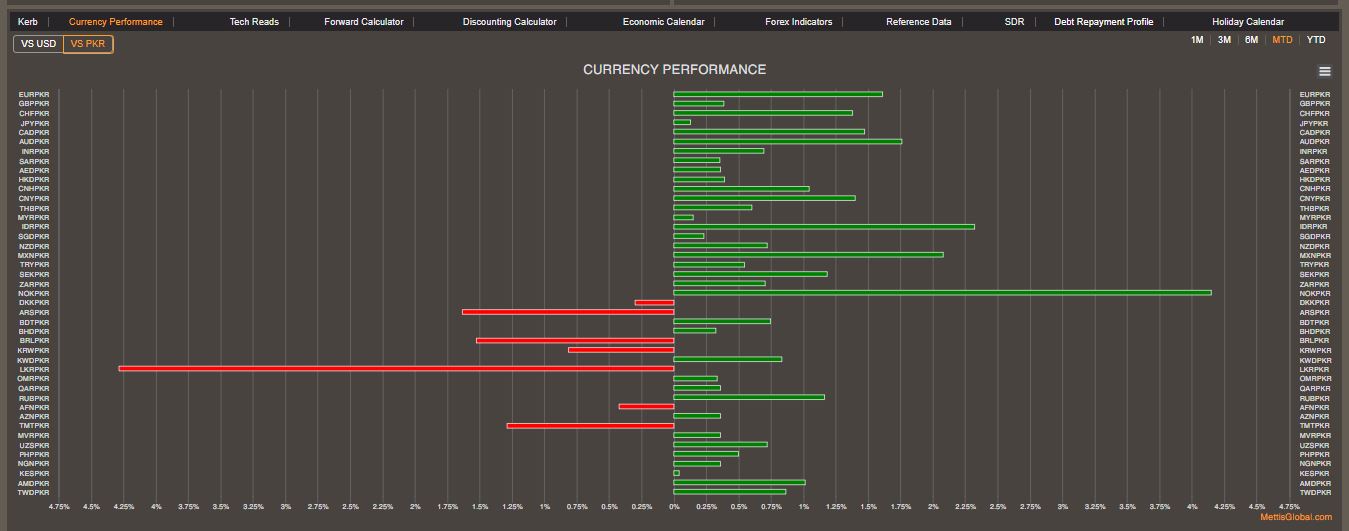

The month to date performance of PKR remained comparatively better against major currencies as the local unit appreciated by 1.75%, 1.61%, 1.47%, 1.37%, 1.39%, 0.38%, and 0.35% against AUD, EUR, CAD, CHF, CNY, GBP, and SAR, respectively.

Within the open market, PKR was traded at 176.70/177.60 per USD.

Alternatively, the currency gained 2.3 rupees against the Pound Sterling as the day's closing quote stood at PKR 237.42 per GBP, while the previous session closed at PKR 239.71 per GBP.

Similarly, PKR's value strengthened by 1.4 rupees against EUR which closed at PKR 198.36 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 9.70/9.90 percent, whereas the 1-week rate was 9.85/9.95 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,835.00 | 120,695.00 116,090.00 |

-3400.00 -2.83% |

| BRENT CRUDE | 68.83 | 69.41 68.60 |

-0.38 -0.55% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.69 | 67.13 66.22 |

-0.29 -0.43% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|