PKR falls by 31 paisa against USD

MG News | March 30, 2022 at 04:56 PM GMT+05:00

March 30, 2022 (MLN): While extending its losing journey, the Pakistani rupee (PKR) has further depreciated by 31 paisa against US dollar on Wednesday in the interbank session as the currency closed the trade at its all-time new low of PKR 182.64.

On Tuesday, the local unit had settled the trade at PKR 182.34 per USD.

The rupee traded in a range of 45 paisa per USD showing an intraday high bid of 182.75 and an intraday low offer of 182.30.

The local unit has been witnessing a free fall for so long mainly due to the heated environment of politics on the domestic front, the war between Russia and Ukraine, volatility in international commodity prices, inflationary threats, and a substantial decline in forex reserve.

The interbank market is expected to remain shaky and nervous until the dust settles. This means the market will ignore the ups and downs of the economy, Asad Rizvi, the former Treasury Head at Chase Manhattan said in his early morning Tweet.

Data will not provide any firm guidance, as all funding and receivables in the pipeline could be delayed because of uncertain conditions, he added.

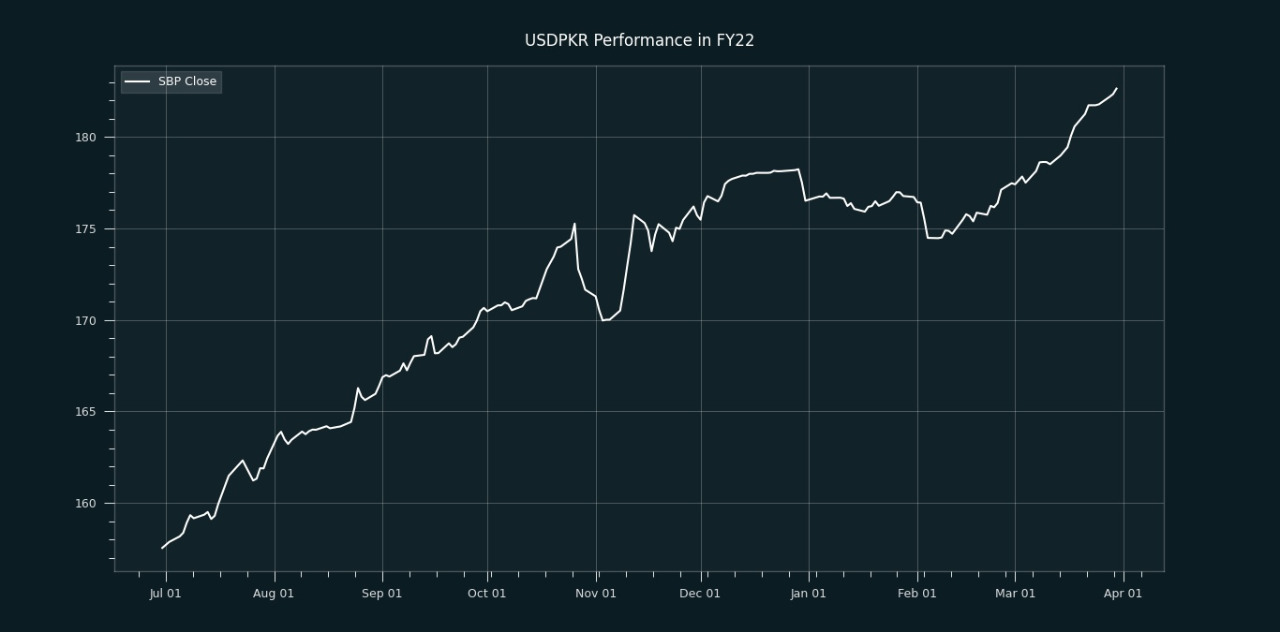

From July’21 to date, the local unit has lost Rs25.09 against the USD. Similarly, the rupee fell by PKR6.12 in CY22, with the month-to-date (MTD) position showing a decline of 2.83%, as per data compiled by Mettis Global.

Within the open market, PKR was traded at 183/184 per USD.

Meanwhile, the currency lost 61 paisa to the Pound Sterling as the day's closing quote stood at PKR 239.67 per GBP, while the previous session closed at PKR 239.06 per GBP.

Similarly, PKR's value weakened by 2.5 rupees against EUR which closed at PKR 203.19 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 9.50/10.00 percent, whereas the 1-week rate was 10.05/10.15 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction