PKR on losing spree, closes at 224.37 per USD

Nilam Bano | December 08, 2022 at 04:59 PM GMT+05:00

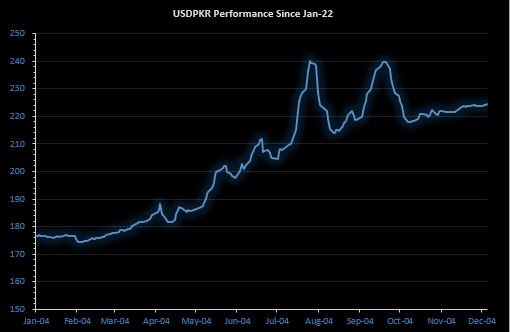

December 08, 2022 (MLN): Drip by drip, the Pakistani rupee (PKR) is losing its ground on rising economic woes as the local unit has depreciated by 21 paisa against the US dollar in today's interbank session to settle the trade at PKR 224.37 per USD, compared to yesterday's closing of PKR 224.16 per USD.

During the session, the rupee traded in a band of 10 paisa per USD showing an intraday high bid of 224 and low offer of 224.15 while in the open market, PKR was traded at 229.70/232 per USD.

It was the fourth consecutive session of the week wherein the local unit remained under pressure mainly due to depressing macros, and melting foreign exchange reserves.

However, the depreciation is not sharp and the rupee is considered fairly stable in the interbank.

The central bank is managing flows through administrative measures. However, in the unofficial market, the rate is over 250, Fahad Rauf Head of Research at Ismail Iqbal Securities noted.

This gap is not sustainable and needs to be addressed, as it impacts our remittances, he added.

In FYTD, PKR lost 19.52 rupees or 8.70%, while it plummeted by 47.85 rupees or 21.33% against the USD in CYTD, as per data compiled by Mettis Global.

Meanwhile, the currency lost 1.5 rupees to the Pound Sterling as the day's closing quote stood at PKR 273.52 per GBP, while the previous session closed at PKR 272.04 per GBP.

Similarly, PKR's value weakened by 1.4 rupees against EUR which closed at PKR 235.91 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO) today, in which it injected Rs139.85 billion into the market for 1 day at 16.23%.

The overnight repo rate towards the close of the session was 16.00/16.50%, whereas the 1-week rate was 15.95/16.05%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction