PKR: A Hard Way to Go

MG News | May 13, 2022 at 04:56 PM GMT+05:00

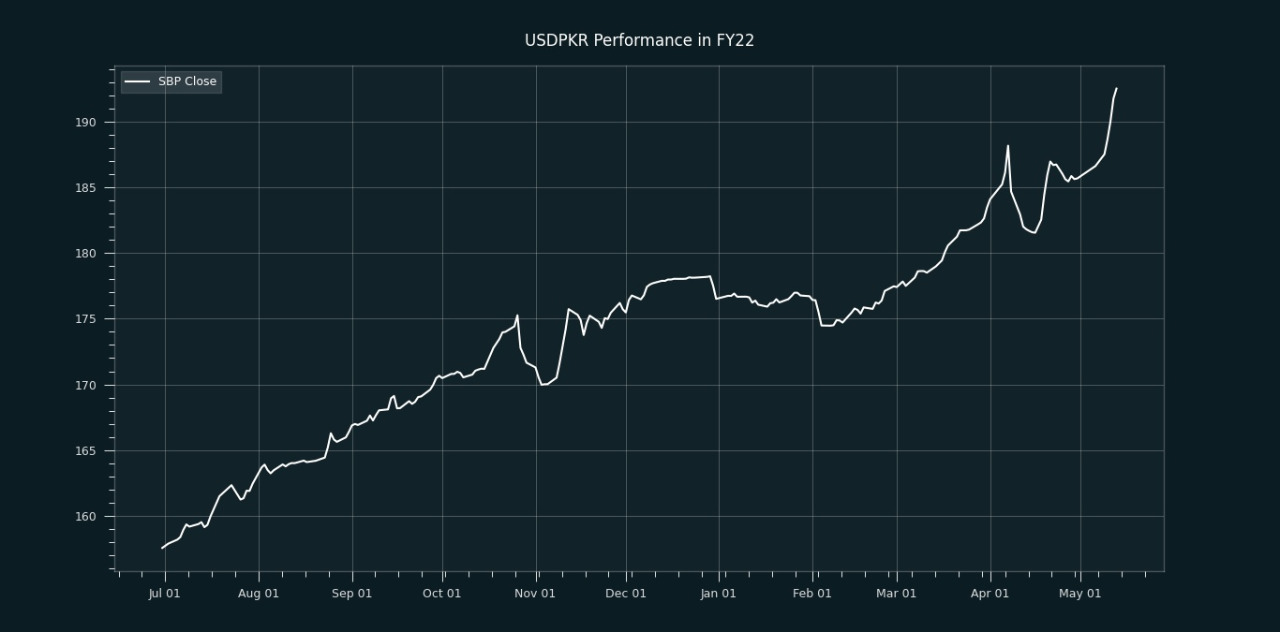

May 13, 2022 (MLN): Owing to the melting foreign exchange reserves, rising trade deficit, and delay in IMF tranche have forced the Pakistani rupee (PKR) to bleed by 5.9 rupees in the outgoing week as the currency settled the week’s trade at 192.53, compared to the previous week’s close of PKR 191.77 per USD.

The rupee endured a highly volatile trading session on Friday with quotes being recorded in a range of 1.45 rupees per USD showing an intraday high bid of 193.95 and an intraday low offer of 191.50, depreciating by 76 paisa by the end of the session.

It is pertinent to mention that the local unit touched the psychological level of 193 per US dollar in the early morning trade on Friday. However, after the release of remittances data where remittances have crossed the $3 billion mark, PKR took a breather in the later hours of trading as it has settled the trade at 192.53 per USD.

Along with the economic crisis, the political noise has also kept PKR under pressure throughout the week. According to experts, all the political parties should be on the same page with regard to the economic interest of Pakistan and the present government has to take difficult/unpopular decisions to prevent the economy from further damage.

Regarding IMF, Zafar Paracha, President of Exchange Companies Association of Pakistan said, “IMF has raised concerns over the subsidy on petroleum products given by Pakistani government and Pakistan side had agreed to roll back the subsidies, however, the relief package is still being provided.”

He also added, “It seems that financial assistance from Saudi Arabia and China is now conditional to the IMF’s allocation of $1bn to Pakistan.”

From July’21 to date, the local unit has lost Rs34.98 against the USD. Similarly, the rupee fell by Rs16.01 in CYTD, with the month-to-date (MTD) position showing a wither of 3.55%, as per data compiled by Mettis Global.

In addition, the performance of PKR remained bleak against major currencies in the previous seven sessions as it weakened by 4.30%, 3.07%, 3.06%, 2.32%, 2.20%, 1.65%, and 1.63% against JPY, AED, SAR, GBP, EUR, CNY, and CHF, respectively.

During the last 52 weeks, PKR lost 20.74% against the greenback, reached its lowest at 192.53 today, and touched its high of 152.59 on May 17, 2021.

Furthermore, the local unit has weakened by 7.55% since its high on May 17, 2021, against EUR. While, it has dropped by 8.57% against GBP since its high on May 17, 2021.

Within the open market, PKR was traded at 192/193.50 per USD.

Meanwhile, the currency lost 1.5 rupees to the Pound Sterling as the day's closing quote stood at PKR 235.34 per GBP, while the previous session closed at PKR 233.86 per GBP.

Similarly, PKR's value remained flat against EUR which closed at PKR 200.44 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO) in which it injected Rs3.55 trillion into the market for 7 days at 12.31 percent.

The overnight repo rate towards the close of the session was 12.60/12.90 percent, whereas the 1-week rate was 12.70/12.80 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction