PBS unveils policies to attract FDI, boost economic growth

.png?width=950&height=450&format=Webp)

MG News | January 02, 2025 at 05:49 PM GMT+05:00

January 02, 2025 (MLN): To boost economic growth in sectors such as agriculture, tourism, textiles, manufacturing, and Information Technology (IT), and to address key challenges in attracting Foreign Direct Investment (FDI), the Pakistan Business Council (PBC) has introduced targeted industrial policies.

The initiatives include tax holidays, duty-free machinery imports, and Special Economic Zones (SEZs) aimed at modernizing these industries, according to the PBC report titled 'Efficient-Seeking FDI in Pakistan.

In agriculture, policies include long-term land leasing for investors and joint Research and Development (R&D) centers for crop development.

Additionally, smart agriculture technologies leverage the Internet of Things (IoT) and Artificial Intelligence (AI).

Cold chain infrastructure is also prioritized to reduce post-harvest losses.

Tourism initiatives feature relaxed regulations in special tourism zones and Public-Private Partnerships (PPPs) for infrastructure.

These efforts are supported by global marketing campaigns and streamlined visa processes, including e-visas and visa-on-arrival.

For the textile sector, SEZs, partnerships with global brands, and subsidies for modern machinery aim to foster value-added production.

Similarly, light manufacturing policies focus on tariff subsidies for automated systems, skill development centers, and FDI in automotive and Electric Vehicle (EV) manufacturing.

In IT, corporate tax exemptions for technology parks, concessional loans, and streamlined export procedures encourage growth, alongside partnerships in fintech, health tech, and edtech.

These measures collectively position Pakistan as an attractive investment hub for global and local investors.

Pakistan should focus on sectors with limited local investment or risk appetite, such as agriculture, manufacturing (textile, leather, electronics), services (IT, tourism, logistics), and value-added mining.

Pakistan’s FDI strategy faces major hurdles, limiting its economic potential.

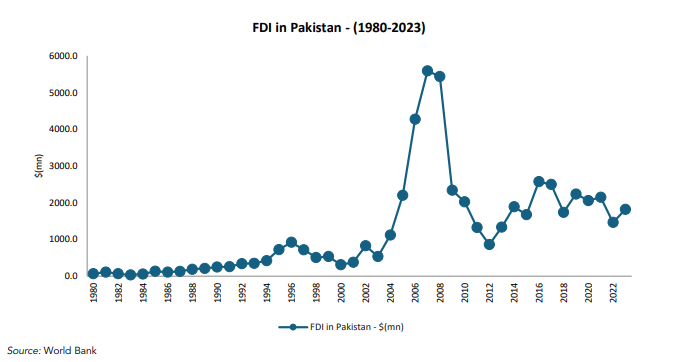

Since independence, FDI in Pakistan has fluctuated, bringing capital and industry advancements.

However, it has not led to broad-based growth or economic stability, highlighting its limitations in addressing the country's challenges.

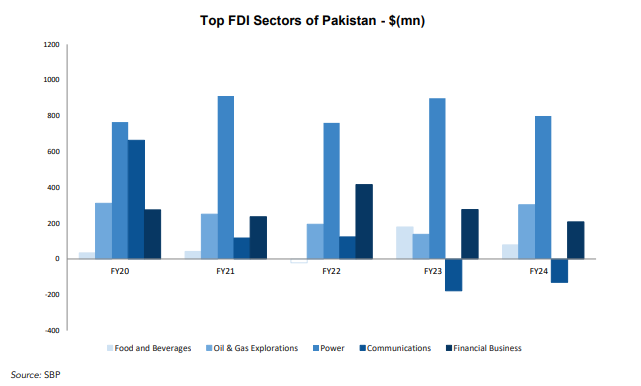

Inflows are heavily concentrated in a few sectors like FMCG and telecom, with critical areas like manufacturing and agriculture underfunded.

Investments are sourced primarily from a limited number of countries, creating vulnerabilities.

Policy instability and regulatory hurdles have caused multinational corporations (MNCs) in key sectors like oil, gas, and pharmaceuticals to divest or scale back operations.

Additionally, many MNCs have shifted from local production to importing goods, reducing economic benefits and increasing foreign exchange outflows.

G2G investments, while a quick fix, often suffer delays, cost overruns, and transparency issues.

Outflows from equity returns, royalties, and import costs frequently surpass inflows, causing a net capital loss.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SCRA Balance

SCRA Balance