PKR falls by 30 paisa in interbank market

MG News | February 15, 2022 at 04:14 PM GMT+05:00

February 15, 2022 (MLN): Continuing its downward slide, the Pakistani rupee (PKR) lost further ground by 30 paisa against the US dollar in today's interbank session as the currency closed the trade at PKR 175.78 per USD.

On Monday, the local unit had registered a notable decline of 77 paisa to settle at PKR 175.47 per USD.

The rupee traded in a range of 45 paisa per USD showing an intraday high bid of 175.90 and an intraday low offer of 175.55.

The domestic unit is under the severe pressure of trade deficit and rising commodity prices amid the ongoing tussle between Russia and Ukraine which has disrupted the world commodity and stock markets.

According to Asad Rizvi, the former Treasury Head at Chase Manhattan, emerging market currencies are under pressure due to uncertainty caused by geopolitical anxiety which has shifted the interest towards safe-haven assets.

Soaring oil prices and an increase in demand is hurting consumers' wallets badly which will keep the local currency under stress, he added.

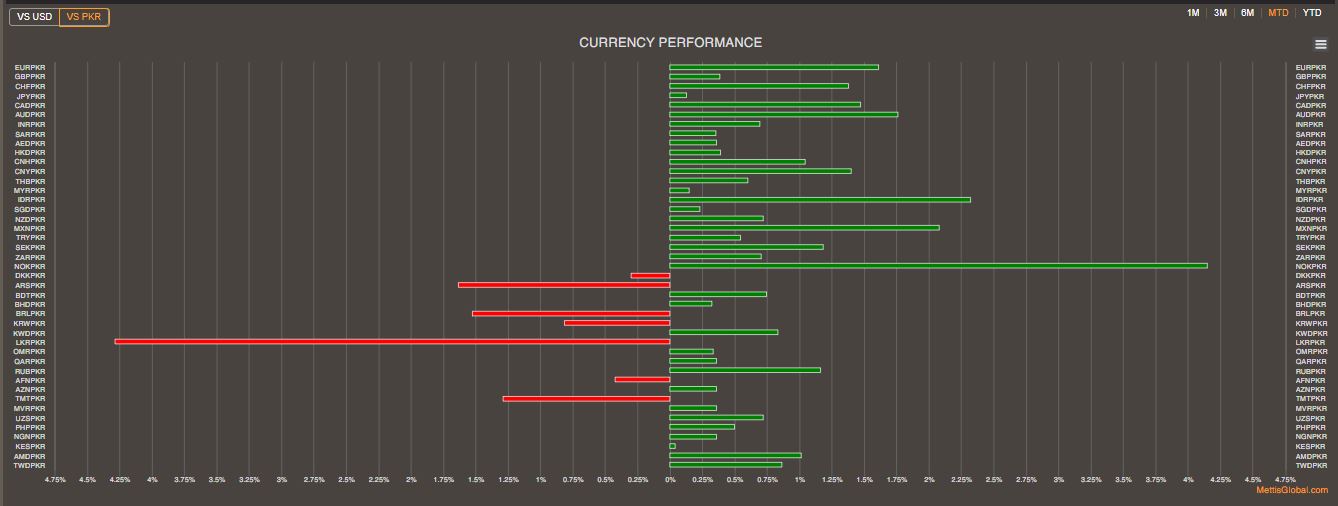

Meanwhile, the local unit has lost Rs18.23 against the USD from July’21 to date, Whereas, the rupee appreciated by PKR 0.73 paisa in CY22, with the month-to-date (MTD) position showing a gain of 0.53%, as per data compiled by Mettis Global.

The month to date performance of PKR remained comparatively better against major currencies as the local unit appreciated by 1.75%, 1.61%, 1.47%, 1.37%, 1.39%, 0.38%, and 0.35% against AUD, EUR, CAD, CHF, CNY, GBP, and SAR, respectively.

Within the open market, PKR was traded at 177.20/178.20 per USD.

The currency lost 1.3 rupees to the Pound Sterling as the day's closing quote stood at PKR 238.3 per GBP, while the previous session closed at PKR 237.05 per GBP.

Similarly, PKR's value weakened by 91 paisa against EUR which closed at PKR 199.44 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 10.05/10.15 percent, whereas the 1-week rate was 9.85/9.95 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,968.50 201.65M | -0.06% -105.23 |

| ALLSHR | 103,095.60 548.55M | -0.02% -24.58 |

| KSE30 | 52,227.68 83.45M | -0.02% -9.82 |

| KMI30 | 243,361.54 40.78M | -0.14% -344.21 |

| KMIALLSHR | 66,863.25 179.83M | -0.09% -57.42 |

| BKTi | 47,426.19 53.84M | -0.02% -8.90 |

| OGTi | 33,363.69 4.42M | 0.69% 227.68 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 86,825.00 | 87,795.00 86,705.00 | -860.00 -0.98% |

| BRENT CRUDE | 62.67 | 62.72 62.20 | 0.29 0.46% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 2.40 2.71% |

| ROTTERDAM COAL MONTHLY | 96.45 | 96.65 96.35 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.69 | 58.72 58.22 | 0.31 0.53% |

| SUGAR #11 WORLD | 15.17 | 15.24 14.96 | 0.18 1.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Disbursement Report of Foreign Economic Assistance

Disbursement Report of Foreign Economic Assistance