Pakistan banks face slow economic recovery: Moody's

By MG News | January 13, 2021 at 03:11 PM GMT+05:00

January 13, 2021: Moody’s Investors Service says in a new report that its stable outlook for Pakistan’s banking system reflects banks’ solid funding and liquidity, although a challenging – but improving – operating environment will weigh on asset quality and profitability.

“Despite a difficult environment, the government’s credit profile is stable due to ongoing reforms and increasing policy effectiveness – a positive for the banks given their outsized holdings of Pakistani government debt link their credit profiles to that of the government,” says Constantinos Kypreos, a Moody’s Senior Vice President.

Moody’s expects the slow economic recovery to affect loan quality, with nonperforming loans (NPLs) expected to rise over the coming months from a sector-wide level of 9.9% of gross loans in September 2020. Banks’ foreign operations, export-oriented industries and companies reliant on government payments and subsidies will be hit hardest, but loan repayment holidays and other government support measures should help contain some risks.

Meanwhile, banks’ profitability, which has materially increased during 2020, will come under pressure on lowered margins, higher loan-loss provisions given the challenging operating environment, and subdued business generation.

Still, Pakistan’s economy should return to a modest 1.5% growth in fiscal 2021, while government and central bank responses and reforms will partially soften the pandemic’s impact.

“Deposit-based funding and good liquidity buffers also remain strengths, while the probability of government support in a crisis is high, even if its ability to do so is limited by fiscal challenges,” adds Kypreos.

Moody’s

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

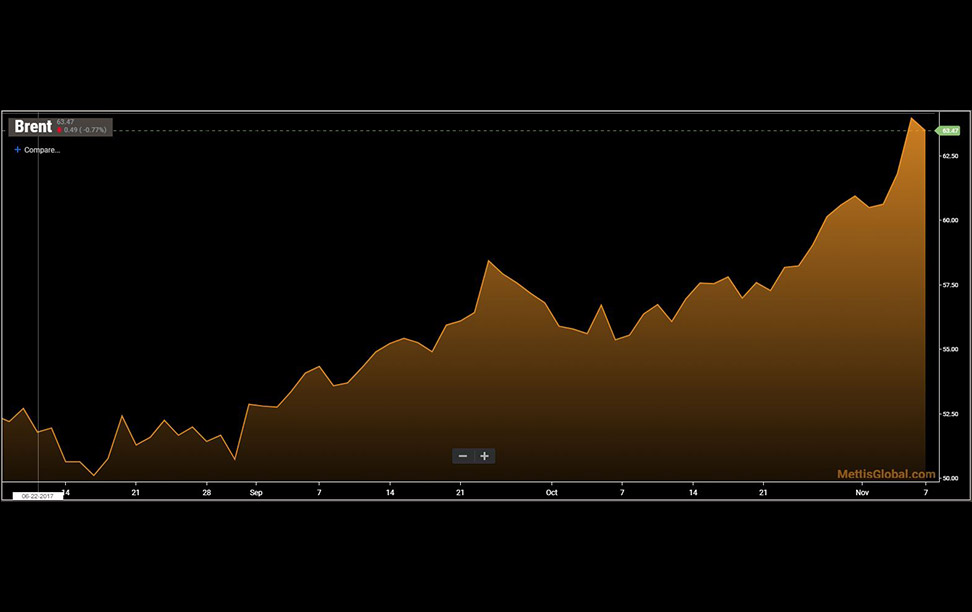

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI