PKR closes all-time low of 168.94 per USD

MG News | September 14, 2021 at 05:30 PM GMT+05:00

September 14, 2021 (MLN): Witnessing a slash of 84 paisa, the Pakistani Rupee (PKR) came down to an all-time low at 168.94 per USD in today’s interbank session.

On Monday, the local unit had closed at PKR 168.10 against the greenback.

The widening trade deficit, deteriorating current account balance and geo-strategic situation pertaining to Afghanistan have plummeted the value of PKR in the interbank market.

The above-mentioned macros have offset the impact of workers’ remittances that have maintained a strong trend, reaching $2.66 billion in August 2021.

Speaking to Mettis Global lately, Zafar Paracha, Secretary-General Exchange Companies Association of Pakistan said, “Late payments against Pakistan’s export to Afghanistan has created pressure over the rupee.”

Expressing his concern over the rising value of the dollar, Asad Rizvi, the Former Treasury Head at Chase Manhattan recently said through his social media account that the widening gap between Inter Bank and Open Market Rate will create serious repercussions including inflationary pressure.

“Rupee should not be allowed to dip below 170-175 levels,” he added.

Throughout the session, the rupee moved within the range of 70 paisa per USD, showing an intraday high bid of 169 and an intraday Low offer of 168.30.

Within the Open Market, PKR was traded at 168.80/169.80 per USD.

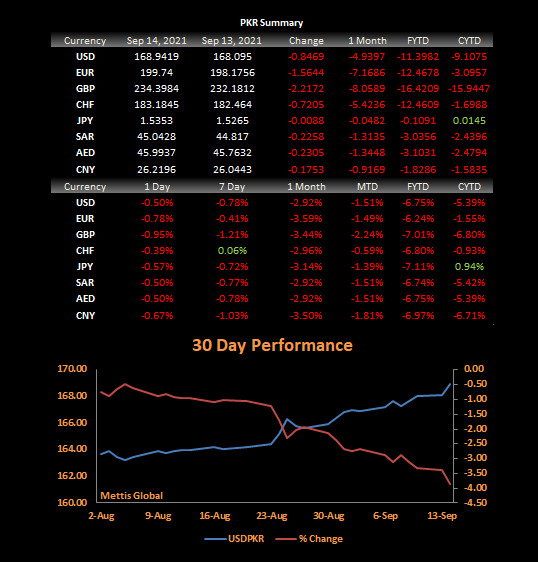

The domestic unit has depreciated by 6.75% or PKR 11.39 in the fiscal year-to-date against the USD. Similarly, the rupee has weakened by 5.39% or PKR 9.10 in CY21, with the month-to-date (MTD) position showing a decline of 0.52%, as per data compiled by Mettis Global.

Moreover, PKR has also lost 2.22 rupees to the Pound Sterling as the day's closing quote stood at PKR 234.40 per GBP, while the previous session closed at PKR 232.18 per GBP.

Similarly, PKR's value weakened by 1.56 paisa against EUR which closed at PKR 19.74 at the interbank today.

The overnight repo rate towards the close of the session was 7.00/7.10 percent, whereas the 1-week rate was 7.05/7.15 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction